Question

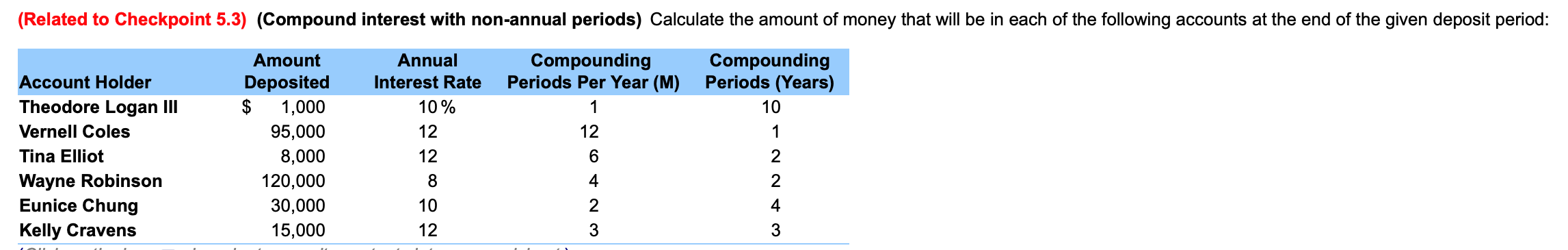

a) The amount of money in Theodore Logan III's account at the end of 10 years will be $? (Round to the nearest cent) b)

-

a) The amount of money in Theodore Logan III's account at the end of 10 years will be $? (Round to the nearest cent) b) The amount of money in Vernell Coles account at the end of 1 year(s) will be $? (Round to the nearest cent) c) The amount of money in Tina Elliots account at the end of 2 years will be $? (Round to the nearest cent)

a) The amount of money in Theodore Logan III's account at the end of 10 years will be $? (Round to the nearest cent) b) The amount of money in Vernell Coles account at the end of 1 year(s) will be $? (Round to the nearest cent) c) The amount of money in Tina Elliots account at the end of 2 years will be $? (Round to the nearest cent)

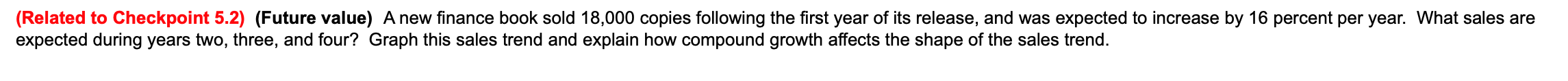

(a) If the 18,000 copies of book sales following the first year of its release were expected to increase by 16 percent per year, what are the expected sales of the new finance book during year two? (Round to the nearest whole number.) (b). If the 18,000 copies of book sales following the first year of its release were expected to increase by 16 percent per year, what are the expected sales of the new finance book during year three? (Round to the nearest whole number.) (c). If the 18,000 copies of book sales following the first year of its release were expected to increase by 16 percent per year, what are the expected sales of the new finance book during year four?

(a) If the 18,000 copies of book sales following the first year of its release were expected to increase by 16 percent per year, what are the expected sales of the new finance book during year two? (Round to the nearest whole number.) (b). If the 18,000 copies of book sales following the first year of its release were expected to increase by 16 percent per year, what are the expected sales of the new finance book during year three? (Round to the nearest whole number.) (c). If the 18,000 copies of book sales following the first year of its release were expected to increase by 16 percent per year, what are the expected sales of the new finance book during year four?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started