Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A suggestion on how to proceed? Instructions for assignment Instructions Type of assignment: Students to form teams of maximum two students. Students in each team

A suggestion on how to proceed?

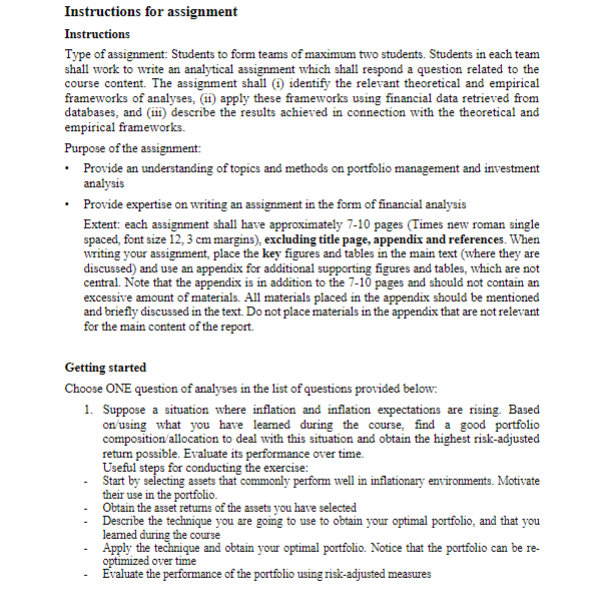

Instructions for assignment Instructions Type of assignment: Students to form teams of maximum two students. Students in each team shall work to write an analytical assignment which shall respond a question related to the course content. The assignment shall (i) identify the relevant theoretical and empirical frameworks of analyses, (ii) apply these frameworks using financial data retrieved from databases, and (iii) describe the results achieved in connection with the theoretical and empirical frameworks. Purpose of the assignment: - Provide an understanding of topics and methods on portfolio management and investment analysis - Provide expertise on writing an assignment in the form of financial analysis Extent: each assignment shall have approximately 710 pages (Times new roman single spaced, font size 12,3cm margins), excluding title page, appendix and references. When writing your assignment, place the key figures and tables in the main text (where they are discussed) and use an appendix for additional supporting figures and tables, which are not central. Note that the appendix is in addition to the 7-10 pages and should not contain an excessive amount of materials. All materials placed in the appendix should be mentioned and briefly discussed in the text. Do not place materials in the appendix that are not relevant for the main content of the report. Getting started Choose ONE question of analyses in the list of questions provided below: 1. Suppose a situation where inflation and inflation expectations are rising. Based on/using what you have learned during the course, find a good portfolio composition/allocation to deal with this situation and obtain the highest risk-adjusted return possible. Evaluate its performance over time. Useful steps for conducting the exercise: - Start by selecting assets that commonly perform well in inflationary environments. Motivate their use in the portfolio. - Obtain the asset returns of the assets you have selected - Describe the technique you are going to use to obtain your optimal portfolio, and that you leamed during the course - Apply the technique and obtain your optimal portfolio. Notice that the portfolio can be reoptimized over time - Evaluate the performance of the portfolio using risk-adjusted measures

Instructions for assignment Instructions Type of assignment: Students to form teams of maximum two students. Students in each team shall work to write an analytical assignment which shall respond a question related to the course content. The assignment shall (i) identify the relevant theoretical and empirical frameworks of analyses, (ii) apply these frameworks using financial data retrieved from databases, and (iii) describe the results achieved in connection with the theoretical and empirical frameworks. Purpose of the assignment: - Provide an understanding of topics and methods on portfolio management and investment analysis - Provide expertise on writing an assignment in the form of financial analysis Extent: each assignment shall have approximately 710 pages (Times new roman single spaced, font size 12,3cm margins), excluding title page, appendix and references. When writing your assignment, place the key figures and tables in the main text (where they are discussed) and use an appendix for additional supporting figures and tables, which are not central. Note that the appendix is in addition to the 7-10 pages and should not contain an excessive amount of materials. All materials placed in the appendix should be mentioned and briefly discussed in the text. Do not place materials in the appendix that are not relevant for the main content of the report. Getting started Choose ONE question of analyses in the list of questions provided below: 1. Suppose a situation where inflation and inflation expectations are rising. Based on/using what you have learned during the course, find a good portfolio composition/allocation to deal with this situation and obtain the highest risk-adjusted return possible. Evaluate its performance over time. Useful steps for conducting the exercise: - Start by selecting assets that commonly perform well in inflationary environments. Motivate their use in the portfolio. - Obtain the asset returns of the assets you have selected - Describe the technique you are going to use to obtain your optimal portfolio, and that you leamed during the course - Apply the technique and obtain your optimal portfolio. Notice that the portfolio can be reoptimized over time - Evaluate the performance of the portfolio using risk-adjusted measures

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started