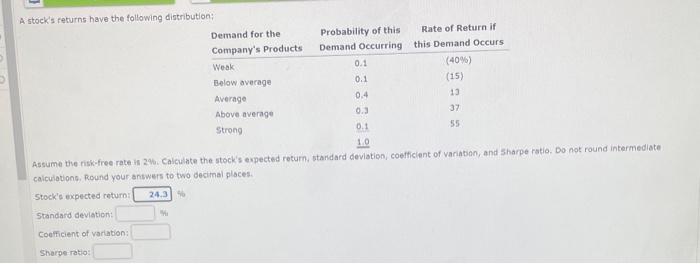

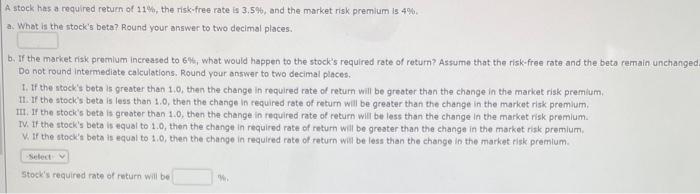

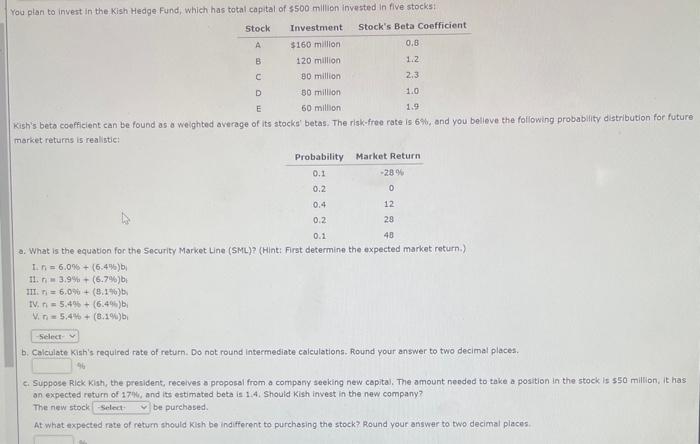

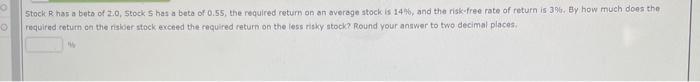

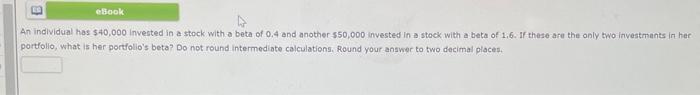

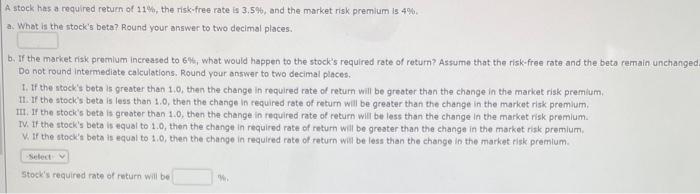

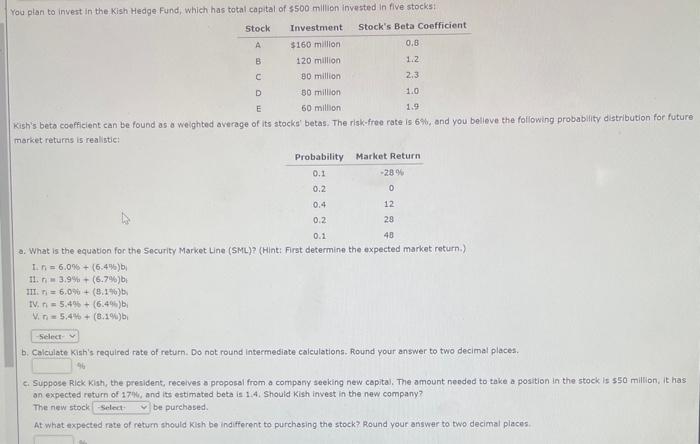

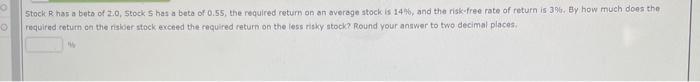

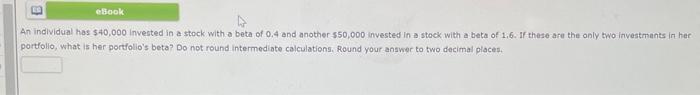

A stock's feturns have the following distribut- Assume tive risk-free rate in 29 . Calculate the stock's expected retum, standard deviation, coefficient of variabon, and snarpe ratio. Do not round intermediate caiculations, Round your answers to two decimal places. 5tock's expected return: Standard deviation: Coefficient of vartation: Sharperatio: A stock has a required return of 11%, the risk-free rate is 3.5%, and the market risk premium 154%. a. What is the stock's beta? Round your answer to two decimal places. b. If the market risk promlum increased to 6\%t, what would happen to the stock's required rate of retum? Assume that the risk-free rate and the beto remain unchanged Do not round intermediate calculations. Round your answer to two decimal places. 1. If the stock's beta is greater than 1.0, then the change in required rate of retum will be greater than the change in the market risk premium, II. If the stock's beta is less than 1.0, then the change in required rate of return will be greater than the change in the market risk premlum. IIt. If the stoci's beta is greater than 1.0, then the change in required rate of return will be less than the change in the market risk premium. IV. If the stock's beta is equal to 1.0, then the change in required rate of retum will be greater than the change in the market risk premlum. W. If the stock't beta is equal to 1,0 , then the change in required rate of retum wis be less than the change in the market risk premlum. Stock's required rate of return will be Kish's beta coefficient can be found as o weighted average of its stocks' betas. The risk-free rate is 6%, snd you believe the following probability distribution for future maricet returns is realistic: a. What is the equation for the Security Market Line (SML)? (Hint: First determine the expected market return.) I+n=6.00s+(6.4%)bi J1. n=3.9%b+(6.7%)b; f V. n=5.405+(6.446)bi yin=5.4%+(8.19)bi b. Calculate kish's required rate of return. Do not round intermediate calculations. Round your answer to two decimal places. 49 c. Suppose Rick Kish, the president, recelves a proposal from a company seeking new capital, The amount needed to take a position in the stock is 550 million, it has an expected return of 17%4 and its estimated beta is 1.4. Should Kish invest in the new company? The new stock be purchased. At what expected rate of return should kish be indifferent to purchesing the stock? Round your answer to two decimal places. required cetum on the risher stock exceed the required return on the less risky atock? Round your answer to two decimal places portollo, what is her portiolio's beta? Do not round intermediate calculationg. Round your answer to two decimal piaces