Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A student plans to save $800 at the end of Year 1, $1000 at the end of Year 2 and Year 3, and $1,200

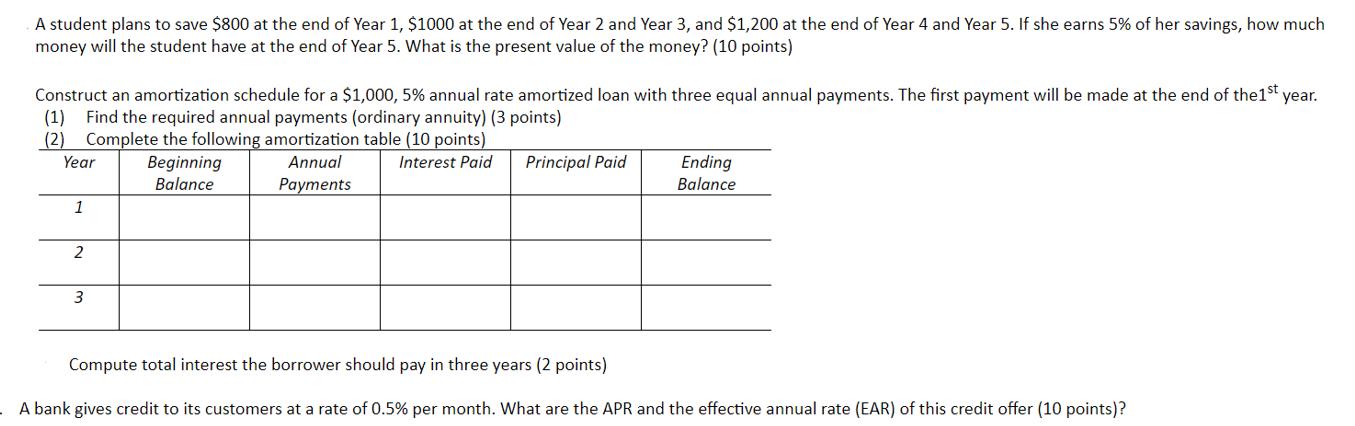

A student plans to save $800 at the end of Year 1, $1000 at the end of Year 2 and Year 3, and $1,200 at the end of Year 4 and Year 5. If she earns 5% of her savings, how much money will the student have at the end of Year 5. What is the present value of the money? (10 points) Construct an amortization schedule for a $1,000, 5% annual rate amortized loan with three equal annual payments. The first payment will be made at the end of the 1st year. (1) Find the required annual payments (ordinary annuity) (3 points) (2) Complete the following amortization table (10 points) Year Interest Paid Annual Payments 1 2 3 Beginning Balance Principal Paid Ending Balance Compute total interest the borrower should pay in three years (2 points) A bank gives credit to its customers at a rate of 0.5% per month. What are the APR and the effective annual rate (EAR) of this credit offer (10 points)?

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 The total savings of the student at the end of Year 1 to Year 5 are End of Year 1 800 End of Year 2 1000 End of Year 3 1000 End of Year 4 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started