Question

Dalia and Roaa formed a partnership. Dalia contributed $10,000 cash and a used Building that originally cost $60,000 and had accumulated depreciation of $20,000.

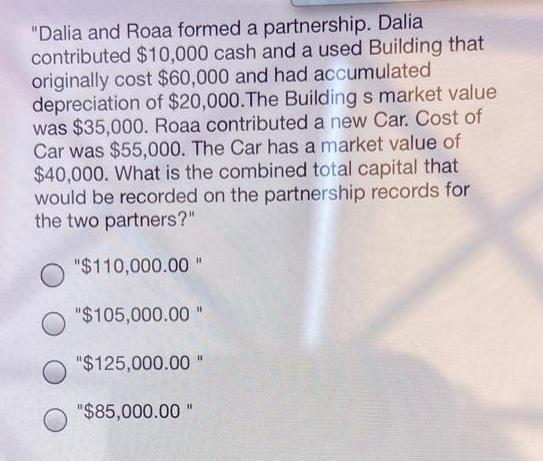

"Dalia and Roaa formed a partnership. Dalia contributed $10,000 cash and a used Building that originally cost $60,000 and had accumulated depreciation of $20,000. The Building s market value was $35,000. Roaa contributed a new Car. Cost of Car was $55,000. The Car has a market value of $40,000. What is the combined total capital that would be recorded on the partnership records for the two partners?" "$110,000.00 " "$105,000.00 " "$125,000.00 " "$85,000.00 "

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

THE COMBINED TOTAL CAPITAL OF THE PARTNERHIP IS DALIA CAPIT AL Cash 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

John E Freunds Mathematical Statistics With Applications

Authors: Irwin Miller, Marylees Miller

8th Edition

978-0321807090, 032180709X, 978-0134995373

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App