Answered step by step

Verified Expert Solution

Question

1 Approved Answer

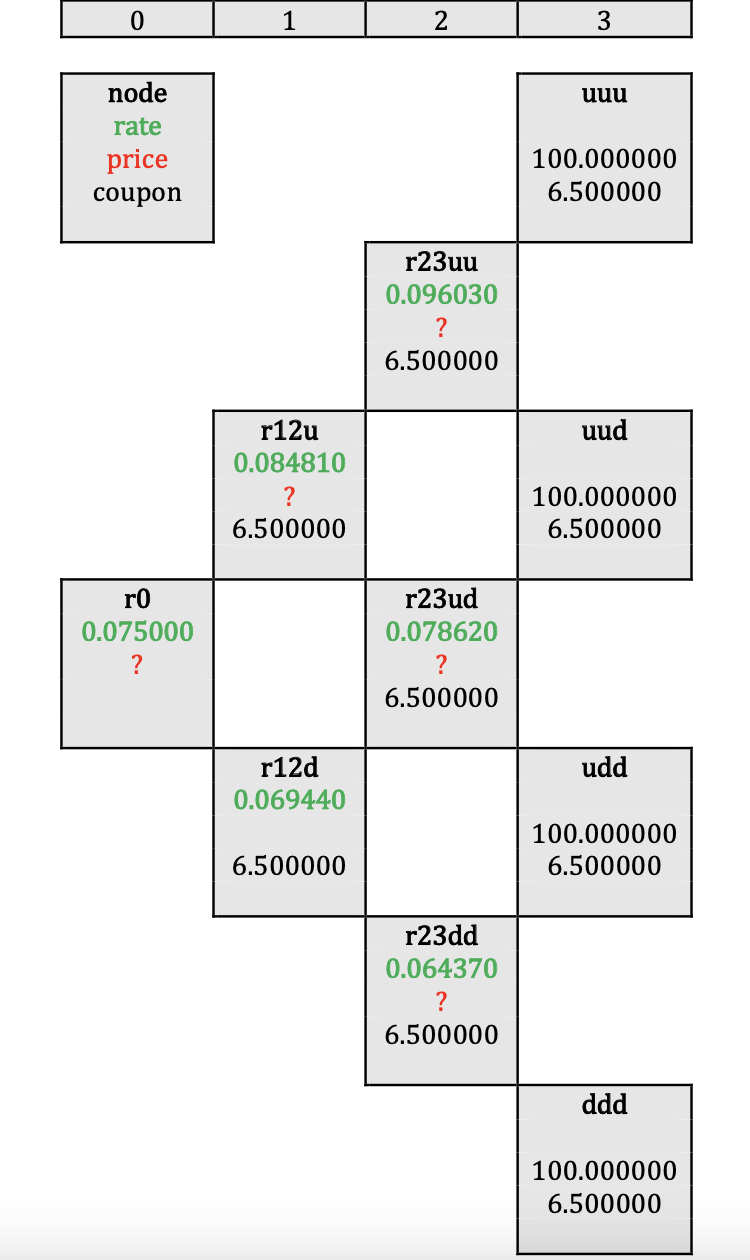

(a) The diagram below shows a binomial tree for a 6.5% coupon bond based on an interest rate volatility of 10%.Create a model (use an

(a) The diagram below shows a binomial tree for a 6.5% coupon bond based on an interest rate volatility of 10%.Create a model (use an Excel spreadsheet) and compute the price of the bond.

(b) Suppose the bond above is now callable at only time 1 and time 2 at prices of 102 and 101, respectively. Calculate the price of the call option associated with the bond.

(c) Discuss your answer in part (b).

(d) If the bond is more convex than it is presently, assess the impact on your answer to part (b).

0 1 2 3 uuu node rate price coupon 100.000000 6.500000 r23uu 0.096030 ? 6.500000 uud r12u 0.084810 ? 6.500000 100.000000 6.500000 ro 0.075000 ? r23ud 0.078620 ? 6.500000 udd r12d 0.069440 100.000000 6.500000 6.500000 r23dd 0.064370 ? 6.500000 ddd 100.000000 6.500000 0 1 2 3 uuu node rate price coupon 100.000000 6.500000 r23uu 0.096030 ? 6.500000 uud r12u 0.084810 ? 6.500000 100.000000 6.500000 ro 0.075000 ? r23ud 0.078620 ? 6.500000 udd r12d 0.069440 100.000000 6.500000 6.500000 r23dd 0.064370 ? 6.500000 ddd 100.000000 6.500000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started