Answered step by step

Verified Expert Solution

Question

1 Approved Answer

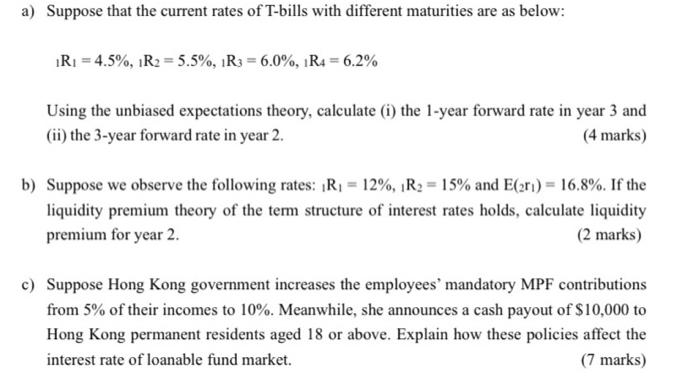

a) Suppose that the current rates of T-bills with different maturities are as below: 1R = 4.5%, 1R = 5.5%, 1R3 = 6.0 %,

a) Suppose that the current rates of T-bills with different maturities are as below: 1R = 4.5%, 1R = 5.5%, 1R3 = 6.0 %, 1 R4 = 6.2% Using the unbiased expectations theory, calculate (i) the 1-year forward rate in year 3 and (ii) the 3-year forward rate in year 2. (4 marks) b) Suppose we observe the following rates: R = 12%, R = 15% and E(2) = 16.8%. If the liquidity premium theory of the term structure of interest rates holds, calculate liquidity premium for year 2. (2 marks) c) Suppose Hong Kong government increases the employees' mandatory MPF contributions from 5% of their incomes to 10%. Meanwhile, she announces a cash payout of $10,000 to Hong Kong permanent residents aged 18 or above. Explain how these policies affect the interest rate of loanable fund market. (7 marks)

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Given 1R1 45 1R2 55 1R3 6 and 1R4 62 We have to find out 1 1 year forward rate in year 3 which can b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started