Question

A stock's price is $40. Over each of the next two three month periods it is expected to go up or down by 20%. The

A stock's price is $40. Over each of the next two three month periods it is expected to go up or down by

20%. The risk free rate is 6% p.a.

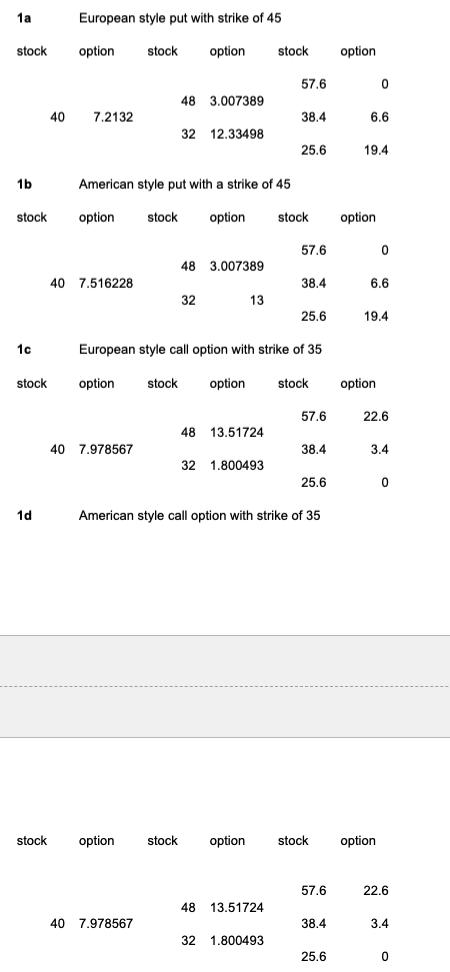

a. What should be the current price of a 6-month European style put option with a strike price of $45?

b. What should be the current price of a 6-month American style put option with a strike price of $45?

c. What should be the current price of a 6-month European style call option with a strike price of $35?

d. What should be the current price of a 6-month American style call option with a strike price of $35?

Since the risk free rate is 6%p.a. and the time period for each option is 3 months we have to change the rate to a per period basis or 1.5% every 3 months. The value of p =(1+.015-.8)/(1.2-.8)= 0.5375. also when we discount we should be discounting by dividing by (1+r)=(1+.015).

1a stock 1b stock 1c stock 1d stock 40 European style put with strike of 45 option 7.2132 option American style put with a strike of 45 stock option 40 7.516228 40 7.978567 stock option stock option option 48 3.007389 32 12.33498 40 7.978567 48 3.007389 stock 32 13 48 13.51724 32 1.800493 option 57.6 48 13.51724 38.4 32 1.800493 25.6 stock European style call option with strike of 35 option stock option stock. option 57.6 38.4 American style call option with strike of 35 25.6 57.6 38.4 25.6 57.6 38.4 6.6 25.6 19.4 option 0 6.6 stock option 0 19.4 22.6 3.4 0 22.6 3.4 0

Step by Step Solution

3.39 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started