Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1- Remeasure the above figures from euros to British pounds as at 31/12/2020 2- Calculate the subsidiary's net income (or net loss) as at 31/12/2020

1- Remeasure the above figures from euros to British pounds as at 31/12/2020

2- Calculate the subsidiary's net income (or net loss) as at 31/12/2020

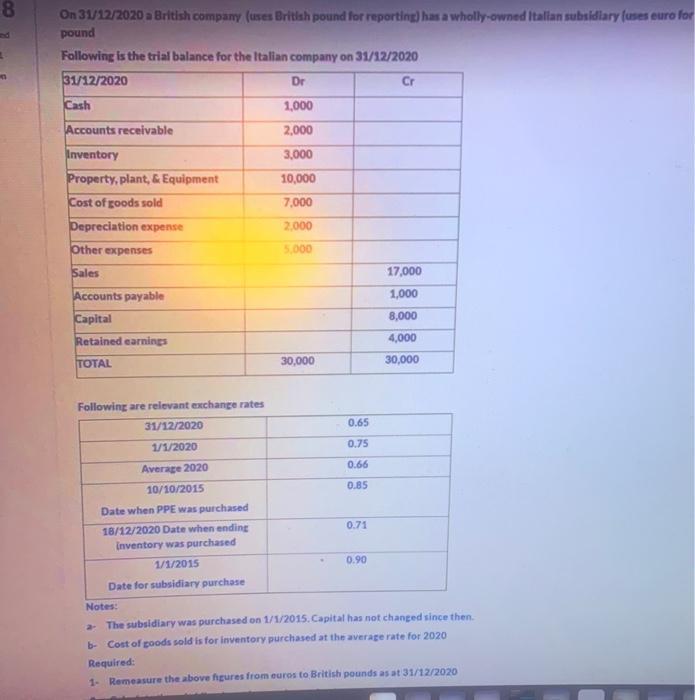

8. On 31/12/2020 a British company (uses British pound for reporting) has a wholly-owned Italian subsidiary (uses euro for pound Following is the trial balance for the Italian company on 31/12/2020 31/12/2020 Dr Cr Cash 1,000 Accounts receivable 2,000 Inventory 3,000 Property, plant, & Equipment 10,000 Cost of goods sold 7,000 Depreciation expense 2,000 Other expenses 5,000 Sales 17,000 Accounts payable 1,000 Capital 8,000 Retained earnings 4,000 TOTAL 30,000 30,000 Following are relevant exchange rates 31/12/2020 0.65 1/1/2020 0.75 0.66 Average 2020 0.85 10/10/2015 Date when PPE was purchased 18/12/2020 Date when endinr inventory was purchased 0.71 0.90 1/1/2015 Date for subsidiary purchase Notes: The subsidiary was purchased on 1/1/2015. Capital has not changed since then. b- Cost of goods sold is for inventory purchased at the average rate for 2020 Required: 1- Remeasure the above fgures from euros to British pounds as at 31/12/2020

Step by Step Solution

★★★★★

3.51 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of Net income or loss of subsidiary as at 31122020 Particulars Amount in Euros Sales 170...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started