Question

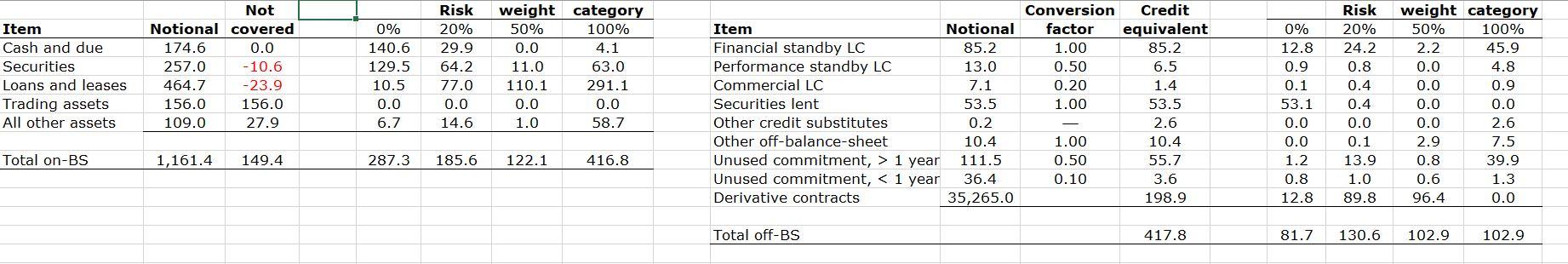

(a) The table in Worksheet Question 2 (a) summarizes both the on-balancesheet assets (left panel) and off-balance-sheet items (right panel) of a major commercial bank

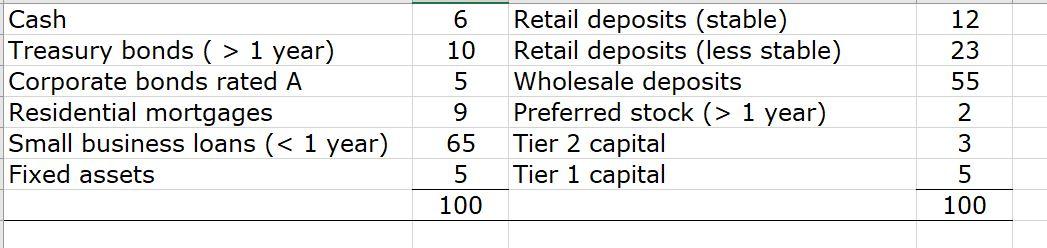

(a) The table in Worksheet Question 2 (a) summarizes both the on-balancesheet assets (left panel) and off-balance-sheet items (right panel) of a major commercial bank ($ billion). First, compute the banks total riskweighted assets. Second, compute the banks capital adequacy ratios. (b) A bank has the balance sheet in Worksheet Question 2 (b). (1) What is the banks net stable funding ratio (NSFR)? (2) The bank issues more preferred stock and keeps the proceeds in residential mortgages in order to satisfy Basel III. What additional preferred stock does the bank need to issue?

(b) A bank has the balance sheet in Worksheet Question 2 (b). (1) What is the banks net stable funding ratio (NSFR)? (2) The bank issues more preferred stock and keeps the proceeds in residential mortgages in order to satisfy Basel III. What additional preferred stock does the bank need to issue?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started