Question

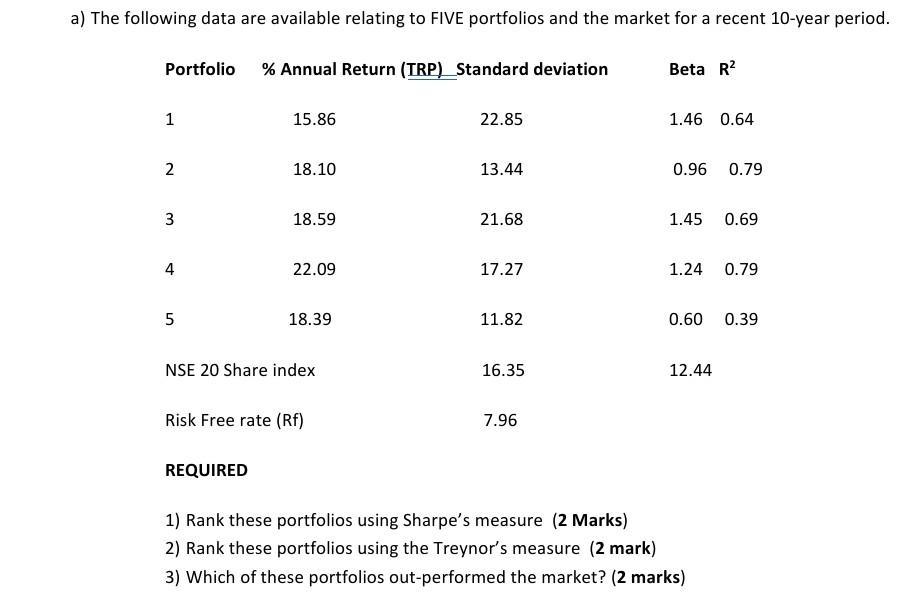

a) The following data are available relating to FIVE portfolios and the market for a recent 10-year period. Portfolio % Annual Return (TRP) Standard

a) The following data are available relating to FIVE portfolios and the market for a recent 10-year period. Portfolio % Annual Return (TRP) Standard deviation Beta R 1 15.86 22.85 1.46 0.64 2 18.10 13.44 0.96 0.79 3 18.59 21.68 1.45 0.69 4 22.09 17.27 1.24 0.79 5 18.39 11.82 0.60 0.39 NSE 20 Share index 16.35 12.44 Risk Free rate (Rf) 7.96 REQUIRED 1) Rank these portfolios using Sharpe's measure (2 Marks) 2) Rank these portfolios using the Treynor's measure (2 mark) 3) Which of these portfolios out-performed the market? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance and Investment decisions and strategies

Authors: Richard Pike, Bill Neale, Philip Linsley

8th edition

1292064064, 978-1292064161, 1292064161, 978-1292064062

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App