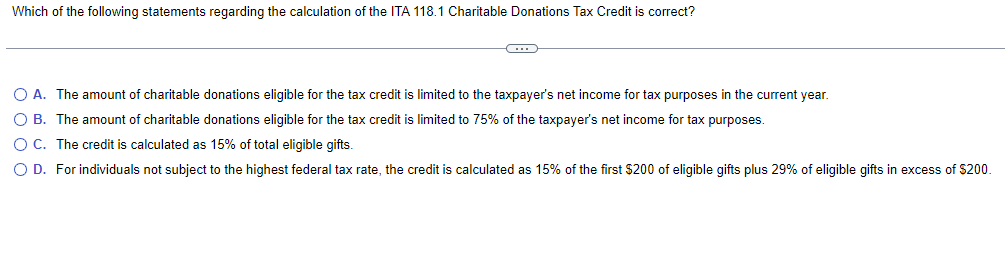

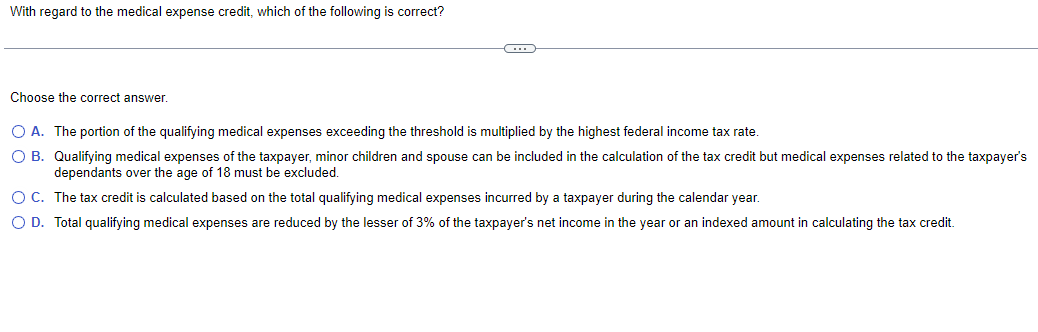

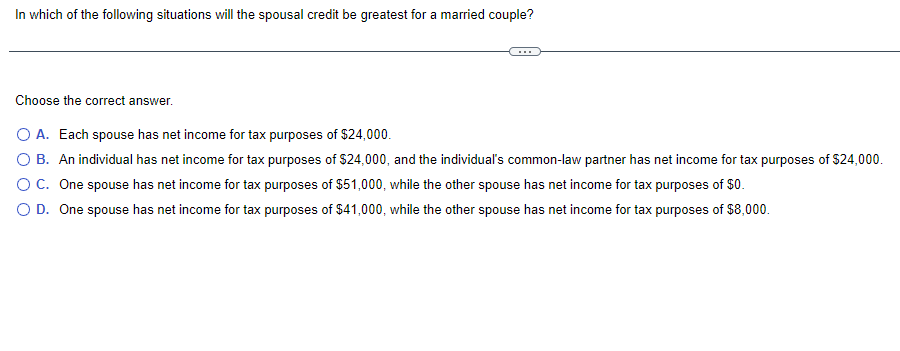

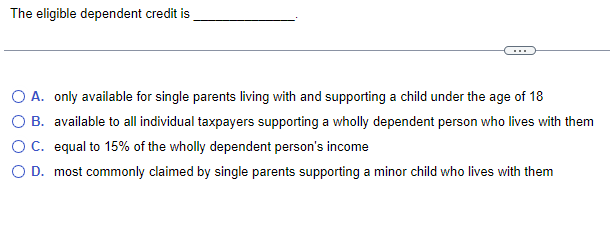

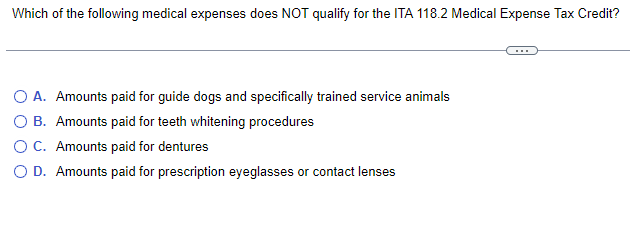

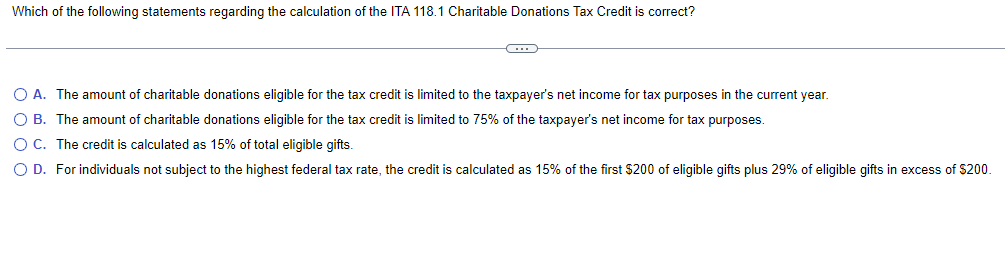

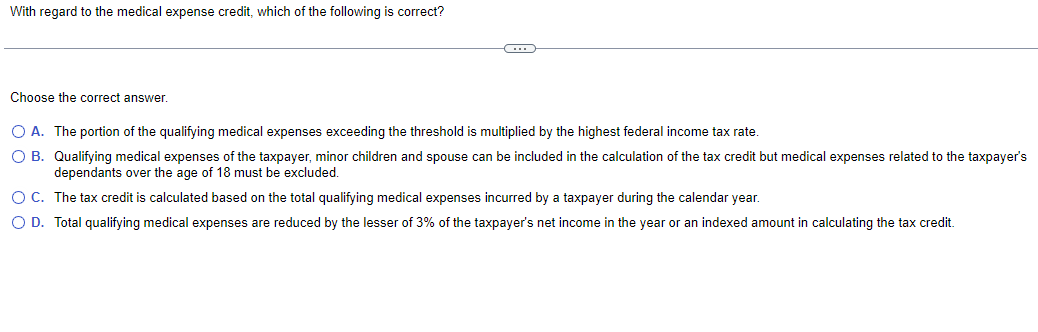

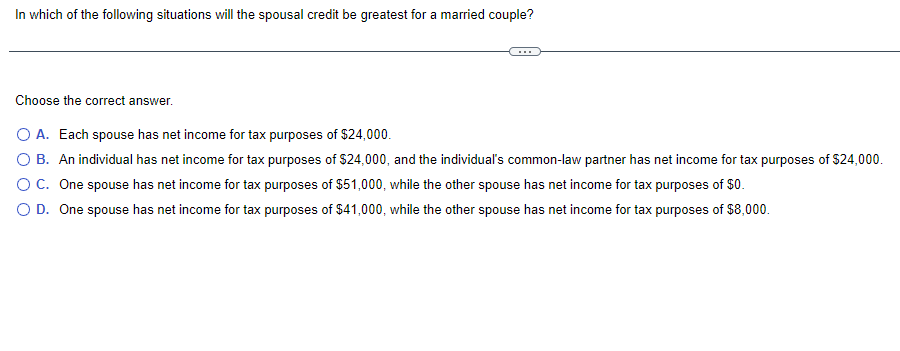

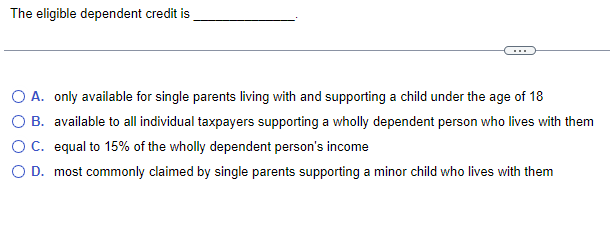

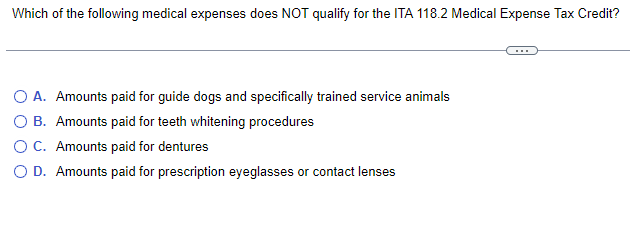

A. The amount of charitable donations eligible for the tax credit is limited to the taxpayer's net income for tax B. The amount of charitable donations eligible for the tax credit is limited to 75% of the taxpayer's net income for tax purposes. C. The credit is calculated as 15% of total eligible gifts. D. For individuals not subject to the highest federal tax rate, the credit is calculated as 15% of the first $200 of eligible gifts plus 29% of eligible gifts in excess of $200. With regard to the medical expense credit, which of the following is correct? Choose the correct answer. A. The portion of the qualifying medical expenses exceeding the threshold is multiplied by the highest federal income tax rate. B. Qualifying medical expenses of the taxpayer, minor children and spouse can be included in the calculation of the tax credit but medical expenses related to the taxpayer's dependants over the age of 18 must be excluded. C. The tax credit is calculated based on the total qualifying medical expenses incurred by a taxpayer during the calendar year. D. Total qualifying medical expenses are reduced by the lesser of 3% of the taxpayer's net income in the year or an indexed amount in calculating the tax In which of the following situations will the spousal credit be greatest for a married couple? Choose the correct answer. A. Each spouse has net income for tax purposes of $24,000. B. An individual has net income for tax purposes of $24,000, and the individual's common-law partner has net income for tax purposes of $24,000. C. One spouse has net income for tax purposes of $51,000, while the other spouse has net income for tax purposes of $0. D. One spouse has net income for tax purposes of $41,000, while the other spouse has net income for tax purposes of $8,000. The eligible dependent credit is A. only available for single parents living with and supporting a child under the age of 18 B. available to all individual taxpayers supporting a wholly dependent person who lives with them C. equal to 15% of the wholly dependent person's income D. most commonly claimed by single parents supporting a minor child who lives with them Which of the following medical expenses does NOT qualify for the ITA 118.2 Medical Expense Tax Credit? A. Amounts paid for guide dogs and specifically trained service animals B. Amounts paid for teeth whitening procedures C. Amounts paid for dentures D. Amounts paid for prescription eyeglasses or contact lenses A. The amount of charitable donations eligible for the tax credit is limited to the taxpayer's net income for tax B. The amount of charitable donations eligible for the tax credit is limited to 75% of the taxpayer's net income for tax purposes. C. The credit is calculated as 15% of total eligible gifts. D. For individuals not subject to the highest federal tax rate, the credit is calculated as 15% of the first $200 of eligible gifts plus 29% of eligible gifts in excess of $200. With regard to the medical expense credit, which of the following is correct? Choose the correct answer. A. The portion of the qualifying medical expenses exceeding the threshold is multiplied by the highest federal income tax rate. B. Qualifying medical expenses of the taxpayer, minor children and spouse can be included in the calculation of the tax credit but medical expenses related to the taxpayer's dependants over the age of 18 must be excluded. C. The tax credit is calculated based on the total qualifying medical expenses incurred by a taxpayer during the calendar year. D. Total qualifying medical expenses are reduced by the lesser of 3% of the taxpayer's net income in the year or an indexed amount in calculating the tax In which of the following situations will the spousal credit be greatest for a married couple? Choose the correct answer. A. Each spouse has net income for tax purposes of $24,000. B. An individual has net income for tax purposes of $24,000, and the individual's common-law partner has net income for tax purposes of $24,000. C. One spouse has net income for tax purposes of $51,000, while the other spouse has net income for tax purposes of $0. D. One spouse has net income for tax purposes of $41,000, while the other spouse has net income for tax purposes of $8,000. The eligible dependent credit is A. only available for single parents living with and supporting a child under the age of 18 B. available to all individual taxpayers supporting a wholly dependent person who lives with them C. equal to 15% of the wholly dependent person's income D. most commonly claimed by single parents supporting a minor child who lives with them Which of the following medical expenses does NOT qualify for the ITA 118.2 Medical Expense Tax Credit? A. Amounts paid for guide dogs and specifically trained service animals B. Amounts paid for teeth whitening procedures C. Amounts paid for dentures D. Amounts paid for prescription eyeglasses or contact lenses