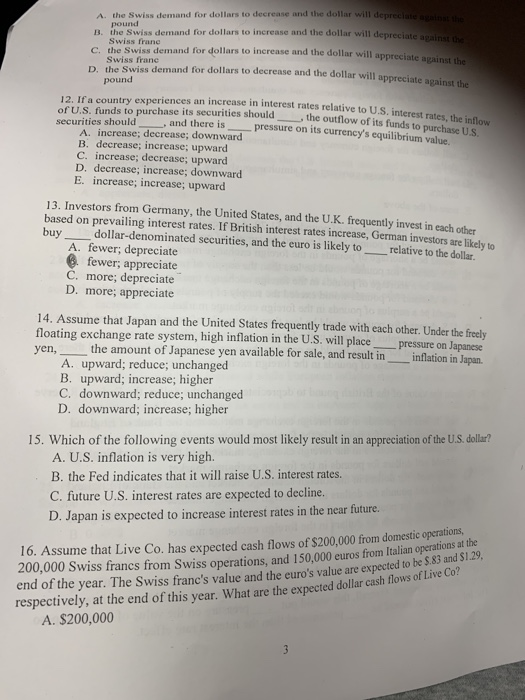

A the Swiss demand for dollars to decrease and the dollar will depreciate pound B. the Swiss demand for dollars to increase and the dollar will depreciate Swiss Frane the Swiss demand for dollars to increase and the dollar will appreciate Swiss frane the Swiss demand for dollars to decrease and the dollar will appreciate pound ciate against the country experiences an increase in interest rates relative to U.S. interest rates the s funds to purchase its securities should the outflow of its funds to purchase securities should and there is pressure on its currency's equilibrium value A increase; decrease; downward B. decrease; increase; upward C. increase; decrease; upward D. decrease; increase; downward E increase; increase; upward 13. Investors from Germany, the United States, and the U.K. frequently invest in each other based on prevailing interest rates. If British interest rates increase, German investors are likely to buy dollar-denominated securities, and the curo is likely to relative to the dollar A fewer; depreciate 6 fewer; appreciate C. more; depreciate D. more; appreciate 14. Assume that Japan and the United States frequently trade with each other. Under the freely floating exchange rate system, high inflation in the U.S. will place pressure on Japanese ven the amount of Japanese yen available for sale, and result in inflation in Jana A. upward; reduce; unchanged B. upward; increase; higher C. downward; reduce; unchanged D. downward; increase; higher 15. Which of the following events would most likely result in an appreciation of the U.S. dollar? A. U.S. inflation is very high. B. the Fed indicates that it will raise U.S. interest rates. C. future U.S. interest rates are expected to decline. D. Japan is expected to increase interest rates in the near future. the euro's value are expected to be $.83 and $1.29, 16. Assume that Live Co, has expected cash flows of $200.000 from domestic operations, 200,000 Swiss francs from Swiss operations, and 150.000 euros from Italian operam end of the year. The Swiss franc's value and the euro's value are expecte respectively, at the end of this year. What are the expected dollar cash flows ou A. $200,000