Answered step by step

Verified Expert Solution

Question

1 Approved Answer

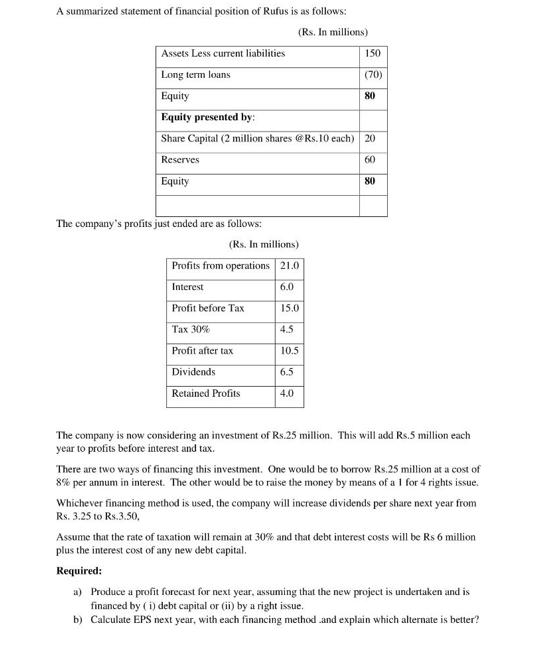

A summarized statement of financial position of Rufus is as follows: (Rs. In millions) Assets Less current liabilities Long term loans Equity The company's

A summarized statement of financial position of Rufus is as follows: (Rs. In millions) Assets Less current liabilities Long term loans Equity The company's profits just ended are as follows: Equity presented by: Share Capital (2 million shares @Rs.10 each) 20 Reserves 60 Equity (Rs. In millions) Profits from operations 21.0 Interest 6.0 Profit before Tax Tax 30% Profit after tax Dividends Retained Profits 150 15.0 4.5 10.5 6.5 4.0 (70) 80 80 The company is now considering an investment of Rs.25 million. This will add Rs.5 million each year to profits before interest and tax. There are two ways of financing this investment. One would be to borrow Rs.25 million at a cost of 8% per annum in interest. The other would be to raise the money by means of a 1 for 4 rights issue. Whichever financing method is used, the company will increase dividends per share next year from Rs. 3.25 to Rs.3.50, Assume that the rate of taxation will remain at 30% and that debt interest costs will be Rs 6 million plus the interest cost of any new debt capital. Required: a) Produce a profit forecast for next year, assuming that the new project is undertaken and is financed by (i) debt capital or (ii) by a right issue. b) Calculate EPS next year, with each financing method and explain which alternate is better?

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started