Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Suppose the risk-free rate is 'X'% and the expected rate of return on the market portfolio is 10%. In your view, the expected rate

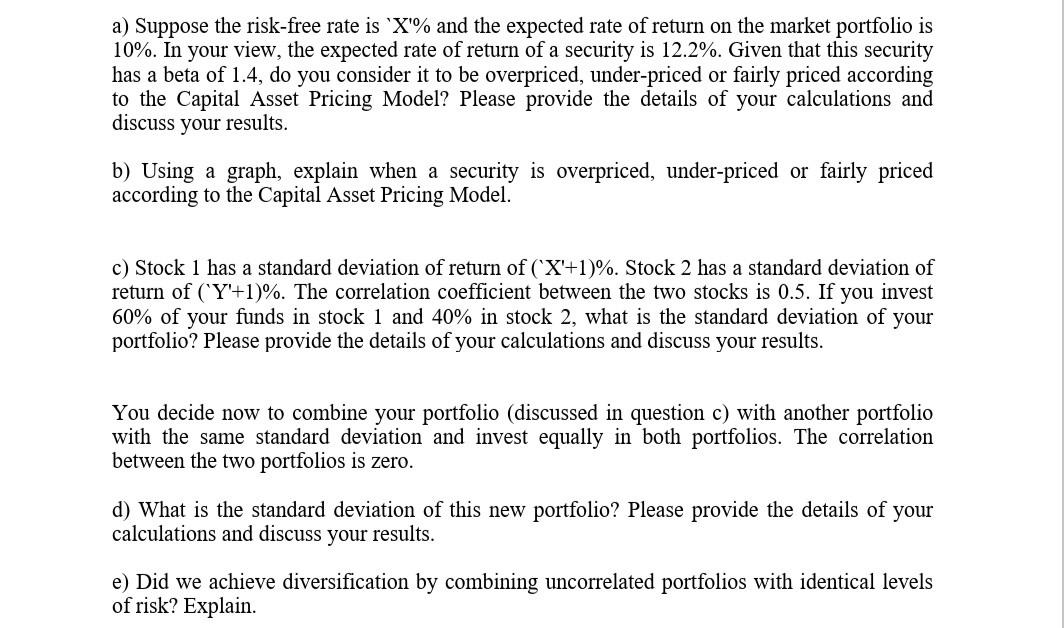

a) Suppose the risk-free rate is 'X'% and the expected rate of return on the market portfolio is 10%. In your view, the expected rate of return of a security is 12.2%. Given that this security has a beta of 1.4, do you consider it to be overpriced, under-priced or fairly priced according to the Capital Asset Pricing Model? Please provide the details of your calculations and discuss your results. b) Using a graph, explain when a security is overpriced, under-priced or fairly priced according to the Capital Asset Pricing Model. c) Stock 1 has a standard deviation of return of ('X'+1)%. Stock 2 has a standard deviation of return of ('Y'+1)%. The correlation coefficient between the two stocks is 0.5. If you invest 60% of your funds in stock 1 and 40% in stock 2, what is the standard deviation of your portfolio? Please provide the details of your calculations and discuss your results. You decide now to combine your portfolio (discussed in question c) with another portfolio with the same standard deviation and invest equally in both portfolios. The correlation between the two portfolios is zero. d) What is the standard deviation of this new portfolio? Please provide the details of your calculations and discuss your results. e) Did we achieve diversification by combining uncorrelated portfolios with identical levels of risk? Explain. a) Suppose the risk-free rate is 'X'% and the expected rate of return on the market portfolio is 10%. In your view, the expected rate of return of a security is 12.2%. Given that this security has a beta of 1.4, do you consider it to be overpriced, under-priced or fairly priced according to the Capital Asset Pricing Model? Please provide the details of your calculations and discuss your results. b) Using a graph, explain when a security is overpriced, under-priced or fairly priced according to the Capital Asset Pricing Model. c) Stock 1 has a standard deviation of return of ('X'+1)%. Stock 2 has a standard deviation of return of ('Y'+1)%. The correlation coefficient between the two stocks is 0.5. If you invest 60% of your funds in stock 1 and 40% in stock 2, what is the standard deviation of your portfolio? Please provide the details of your calculations and discuss your results. You decide now to combine your portfolio (discussed in question c) with another portfolio with the same standard deviation and invest equally in both portfolios. The correlation between the two portfolios is zero. d) What is the standard deviation of this new portfolio? Please provide the details of your calculations and discuss your results. e) Did we achieve diversification by combining uncorrelated portfolios with identical levels of risk? Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started