Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Suppose the income tax authorities permitted a choice between these two depreciation methods. Which method would FedEx select for income-tax purposes? Why? (3

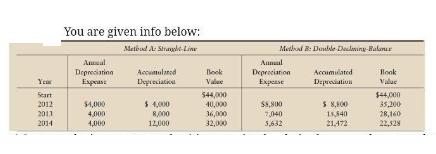

a) Suppose the income tax authorities permitted a choice between these two depreciation methods. Which method would FedEx select for income-tax purposes? Why? (3 points) b) Suppose FedEx purchased the equipment described in the table on January 1, 2012. Management has depreciated the equipment by using the double-declining-balance method. On July 1, 2014, FedEx sold the equipment for $27,000 cash. (3 points) c)Record depreciation for 2014 and the sale of the equipment on July 1, 2014. (2 points) You Seart 2012 2011 2014 You are given info below: Method A Strap-Line Annual Depreciation Expeast $4,000 4,000 4,000 Accumulated Depreciation $4,000 8,000 12,000 Book Value $44,000 40,000 36,000 32,000 Med B: Double Decling-Balance Aamal Depreciation Expense $8,800 7,0040 3,632 Accumulated Depreciation $ 8,500 15,840 21.472 Book Vilac $44,000 35,200 28,160 22,328

Step by Step Solution

★★★★★

3.33 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a Based on the given information if the income tax authorities permitted a choice between the straightline and doubledeclining balance depreciation me...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started