Question

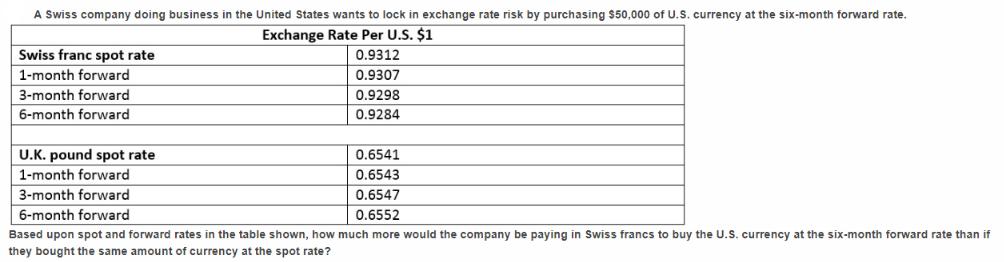

A Swiss company doing business in the United States wants to lock in exchange rate risk by purchasing $50,000 of U.S. currency at the

A Swiss company doing business in the United States wants to lock in exchange rate risk by purchasing $50,000 of U.S. currency at the six-month forward rate. Exchange Rate Per U.S. $1 0.9312 0.9307 0.9298 0.9284 Swiss franc spot rate 1-month forward 3-month forward 6-month forward U.K. pound spot rate 1-month forward 3-month forward 6-month forward 0.6541 0.6543 0.6547 0.6552 Based upon spot and forward rates in the table shown, how much more would the company be paying in Swiss francs to buy the U.S. currency at the six-month forward rate than if they bought the same amount of currency at the spot rate?

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To calculate how much more the company would be paying in Swiss francs ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Macroeconomics Principles Applications And Tools

Authors: Arthur O Sullivan, Steven M. Sheffrin, Stephen J. Perez

7th Edition

978-0134089034, 9780134062754, 134089030, 134062752, 978-0132555234

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App