A Swiss investor based in Switzerland, expects the U.S. dollar to depreciate by 7.5% over the next year. The interest rate on one-year risk-free

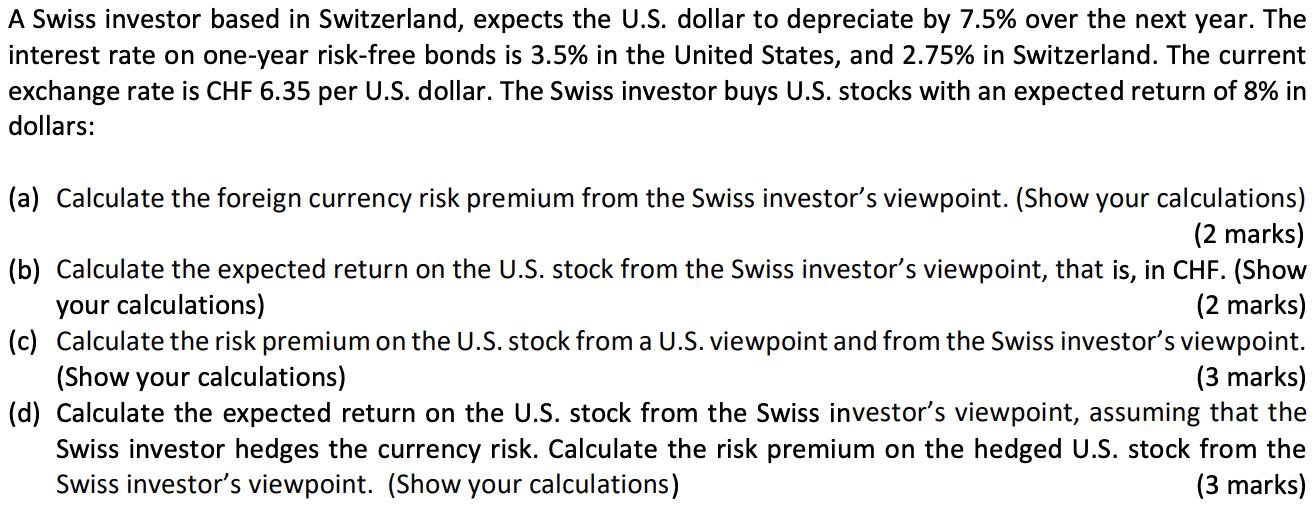

A Swiss investor based in Switzerland, expects the U.S. dollar to depreciate by 7.5% over the next year. The interest rate on one-year risk-free bonds is 3.5% in the United States, and 2.75% in Switzerland. The current exchange rate is CHF 6.35 per U.S. dollar. The Swiss investor buys U.S. stocks with an expected return of 8% in dollars: (a) Calculate the foreign currency risk premium from the Swiss investor's viewpoint. (Show your calculations) (2 marks) (b) Calculate the expected return on the U.S. stock from the Swiss investor's viewpoint, that is, in CHF. (Show your calculations) (2 marks) (c) Calculate the risk premium on the U.S. stock from a U.S. viewpoint and from the Swiss investor's viewpoint. (Show your calculations) (3 marks) (d) Calculate the expected return on the U.S. stock from the Swiss investor's viewpoint, assuming that the Swiss investor hedges the currency risk. Calculate the risk premium on the hedged U.S. stock from the Swiss investor's viewpoint. (Show your calculations) (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Currency Risk Premium and Expected Returns Foreign Currency Risk Premium Solution Calculate expected dollar appreciation based on interest rate differ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started