Question

a. The following table reports the nominal exchange rate of the US dollar against two other American currencies (Canadian dollar and Mexican pesos) on 31/12/2021.

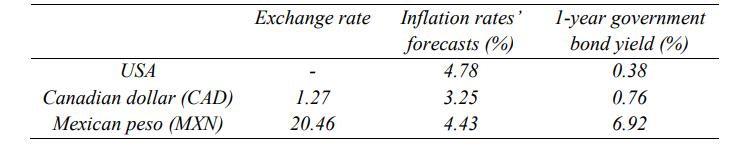

a. The following table reports the nominal exchange rate of the US dollar against two other American currencies (Canadian dollar and Mexican pesos) on 31/12/2021. It also presents the inflation rates’ forecasts for the next 1-year period (estimated by the OECD), as well as the 1- year government bond yield (in %) for both countries.

You are a US citizen and you want to invest $300,000 to a 1-year government bond. Which country is the best to invest money in?

b. Mr. Garamond, the owner of a small publishing house in Bologna, plans to invest 2.5 million euros for one year, and he thinks to buy either a US bond with interest rate 0.38% or an Italian bond with interest rate −0.49%. Note also that today’s euro nominal exchange rate per $ equals 0.876.

i. If Mr. Garamond expects annual appreciation of the euro by 3.5%, what will be his choice? Comment on your answer.

ii. Which expectations’ scheme regarding the exchange rate will make Mr. Garamond indifferent between the two alternatives?

c. Since 1986, The Economist has developed the ‘Big Mac Index’, as an example of the law of one price. This index serves as a comparison (but not perfect) point as to whether currencies are overvalued or undervalued. On January 31, 2022, a Big Mac costs $5.81 in the USA and 4,600 won in South Korea. Is the won overvalued or undervalued?

USA Canadian dollar (CAD) Mexican peso (MXN) Exchange rate 1.27 20.46 Inflation rates' forecasts (%) 4.78 3.25 4.43 1-year government bond yield (%) 0.38 0.76 6.92

Step by Step Solution

3.32 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a The best country to invest 300000 in a 1year government bond is the United States The exchange rate of the US dollar against both the Canadian dollar and the Mexican peso is higher than their respec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started