Answered step by step

Verified Expert Solution

Question

1 Approved Answer

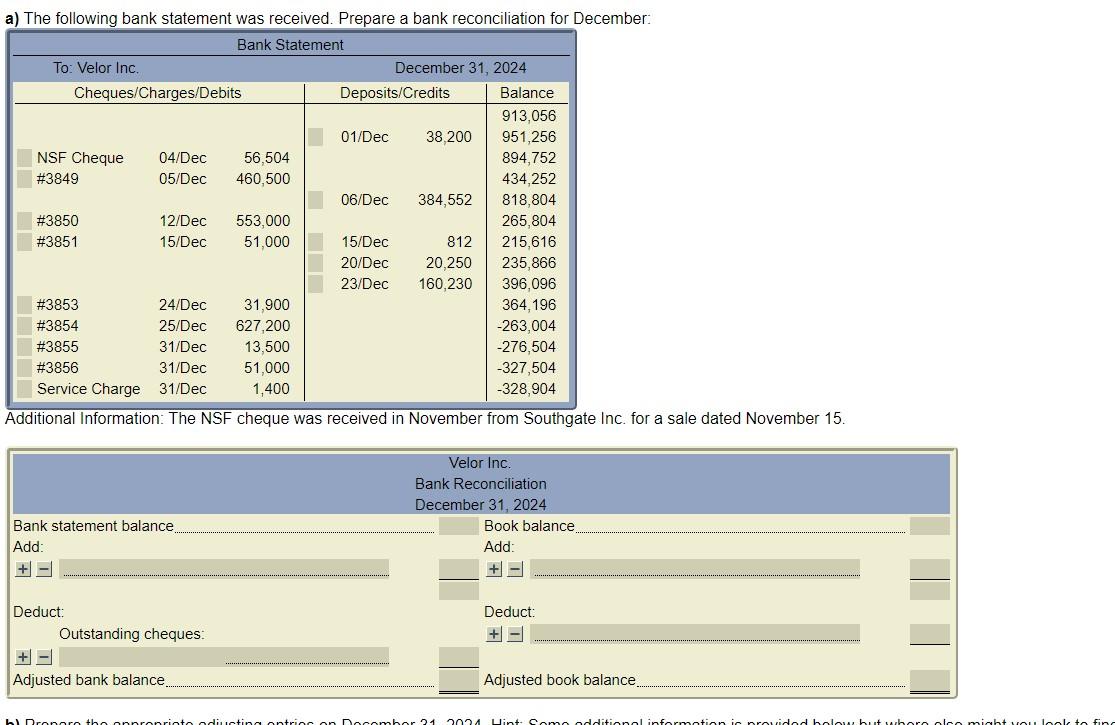

a) The following bank statement was received. Prepare a bank reconciliation for December: Bank Statement To: Velor Inc. December 31, 2024 Cheques/Charges/Debits Deposits/Credits Balance

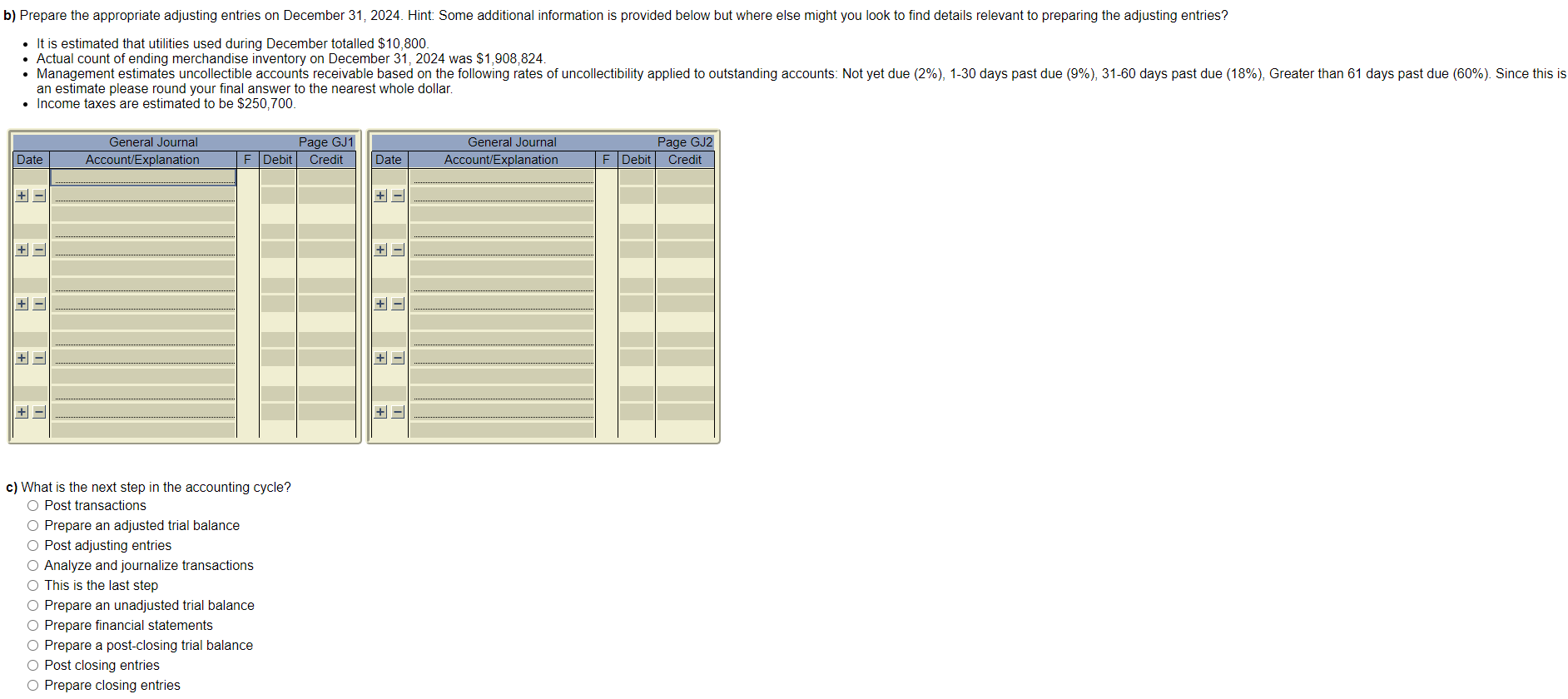

a) The following bank statement was received. Prepare a bank reconciliation for December: Bank Statement To: Velor Inc. December 31, 2024 Cheques/Charges/Debits Deposits/Credits Balance 913,056 01/Dec 38,200 951,256 NSF Cheque #3849 04/Dec 05/Dec 56,504 894,752 460,500 434,252 06/Dec 384,552 818,804 #3850 #3851 12/Dec 553,000 15/Dec 51,000 265,804 15/Dec 20/Dec 23/Dec 160,230 812 215,616 20,250 235,866 396,096 #3853 #3854 24/Dec 31,900 25/Dec 627,200 364,196 -263,004 #3855 31/Dec 13,500 -276,504 #3856 31/Dec Service Charge 31/Dec 51,000 1,400 -327,504 -328,904 Additional Information: The NSF cheque was received in November from Southgate Inc. for a sale dated November 15. Bank statement balance... Add: Velor Inc. Bank Reconciliation December 31, 2024 Book balance. Add: Deduct: Outstanding cheques: Adjusted bank balance.... Deduct: Adjusted book balance.. bl Dropose the appropriate adiucting entries on December 21 2001 Wint Some additional information is provided below. hut where also might vou look to find b) Prepare the appropriate adjusting entries on December 31, 2024. Hint: Some additional information is provided below but where else might you look to find details relevant to preparing the adjusting entries? It is estimated that utilities used during December totalled $10,800. Actual count of ending merchandise inventory on December 31, 2024 was $1,908,824. Management estimates uncollectible accounts receivable based on the following rates of uncollectibility applied to outstanding accounts: Not yet due (2%), 1-30 days past due (9%), 31-60 days past due (18%), Greater than 61 days past due (60%). Since this is an estimate please round your final answer to the nearest whole dollar. Income taxes are estimated to be $250,700. Date + + = + = + + - General Journal Account/Explanation F Debit Page GJ1 Credit Date General Journal Account/Explanation Page GJ2 F Debit Credit c) What is the next step in the accounting cycle? O Post transactions O Prepare an adjusted trial balance Post adjusting entries Analyze and journalize transactions This is the last step O Prepare an unadjusted trial balance O Prepare financial statements O Prepare a post-closing trial balance Post closing entries O Prepare closing entries + - + + - + -

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started