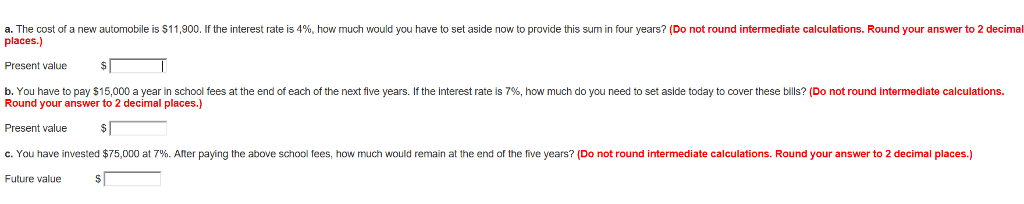

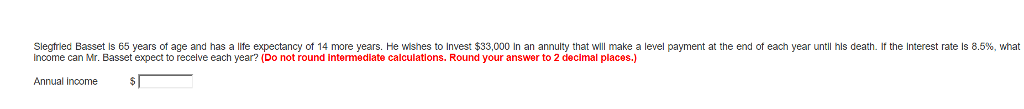

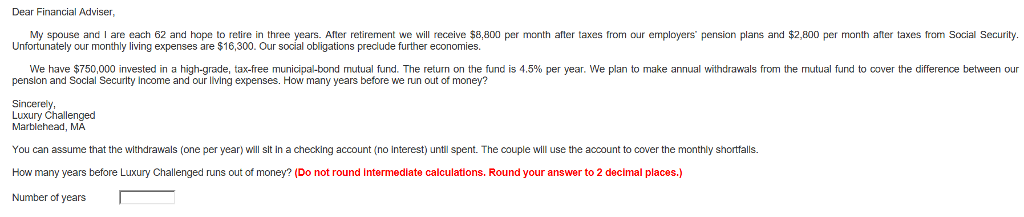

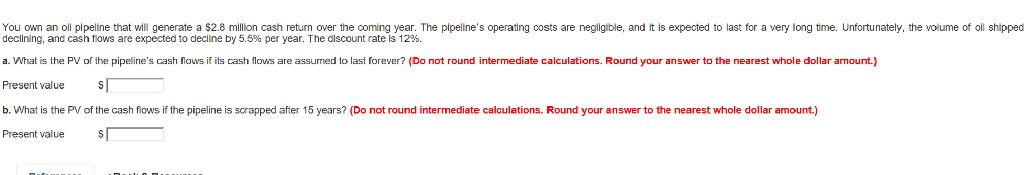

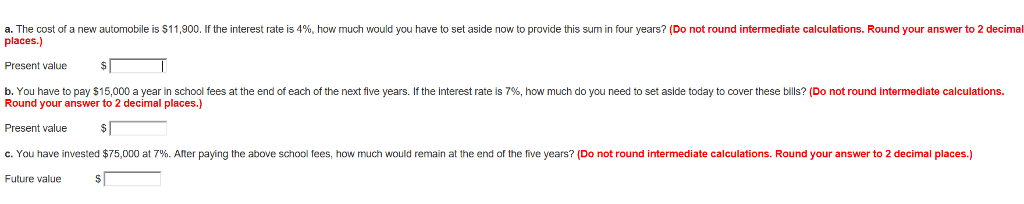

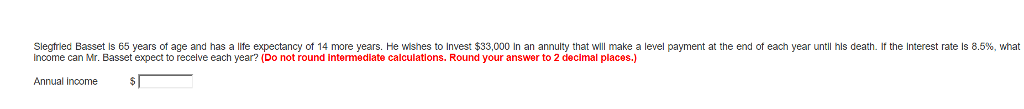

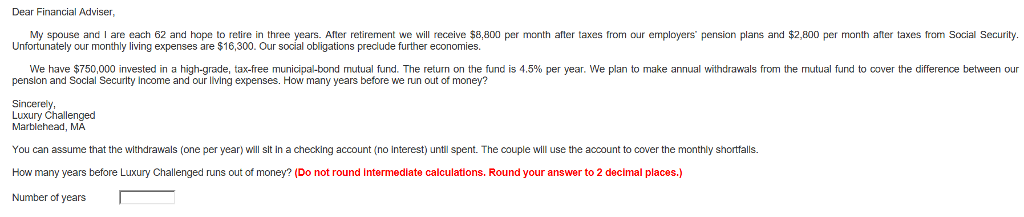

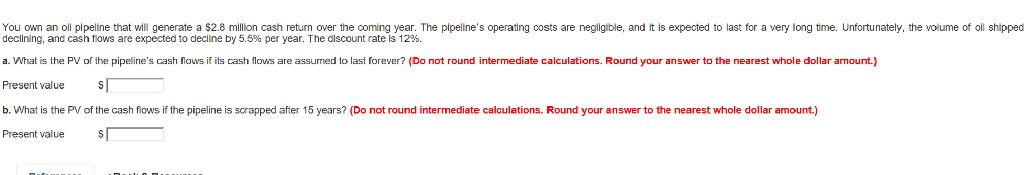

a. The cost of a new automobile is $11,900 lf he interest rate is 4%, how much would you have to set aside now to provide this sum in four years? Do not round intermediate calculations. Round your answer to 2 decimal places.) Present value b, You have to pay $15,000 a year in school fees at the end of each of the next five years. If the Interest rate is 7%, how much do you need to set aside today to cover these bills? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Present value c. You have invested $75,000 at 7%. After paying the above school fees, how much would remain at the end of the five years? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Future value sieg ied Basset is 65 years of age and has a e expectancy o 14 more years. He w nes to invest $3 in an annu t at wil make a le el payment at the end of e Income can Mr. Basset expect to recelve each year? (Do not round intermediate calculations. Round your answer to 2 decimal places.) year his death. the nterest at S9% what Dear Financial Adviser, My spouse and I are each 62 and hope to retire in three years. After retirement we will receive $8,800 per month after taxes from our employers pension plans and $2,800 per month after taxes from Social Security. Unfortunately our monthly living expenses are $16,300. Our social obligations preclude further economies. We have $750,000 invested in a high-grade ta ree munica a bond mutual fund. The return on he fund 1s 4,5% per ear. we an to make annual dra as om hem tua und 0 over hear ere ce between penslon and Soclal Securlty Income and our living expenses. How many years before we run out of money? Sincerely Marblehead, MA You can assume that the withdrawals (one per year) will sit In a checking account (no interest) until spent. The couple will use the account to cover the monthly shortfalls. How many years before Luxury Challenged runs out of money? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Number of years You own an oll plpeline that wll generate a $2.8 million cash return over the coming year. The pipeline's operating costs are negligible, and it is expected to last for a very long time. Unfortunately, the volume of oll shipped declining, and cash flows are expected to decline by 5.5% per year. The discount rate is 12% a. What is the PV of the pipeline's cash flows if its cash flows are assumed to last forever? (Do not round intermediate calculations. Round your answer to the nearest whole dollar amount.) Present value b. What is the PV of the cash flows if the pipeline is scrapped after 15 years? (Do not round intermediate calculations. Round your answer to the nearest whole dollar amount.) Present value