Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A T-bill that expires Nov 15, 2012. It has 184 days to maturity. The bid discount is 0.145%. What is the Bond Equivalent (bid) Yield?

A T-bill that expires Nov 15, 2012. It has 184 days to maturity. The bid discount is 0.145%. What is the Bond Equivalent (bid) Yield?

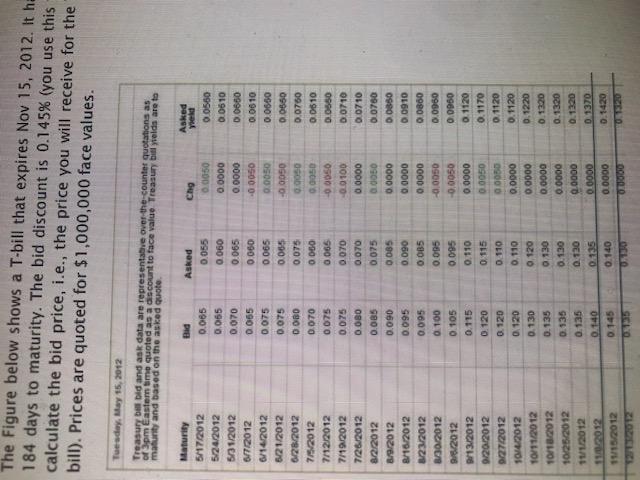

The Figure below shows a T-bill that expires Nov 15, 2012. It ha 184 days to maturity. The bid discount is 0.145% (you use this calculate the bid price, i.e., the price you will receive for the bill). Prices are quoted for $1,000,000 face values. Tuesday, May 15, 2012 Treasury bebid and ask data are representative over-the-counter quotations as of 3pm Eastem limo quoted as a discount to face value Treasury bill yields are to maturity and based on the asked Quote Cho 00050 0.0000 0.0000 -00050 0.0050 -0.0050 5/17/2012 5/24/2012 5/31/2012 6/7/2012 6/14/2012 6/21/2012 6/28/2012 7/5/2012 7/12/2012 7/19/2012 7/26/2012 8/2/2012 8/9/2012 8/16/2012 8/23/2012 8/30/2012 9/6/2012 9/13/2012 9/20/2012 027/2012 10/2012 10/11/2012 10/18/2012 10/25/2012 11/1/2012 11/10/2012 115.2012 Bid 0.065 0.065 0.070 0.065 0.075 0.075 0.000 0.070 0.075 0.075 0.080 0.085 0.090 0.095 0.095 0.100 0.105 0.115 0.120 0.120 0.120 0.130 0.135 0.135 0.135 0.140 0.145 Asked 0.055 0.060 0.065 0060 0.065 0.065 0.075 0 000 0.066 0070 0.070 0.075 0085 0.090 0.085 0.095 0.095 0.110 0.115 0.110 0. 110 0 120 0 130 0.130 0.130 035 0.140 010 0050 -0.0050 00100 0.0000 00050 0.0000 0.0000 0.0000 -0.0050 -0.0050 0.0000 0.0050 00050 0.0000 0.0000 0.0000 0.0000 0.0000 0.0090 0.0000 00000 Asked Weld 0.0560 0.0610 0.0650 0.0610 0.0650 0.0550 0.0760 0.0610 0.0550 0.0710 0.0710 0.0780 0.0850 0.09 10 0.0860 0.0960 0.0950 0.1120 0.1170 0.1120 0.1120 0.1220 0.1320 0.1320 0.1320 0 1370 0.1420 The Figure below shows a T-bill that expires Nov 15, 2012. It ha 184 days to maturity. The bid discount is 0.145% (you use this calculate the bid price, i.e., the price you will receive for the bill). Prices are quoted for $1,000,000 face values. Tuesday, May 15, 2012 Treasury bebid and ask data are representative over-the-counter quotations as of 3pm Eastem limo quoted as a discount to face value Treasury bill yields are to maturity and based on the asked Quote Cho 00050 0.0000 0.0000 -00050 0.0050 -0.0050 5/17/2012 5/24/2012 5/31/2012 6/7/2012 6/14/2012 6/21/2012 6/28/2012 7/5/2012 7/12/2012 7/19/2012 7/26/2012 8/2/2012 8/9/2012 8/16/2012 8/23/2012 8/30/2012 9/6/2012 9/13/2012 9/20/2012 027/2012 10/2012 10/11/2012 10/18/2012 10/25/2012 11/1/2012 11/10/2012 115.2012 Bid 0.065 0.065 0.070 0.065 0.075 0.075 0.000 0.070 0.075 0.075 0.080 0.085 0.090 0.095 0.095 0.100 0.105 0.115 0.120 0.120 0.120 0.130 0.135 0.135 0.135 0.140 0.145 Asked 0.055 0.060 0.065 0060 0.065 0.065 0.075 0 000 0.066 0070 0.070 0.075 0085 0.090 0.085 0.095 0.095 0.110 0.115 0.110 0. 110 0 120 0 130 0.130 0.130 035 0.140 010 0050 -0.0050 00100 0.0000 00050 0.0000 0.0000 0.0000 -0.0050 -0.0050 0.0000 0.0050 00050 0.0000 0.0000 0.0000 0.0000 0.0000 0.0090 0.0000 00000 Asked Weld 0.0560 0.0610 0.0650 0.0610 0.0650 0.0550 0.0760 0.0610 0.0550 0.0710 0.0710 0.0780 0.0850 0.09 10 0.0860 0.0960 0.0950 0.1120 0.1170 0.1120 0.1120 0.1220 0.1320 0.1320 0.1320 0 1370 0.1420Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started