Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A student seeks your advice for the elaboration of a hedging strategy against interest rate risk. Three years from now, the student will need

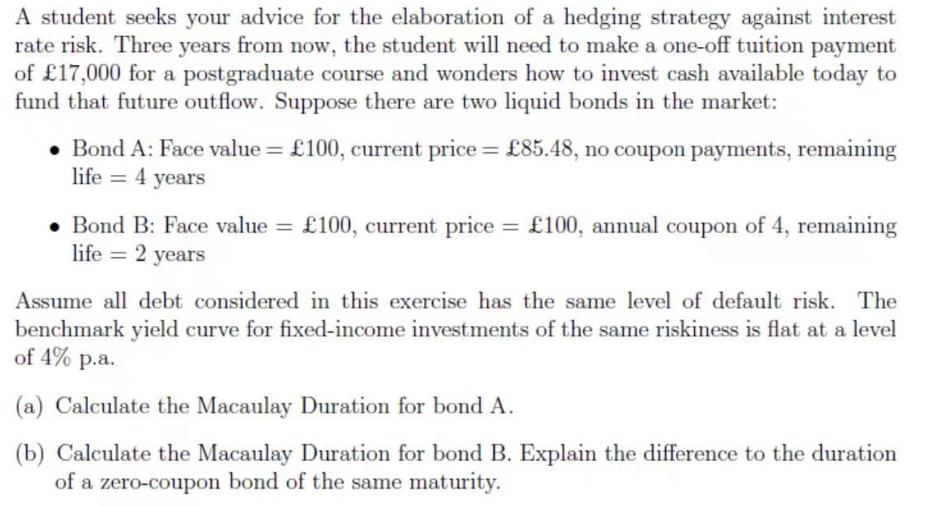

A student seeks your advice for the elaboration of a hedging strategy against interest rate risk. Three years from now, the student will need to make a one-off tuition payment of 17,000 for a postgraduate course and wonders how to invest cash available today to fund that future outflow. Suppose there are two liquid bonds in the market: Bond A: Face value = 100, current price = 85.48, no coupon payments, remaining life = 4 years Bond B: Face value = 100, current price life = 2 years 100, current price = 100, annual coupon of 4, remaining Assume all debt considered in this exercise has the same level of default risk. The benchmark yield curve for fixed-income investments of the same riskiness is flat at a level of 4% p.a. (a) Calculate the Macaulay Duration for bond A. (b) Calculate the Macaulay Duration for bond B. Explain the difference to the duration of a zero-coupon bond of the same maturity.

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a We must first determine the present value of each cash flow and then weigh them according to how long to maturity they have in order to determine the Macaulay Duration for bond A We simply need to d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started