Question

A stock will pay a dividend of $2.00 at the end of cach quarter during the coming year. The first quarterly dividend for the

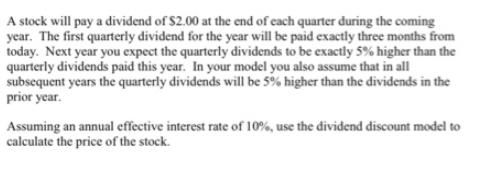

A stock will pay a dividend of $2.00 at the end of cach quarter during the coming year. The first quarterly dividend for the year will be paid exactly three months from today. Next year you expect the quarterly dividends to be exactly 5% higher than the quarterly dividends paid this year. In your model you also assume that in all subsequent years the quarterly dividends will be 5% higher than the dividends in the prior year. Assuming an annual effective interest rate of 10%, use the dividend discount model to calculate the price of the stock.

Step by Step Solution

3.48 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Business Math

Authors: Cheryl Cleaves, Margie Hobbs, Jeffrey Noble

10th edition

133011208, 978-0321924308, 321924304, 978-0133011203

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App