Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A tax-inspector can either inspect or not inspect a company for the true size of reported profits in its tax return. The company can

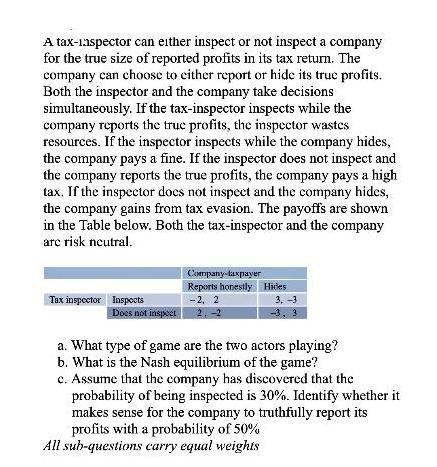

A tax-inspector can either inspect or not inspect a company for the true size of reported profits in its tax return. The company can choose to either report or hide its truc profits. Both the inspector and the company take decisions simultaneously. If the tax-inspector inspects while the company reports the truc profits, the inspector wastes resources. If the inspector inspects while the company hides, the company pays a fine. If the inspector does not inspect and the company reports the true profits, the company pays a high tax. If the inspector does not inspect and the company hides, the company gains from tax evasion. The payoffs are shown in the Table below. Both the tax-inspector and the company are risk neutral. Tax inspector Inspects Does not inspect Company-taxpayer Reports honestly Hides -2, 2 3,-3 -3, 3 a. What type of game are the two actors playing? b. What is the Nash equilibrium of the game? c. Assume that the company has discovered that the probability of being inspected is 30%. Identify whether it makes sense for the company to truthfully report its profits with a probability of 50% All sub-questions carry equal weights

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a The two actors are playing a simultaneousmove twoplayer nonzerosum game of incomplete infor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started