Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) The BBC Company paid a K2.50 dividend per share at the end of the year. The dividend is expected to grow by 10 percent

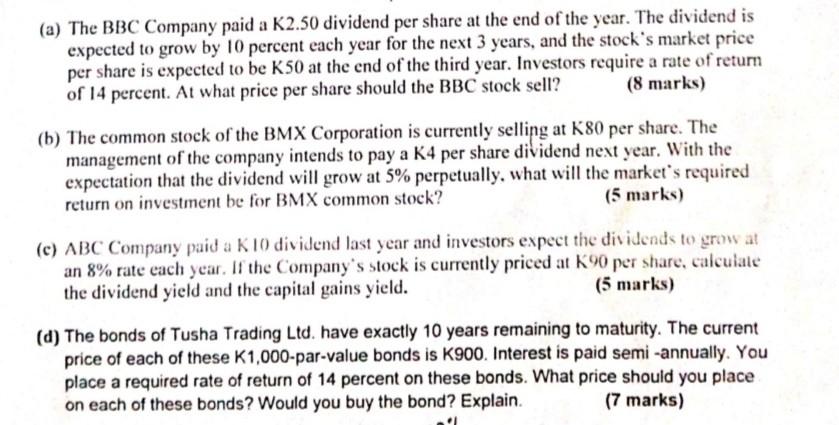

(a) The BBC Company paid a K2.50 dividend per share at the end of the year. The dividend is expected to grow by 10 percent each year for the next 3 years, and the stock's market price per share is expected to be K50 at the end of the third year. Investors require a rate of return of 14 percent. At what price per share should the BBC stock sell? (8 marks) (b) The common stock of the BMX Corporation is currently selling at K80 per share. The management of the company intends to pay a K4 per share dividend next year. With the expectation that the dividend will grow at 5% perpetually, what will the market's required return on investment be for BMX common stock? (5 marks) (c) ABC Company paid a K10 dividend last year and investors expect the dividends to grow at an 8% rate each year. If the Company's stock is currently priced at K90 per share, calculate the dividend yield and the capital gains yield. (5 marks) (d) The bonds of Tusha Trading Ltd. have exactly 10 years remaining to maturity. The current price of each of these K1,000-par-value bonds is K900. Interest is paid semi-annually. You place a required rate of return of 14 percent on these bonds. What price should you place on each of these bonds? Would you buy the bond? Explain. (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started