Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A swap line is a loan of a source-country currency by the source-country central bank to a recipient-country central bank, keeping the recipient country

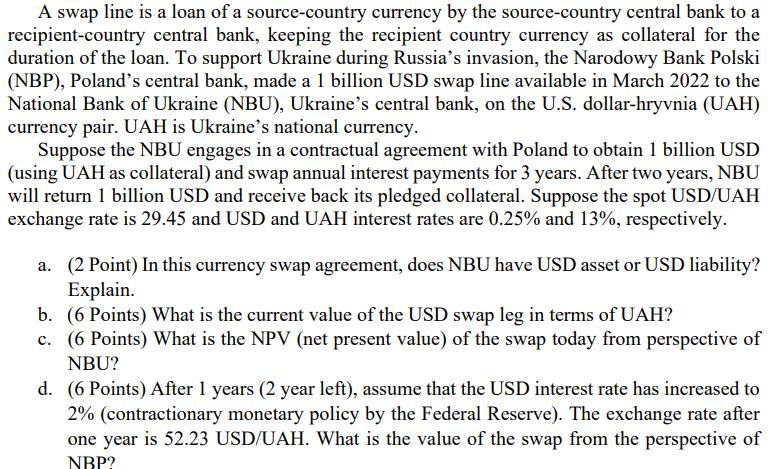

A swap line is a loan of a source-country currency by the source-country central bank to a recipient-country central bank, keeping the recipient country currency as collateral for the duration of the loan. To support Ukraine during Russia's invasion, the Narodowy Bank Polski (NBP), Poland's central bank, made a 1 billion USD swap line available in March 2022 to the National Bank of Ukraine (NBU), Ukraine's central bank, on the U.S. dollar-hryvnia (UAH) currency pair. UAH is Ukraine's national currency. Suppose the NBU engages in a contractual agreement with Poland to obtain 1 billion USD (using UAH as collateral) and swap annual interest payments for 3 years. After two years, NBU will return 1 billion USD and receive back its pledged collateral. Suppose the spot USD/UAH exchange rate is 29.45 and USD and UAH interest rates are 0.25% and 13%, respectively. a. (2 Point) In this currency swap agreement, does NBU have USD asset or USD liability? Explain. b. (6 Points) What is the current value of the USD swap leg in terms of UAH? c. (6 Points) What is the NPV (net present value) of the swap today from perspective of NBU? d. (6 Points) After 1 years (2 year left), assume that the USD interest rate has increased to 2% (contractionary monetary policy by the Federal Reserve). The exchange rate after one year is 52.23 USD/UAH. What is the value of the swap from the perspective of NBP?

Step by Step Solution

★★★★★

3.42 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

a In this currency swap agreement the NBU has a USD liability This is because the NBU is borrowing USD from the NBP and will have to repay the borrowe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started