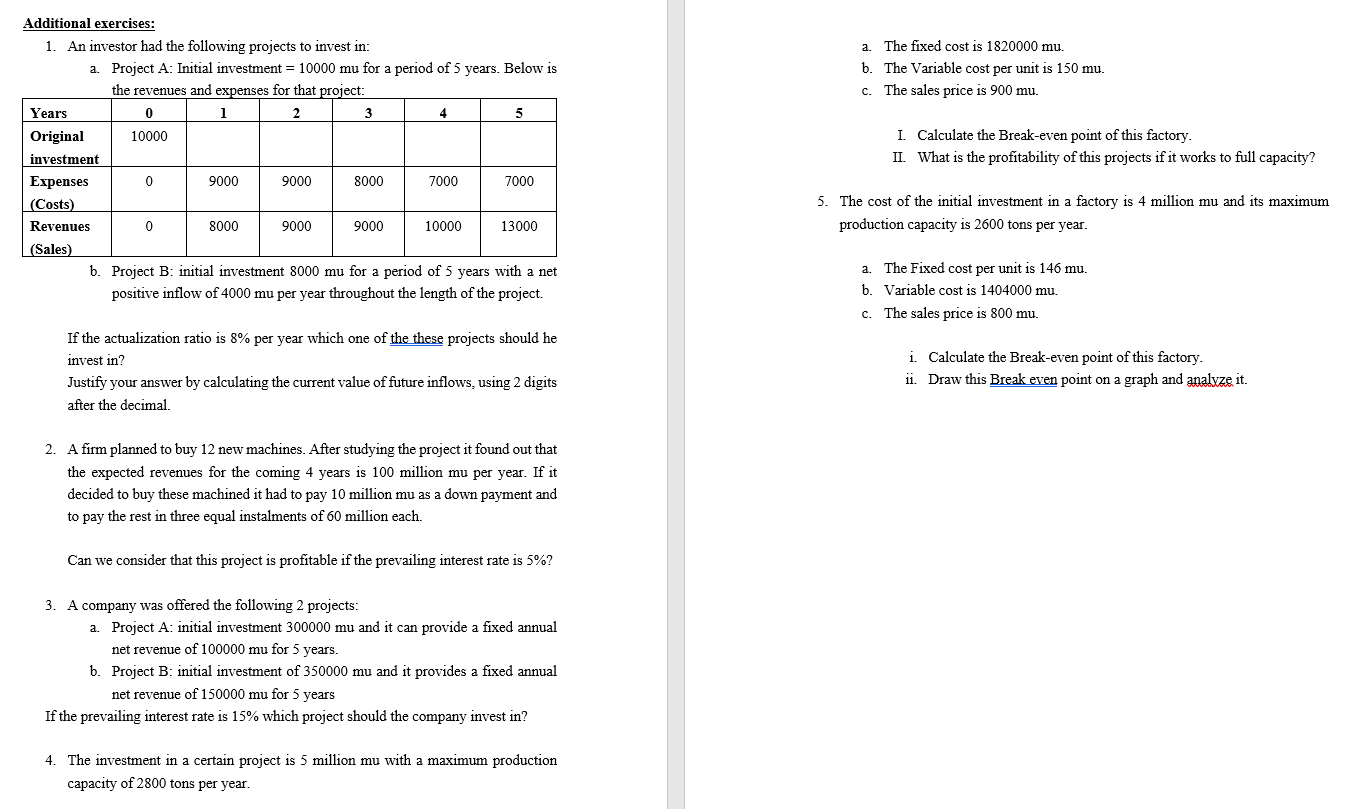

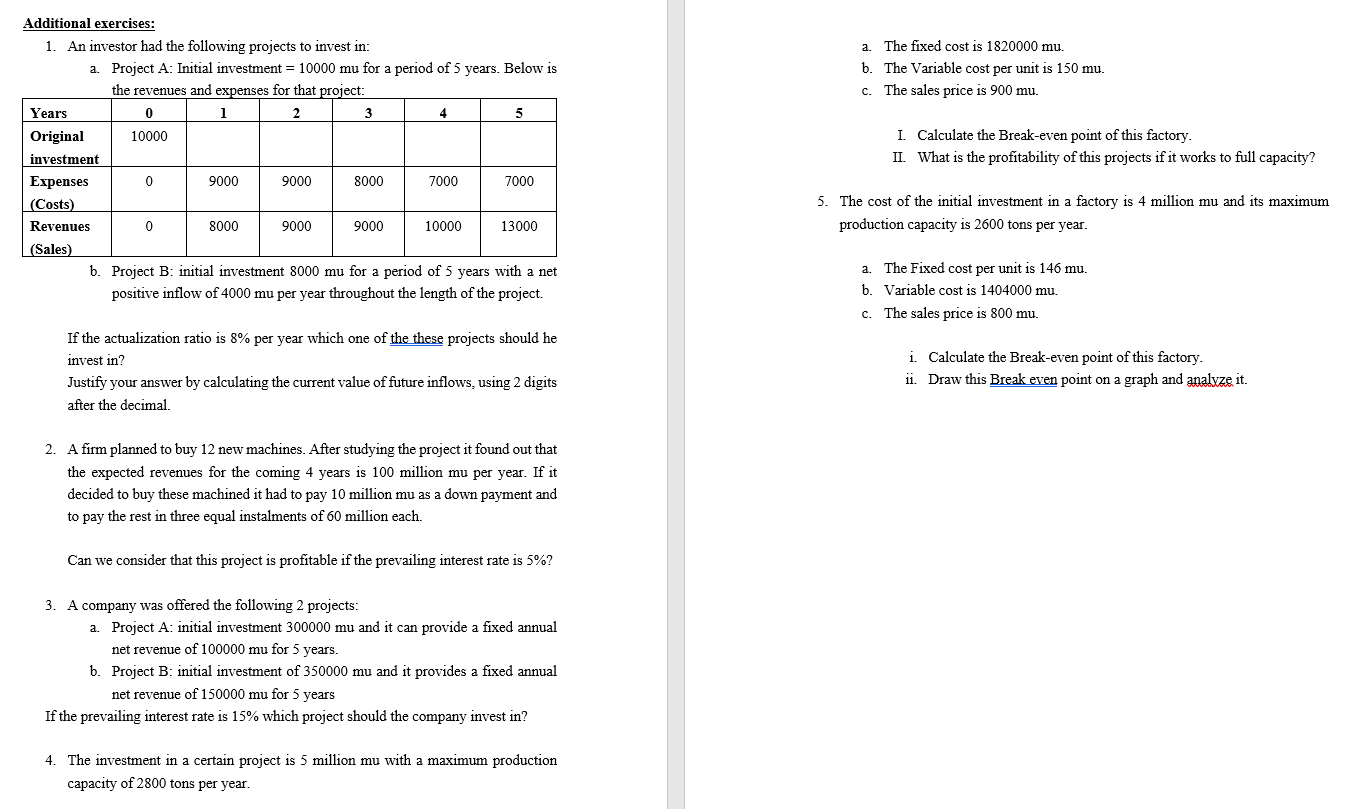

a. The fixed cost is 1820000 mu. b. The Variable cost per unit is 150 mu. c. The sales price is 900 mu. Additional exercises: 1. An investor had the following projects to invest in: a. Project A: Initial investment = 10000 mu for a period of 5 years. Below is the revenues and expenses for that project: Years 0 1 3 4 5 Original 10000 investment Expenses 0 9000 9000 8000 7000 7000 (Costs) Revenues 0 8000 9000 9000 10000 13000 (Sales) b. Project B: initial investment 8000 mu for a period of 5 years with a net positive inflow of 4000 mu per year throughout the length of the project. I. Calculate the Break-even point of this factory. II. What is the profitability of this projects if it works to full capacity? 5. The cost of the initial investment in a factory is 4 million mu and its maximum production capacity is 2600 tons per year. a The Fixed cost per unit is 146 mu. b. Variable cost is 1404000 mu. c. The sales price is 800 mu. If the actualization ratio is 8% per year which one of the these projects should he invest in? Justify your answer by calculating the current value of future inflows, using 2 digits after the decimal. i. Calculate the Break-even point of this factory. ii. Draw this Break even point on a graph and analyze it. 2. A firm planned to buy 12 new machines. After studying the project it found out that the expected revenues for the coming 4 years is 100 million mu per year. If it decided to buy these machined it had to pay 10 million mu as a down payment and to pay the rest in three equal instalments of 60 million each. Can we consider that this project is profitable if the prevailing interest rate is 5%? 3. A company was offered the following 2 projects: a. Project A: initial investment 300000 mu and it can provide a fixed annual net revenue of 100000 mu for 5 years. b. Project B: initial investment of 350000 mu and it provides a fixed annual net revenue of 150000 mu for 5 years If the prevailing interest rate is 15% which project should the company invest in? 4. The investment in a certain project is 5 million mu with a maximum production capacity of 2800 tons per year