Answered step by step

Verified Expert Solution

Question

1 Approved Answer

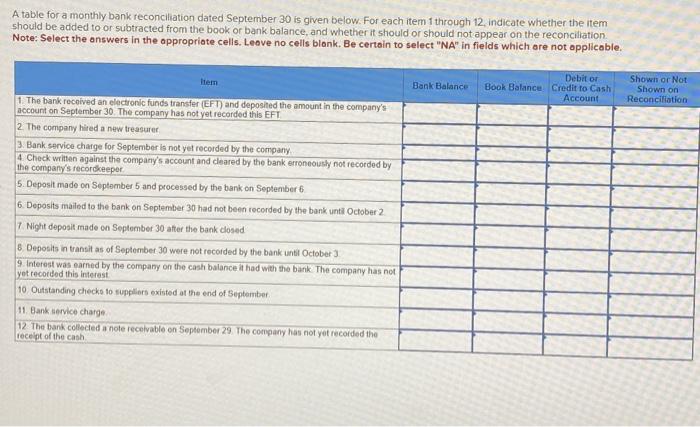

A table for a monthly bank reconciliation dated September 30 is given below. For each item 1 through 12, indicate whether the item should

A table for a monthly bank reconciliation dated September 30 is given below. For each item 1 through 12, indicate whether the item should be added to or subtracted from the book or bank balance, and whether it should or should not appear on the reconciliation. Note: Select the answers in the appropriate cells. Leave no cells blank. Be certain to select "NA" in fields which are not applicable. Item 1. The bank received an electronic funds transfer (EFT) and deposited the amount in the company's account on September 30. The company has not yet recorded this EFT 2. The company hired a new treasurer 3. Bank service charge for September is not yet recorded by the company 4. Check written against the company's account and cleared by the bank erroneously not recorded by the company's recordkeeper 5. Deposit made on September 5 and processed by the bank on September 6 6. Deposits mailed to the bank on September 30 had not been recorded by the bank until October 2 7. Night deposit made on September 30 after the bank closed 8. Deposits in transit as of September 30 were not recorded by the bank until October 3 9. Interest was earned by the company on the cash balance it had with the bank. The company has not yet recorded this interest 10 Outstanding checks to suppliers existed at the end of September 11. Bank service charge. 12 The bank collected a note receivable on September 29 The company has not yet recorded the receipt of the cash Debit or Bank Balance Book Balance Credit to Cash Account Shown or Not Shown on Reconciliation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started