Answered step by step

Verified Expert Solution

Question

1 Approved Answer

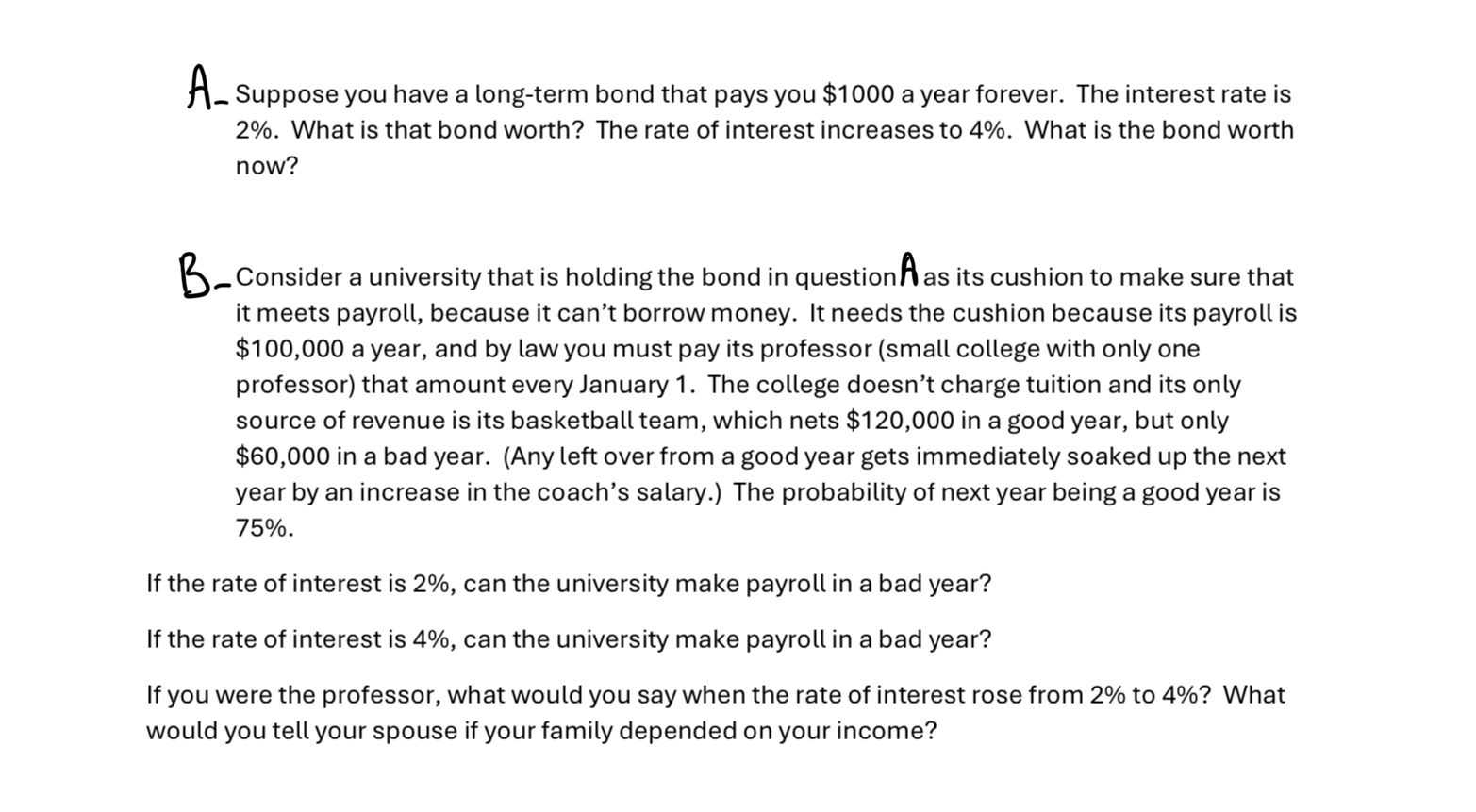

A _ Suppose you have a long - term bond that pays you $ 1 0 0 0 a year forever. The interest rate is

A Suppose you have a longterm bond that pays you $ a year forever. The interest rate is What is that bond worth? The rate of interest increases to What is the bond worth now?

Consider a university that is holding the bond in question as its cushion to make sure that it meets payroll, because it can't borrow money. It needs the cushion because its payroll is $ a year, and by law you must pay its professor small college with only one professor that amount every January The college doesn't charge tuition and its only source of revenue is its basketball team, which nets $ in a good year, but only $ in a bad year. Any left over from a good year gets immediately soaked up the next year by an increase in the coach's salary. The probability of next year being a good year is

If the rate of interest is can the university make payroll in a bad year?

If the rate of interest is can the university make payroll in a bad year?

If you were the professor, what would you say when the rate of interest rose from to What would you tell your spouse if your family depended on your income?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started