Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Let time be denoted by t = 1,2,3,4... Assume that there are two types of agents in the economy. Agents of type 1 have

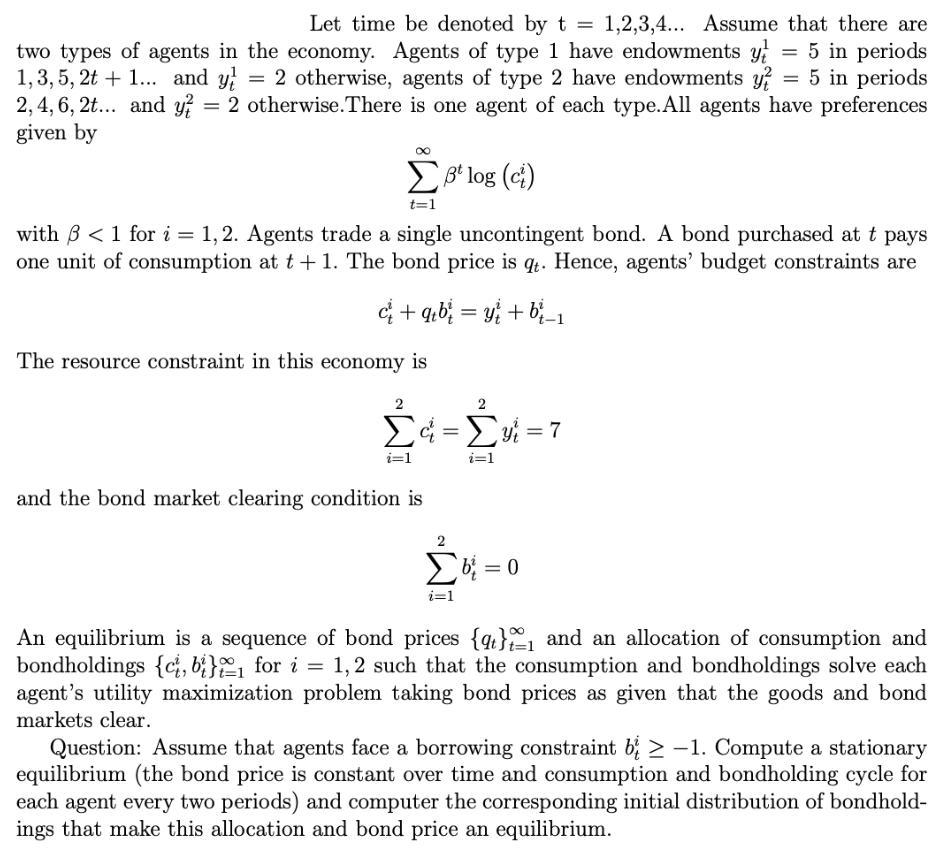

Let time be denoted by t = 1,2,3,4... Assume that there are two types of agents in the economy. Agents of type 1 have endowments y = 5 in periods 1,3,5, 2t + 1... and y = 2 otherwise, agents of type 2 have endowments y = 5 in periods 2, 4, 6, 2t... and y? = 2 otherwise. There is one agent of each type. All agents have preferences given by B log (c) t=1 with 3 < 1 for i=1,2. Agents trade a single uncontingent bond. A bond purchased at t pays one unit of consumption at t + 1. The bond price is qt. Hence, agents' budget constraints are c+qb = + b-1 The resource constraint in this economy is 2 = = i=1 and the bond market clearing condition is i=1 2 b=0 i=1 An equilibrium is a sequence of bond prices {q} and an allocation of consumption and bondholdings {c, bi} for i = 1,2 such that the consumption and bondholdings solve each agent's utility maximization problem taking bond prices as given that the goods and bond markets clear. Question: Assume that agents face a borrowing constraint b> -1. Compute a stationary equilibrium (the bond price is constant over time and consumption and bondholding cycle for each agent every two periods) and computer the corresponding initial distribution of bondhold- ings that make this allocation and bond price an equilibrium.

Step by Step Solution

★★★★★

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The answer provided below has been developed in a clear step by step manner Step 1 The bond price in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started