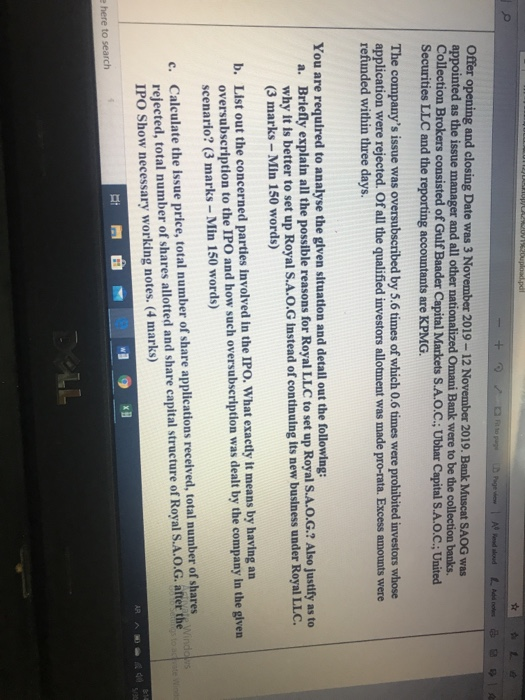

A tad notes Case Study 1: Royal LLC is a well-established company operating its business successfully for the past 15 years in Sultanate of Oman. It has diverse business interests ranging from construction, health care, automobiles and fertilizers. It consists of 5 partners namely Ali, Ahmed, Rehman, Sulaiman & Noah. The partners of the company decided to venture into manufacturing sector producing food products like flour mixes and doughs, breakfast cereals and baked goods. From the previous experience and success, these partners will be here onwards known as promoters and are confident that they can succeed in their new venture too. Based on the feasibility study it is found that the proposed integrated food manufacturing company is expected to create over 600 direct jobs during the first 10 years of operations. However, an additional 1,000 indirect and induced employment opportunities will be created over the same timeframe, with significant implications for income generation and socio-economic growth. Moreover, according to reports, food demand is projected to grow from 4.7 million tonnes in 2017 to 6.9 million tonnes by 2040, at the annual rate of 1.2 -1.8 per cent, while the consumption of cereals is set to increase due to its eminence in the daily meal. A sizable part of the demand for the food products to be manufactured by the company is expected to come from the growing array of food related businesses - both operational and under development including restaurants, bakery, biscuit making, fast food chains, grocery stores etc. Activate Windows Initially the manufacturing concern is anticipated to incur losses as it must face immense competition from the existing food market suppliers which is flooded with non-Omani food products manufactured in UAE, Saudi AR it here to search DLL O files/Users/DELLS20112/Desktop/C220V1%20upload.pdt At top Initially the manufacturing concern is anticipated to incur losses as it must face immense competition from the ID Page View All Bradloud existing food market suppliers which is flooded with non-Omani food products manufactured in UAE, Saudi Arabia and other nearby nations. But after a short period of losses, the promoters are confident that it will overcome all the marketability problems by producing good quality products at affordable prices which will attract customers and thereby improving its income generating capacity. Promoters are expecting that in the long run, the profits from this business will surpass the profits from all their current businesses. Business plan indicated the estimation to start this business would be OMR 60 million which is a huge investment. Such huge investment will be a burden on the already successful businesses from which the owners have to set apart the money to start their new business. Even though the prospects of the business appear to be bright, the owners of the business do not want to mix up the existing business with the new one. So, they decided that the manufacturing business will be a Leparate entity which will be set up as a public limited company different from Royal LLC. To set up a public limited company i.e., SAOG, requires a few legal procedures and steps to be followed. Omani Commercial Companies law provides us with the details of the procedure to be followed and rules to be abided by while setting up a company. Regal consultants were appointed to look after such process of formation of Royal S.A.O.G. Oman's legal procedures have been drawn with the intention of bringing more fruitful investors and lenders for every company. It is also important to note that company could go for borrowings from the commercial banks which are supported by Central Bank of Oman. Thus, the founder members of Royal LLC followed rules governed by the Commercial Companies law in formation of Royal S.A.O.G. The initial process was completed by 1" October 2019. Royal S.A.O.G entrusted with a Board of directors consisted of five promoters as minimum to decide the matters accordingly as per the provisions of the commercial companies law. to search U hekersDES20112/Desktop/CAZZOV1.20upload pdf completed by 1"October 2019. Royal S.A.O.G entrusted with a Board of directors consisted of five promoters as minimum to decide the matters accordingly as per the provisions of the commercial companies law. The company had to qualify for its minimum capital requirement through an Initial Public Offering. In order to raise the required capital amount, based on the information given above, the promoters decided to take a loan of OMR 10 million from Bank Muscat based on the reputation held by Royal LLC. The company was to be registered with capital of OMR 50 million divided into shares of 100 baiza each. 30% of the share capital was contributed by the promoters and 40% of the share capital was to be raised through an initial public offer. The type of shares offered for subscription consist only of ordinary shares. Each single share carries the right to one vote at any general meeting. Offer price for each share was at a premium of 20% along with additional share issue expense of 2 baiza per offer share. Purpose of the IPO is to comply with the obligations stipulated in 66.6 1986 1985 86 sl Islator ype here to search ELL Ofe/c/users/DELL%20112/Desktop/CA220V1.20upload.pdf Pageview | A Read Mod share issue expense of 2 baiza per offer share. Purpose of the IPO is to comply with the obligations stipulated in the Oman commercial law with regards to company formation. Persons eligible for Offer Shares can be Omani and non-Omani individuals and juristic persons who can apply a minimum of 1,000 Offer Shares and in multiples of 100 Shares. Persons prohibited from subscribing to the Offer are the following: Sole proprietorship establishments: The owners of sole proprietorship establishments may only submit Applications in their personal names. Trust accounts: Customers registered under trust accounts may only submit Applications in their personal names Multiple Applications: An Applicant may not submit more than one Application. Joint Applications: Applicants may not submit applications in the name of more than one individual (including on behalf of legal heirs). All such Applications will be rejected without contacting the Applicant. Proposed allocation procedure: In case of oversubscription, for the purpose of allocating the Offer Shares between the eligible investor groups, the allocation of the Offer Shares will be 1:4. The maximum limit of shares allotted to an individual cannot be more than 200,000 shares. Offer opening and closing Date was 3 November 2019 - 12 November 2019. Bank Muscat SAOG was appointed as the issue manager and all other nationalized Omani Bank were to be the collection banks Collection Brokers consisted of Gulf Baader Capital Markets S.A.O.C. Ubhar Capital S.A.O.C., United Caritas TIC and more Type here to search DMC Dupload.pl A Rended Offer opening and closing Date was 3 November 2019 - 12 November 2019. Bank Muscat SAOG was appointed as the issue manager and all other nationalized Omani Bank were to be the collection banks. Collection Brokers consisted of Gulf Baader Capital Markets S.A.O.C.: Ubhar Capital S.A.O.C., United Securities LLC and the reporting accountants are KPMG. The company's issue was oversubscribed by 5.6 times of which 0.6 times were prohibited investors whose application were rejected. Of all the qualified investors allotment was made pro-rata. Excess amounts were refunded within three days. You are required to analyse the given situation and detall out the following: a. Briefly explain all the possible reasons for Royal LLC to set up Royal S.A.O.G.? Also justify as to why it is better to set up Royal S.A.O.G instead of continuing its new business under Royal LLC. (3 marks - Min 150 words) b. List out the concerned parties involved in the IPO. What exactly it means by having an oversubscription to the IPO and how such oversubscription was dealt by the company in the given scenario? (3 marks - Min 150 words) c. Calculate the issue price, total number of share applications received, total number of shares e Windows rejected, total number of shares allotted and share capital structure of Royal S.A.O.G. after the IPO Show necessary working notes. (4 marks) e here to search