Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) The value of your country's currency has been experiencing a drastic downward decrease in value relative to other major world currencies. In relation

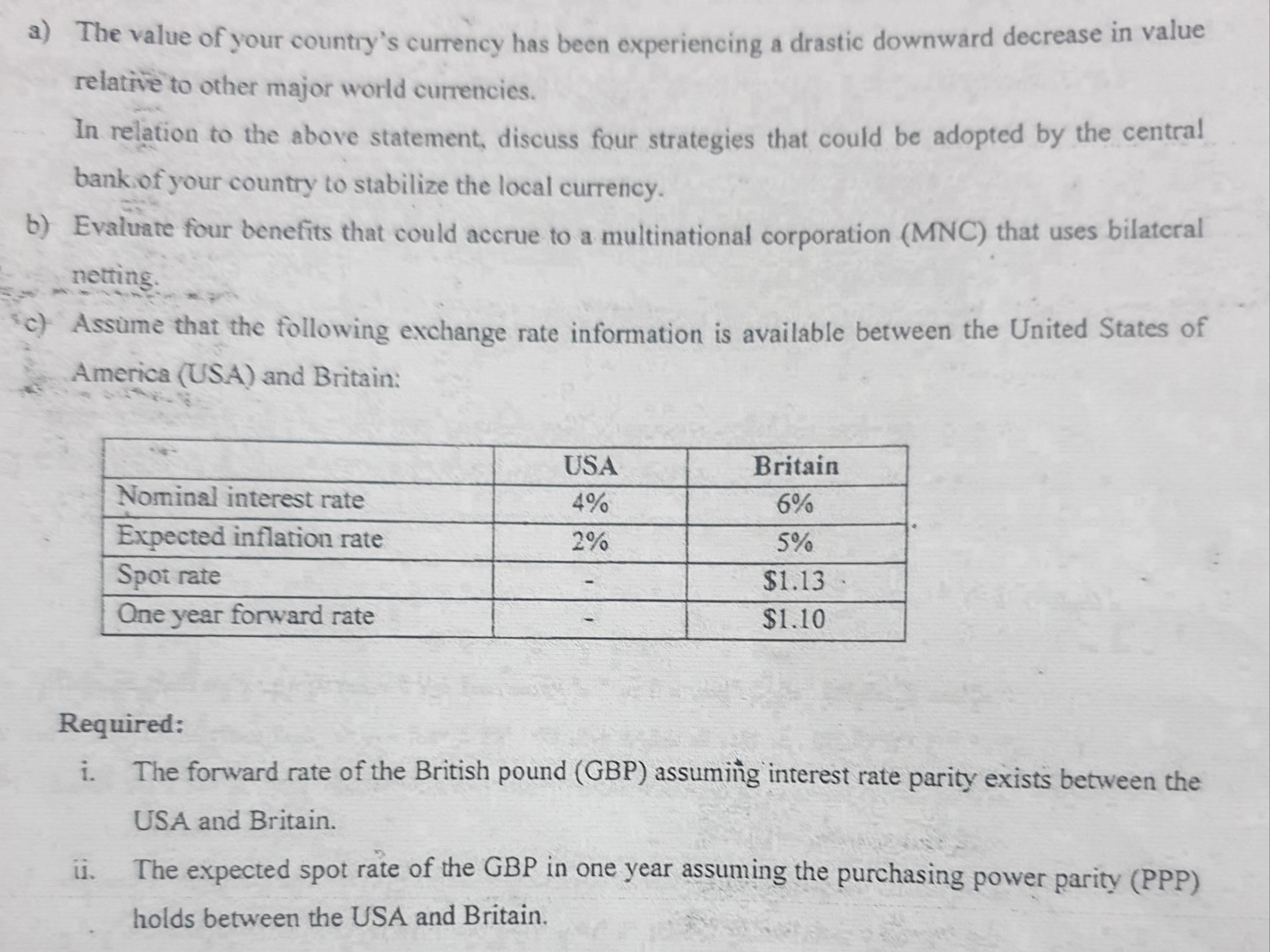

a) The value of your country's currency has been experiencing a drastic downward decrease in value relative to other major world currencies. In relation to the above statement, discuss four strategies that could be adopted by the central bank of your country to stabilize the local currency. b) Evaluate four benefits that could accrue to a multinational corporation (MNC) that uses bilateral netting. c) Assume that the following exchange rate information is available between the United States of America (USA) and Britain: Nominal interest rate Expected inflation rate . Spot rate One year forward rate USA 4% 2% Britain 6% 5% $1.13 $1.10 Required: i. The forward rate of the British pound (GBP) assuming interest rate parity exists between the USA and Britain. The expected spot rate of the GBP in one year assuming the purchasing power parity (PPP) holds between the USA and Britain. iii. iv. The expected spot rate of the GBP in one year assuming the international fisher effect (IFE) holds between the USA and Britain. Describe two methods that could be used to determine whether the purchasing power parity (PPP) exists among countries.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a Strategies to Stabilize the Local Currency Monetary Policy Adjustment The central bank can implement monetary policy tools to control the money supply and interest rates By adjusting interest ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started