Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A student takes on $40,000 of debt on August 2 of 2024 at an annual interest rate of 8%. She makes no payments while

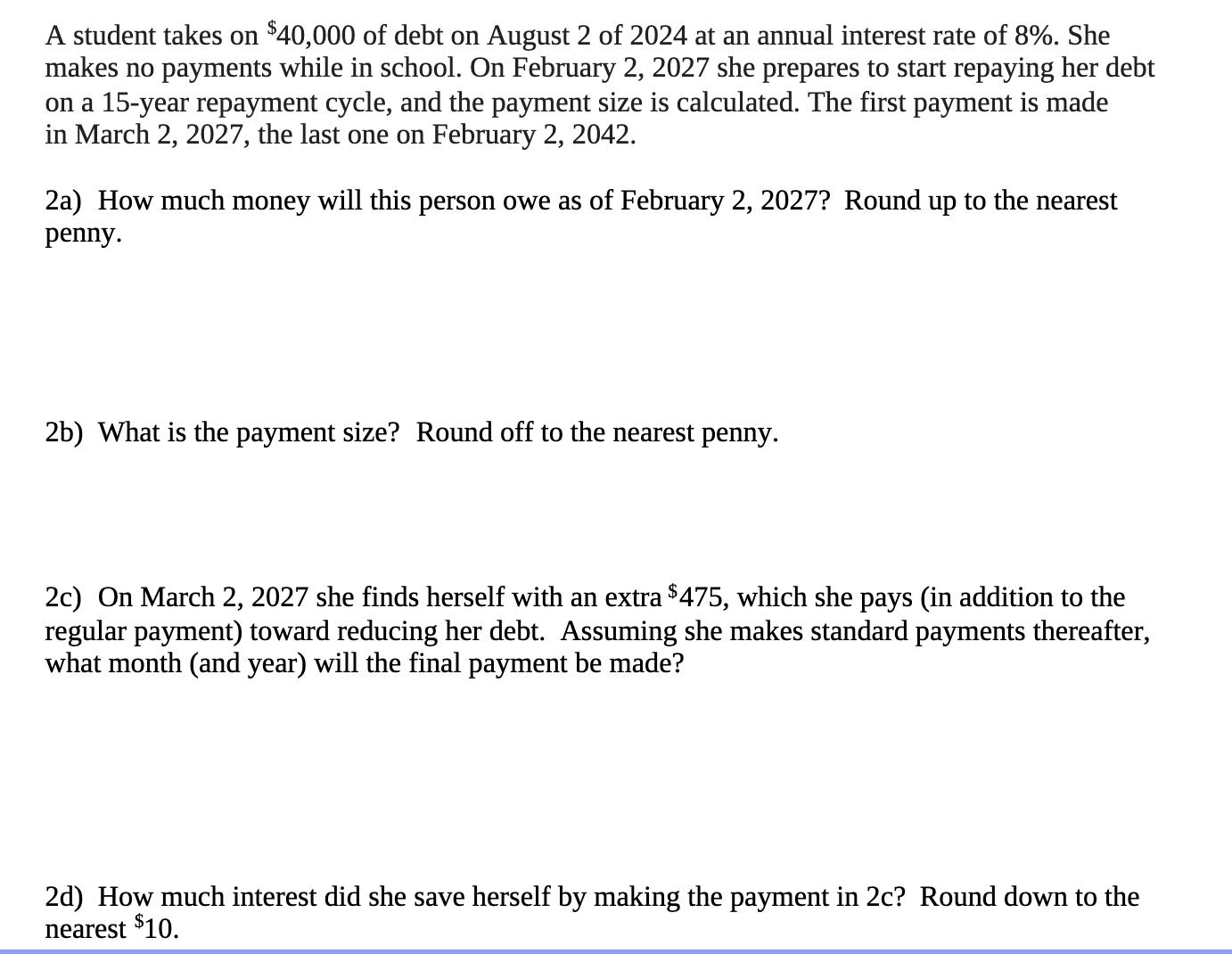

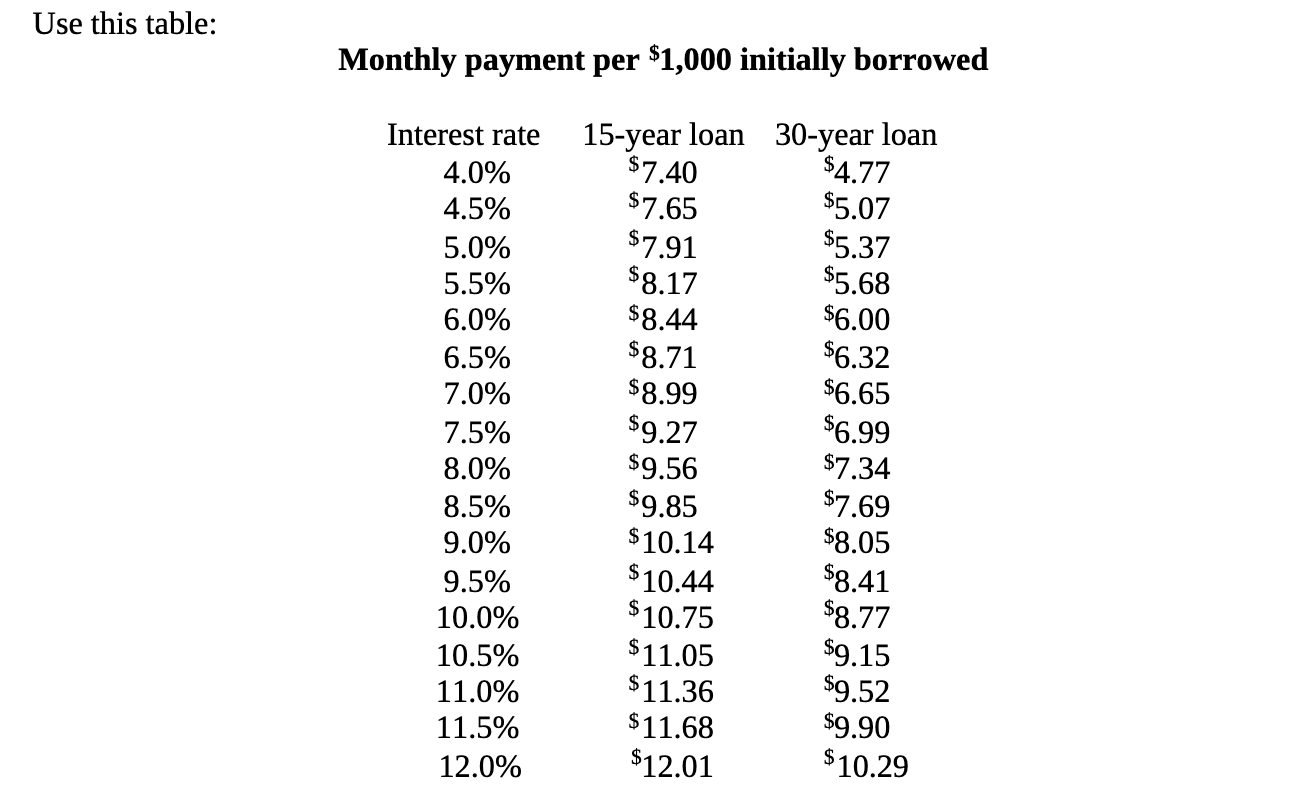

A student takes on $40,000 of debt on August 2 of 2024 at an annual interest rate of 8%. She makes no payments while in school. On February 2, 2027 she prepares to start repaying her debt on a 15-year repayment cycle, and the payment size is calculated. The first payment is made in March 2, 2027, the last one on February 2, 2042. 2a) How much money will this person owe as of February 2, 2027? Round up to the nearest penny. 2b) What is the payment size? Round off to the nearest penny. 2c) On March 2, 2027 she finds herself with an extra $475, which she pays (in addition to the regular payment) toward reducing her debt. Assuming she makes standard payments thereafter, what month (and year) will the final payment be made? 2d) How much interest did she save herself by making the payment in 2c? Round down to the nearest $10. Use this table: Monthly payment per $1,000 initially borrowed Interest rate 15-year loan 30-year loan 4.0% $7.40 $4.77 4.5% $7.65 $5.07 5.0% $7.91 $5.37 5.5% $8.17 $5.68 6.0% $8.44 $6.00 6.5% $8.71 $6.32 7.0% $8.99 $6.65 7.5% $9.27 $6.99 8.0% $9.56 $7.34 8.5% $9.85 $7.69 9.0% $10.14 $8.05 9.5% $10.44 $8.41 10.0% $10.75 $8.77 10.5% $11.05 $9.15 11.0% $11.36 $9.52 11.5% $11.68 $9.90 12.0% $12.01 $10.29

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve these questions we need to use the formulas for calculating loan balances and loan payments Lets break down each question 2a To calculate the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started