Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Suppose SSS company is going to acquire XQQ company. How can XQQ company make the takeover more difficult for SSS company if XQQ

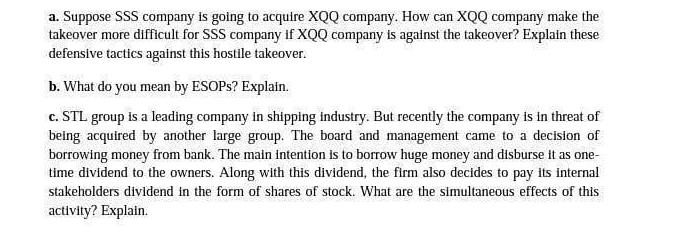

a. Suppose SSS company is going to acquire XQQ company. How can XQQ company make the takeover more difficult for SSS company if XQQ company is against the takeover? Explain these defensive tactics against this hostile takeover. b. What do you mean by ESOPS? Explain. c. STL group is a leading company in shipping industry. But recently the company is in threat of being acquired by another large group. The board and management came to a decision of borrowing money from bank. The main intention is to borrow huge money and disburse it as one- time dividend to the owners. Along with this dividend, the firm also decides to pay its internal stakeholders dividend in the form of shares of stock. What are the simultaneous effects of this activity? Explain.

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a XQQ company can employ various defensive tactics to make the takeover more difficult for SSS company Some of these tactics include 1 Poison Pill XQQ company can adopt a poison pill strategy where it ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started