Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A target company was acquired at the end of Year 0 . The acquirer purchased 1 0 0 % of the equity. Calculate the return

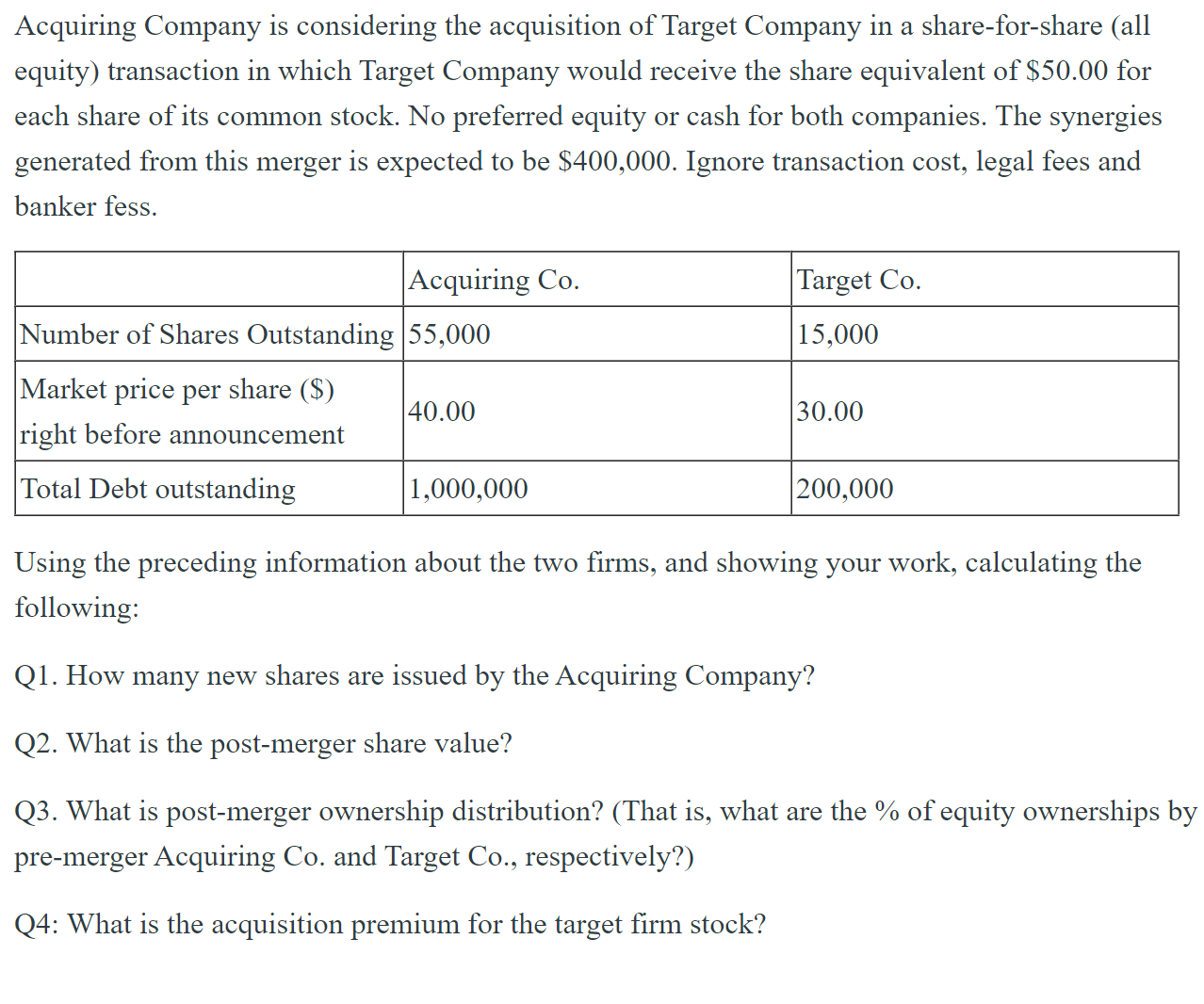

A target company was acquired at the end of Year The acquirer purchased of the equity. Calculate the return on beginning invested capital in year A target company was acquired at the end of Year The acquirer purchased of the equity. Calculate the return on beginning invested capital in year Acquiring Company is considering the acquisition of Target Company in a shareforshare all

equity transaction in which Target Company would receive the share equivalent of $ for

each share of its common stock. No preferred equity or cash for both companies. The synergies

generated from this merger is expected to be $ Ignore transaction cost, legal fees and

banker fess.

Using the preceding information about the two firms, and showing your work, calculating the

following:

Q How many new shares are issued by the Acquiring Company?

Q What is the postmerger share value?

Q What is postmerger ownership distribution? That is what are the of equity ownerships by

premerger Acquiring Co and Target Co respectively?

Q: What is the acquisition premium for the target firm stock?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started