Question

A Sukuk with an embedded option has 3 months left to maturity. At maturity, sukuk holders can either get back the face value or

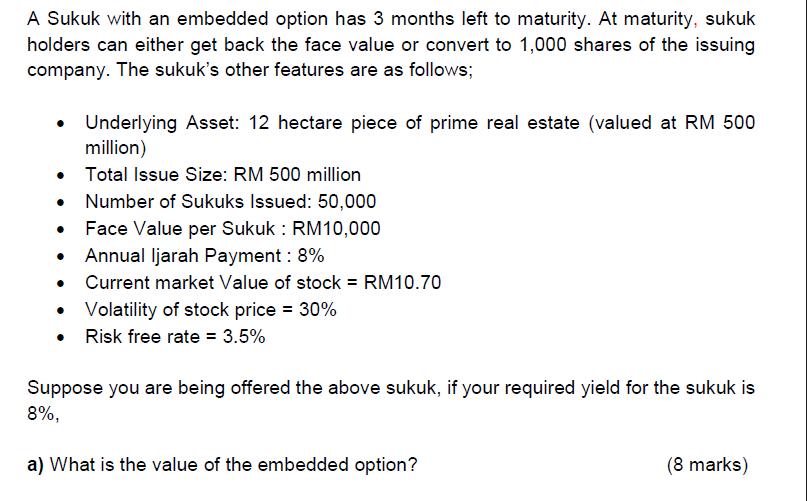

A Sukuk with an embedded option has 3 months left to maturity. At maturity, sukuk holders can either get back the face value or convert to 1,000 shares of the issuing company. The sukuk's other features are as follows; Underlying Asset: 12 hectare piece of prime real estate (valued at RM 500 million) Total Issue Size: RM 500 million Number of Sukuks Issued: 50,000 Face Value per Sukuk : RM10,000 Annual Ijarah Payment : 8% Current market Value of stock = RM10.70 Volatility of stock price = 30% Risk free rate = 3.5% Suppose you are being offered the above sukuk, if your required yield for the sukuk is 8%, a) What is the value of the embedded option? (8 marks)

Step by Step Solution

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the value of the embedded option in the sukuk we can use an option pricing model such a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting and Analysis

Authors: Flawrence Revsine, Daniel Collins, Bruce, Mittelstaedt, Leon

6th edition

9780077632182, 78025672, 77632184, 978-0078025679

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App