A three part question asks: How many shares of preferred stock are: (a) authorized (b) issued (c) outstanding

Can the information to answer this question be found on this page or is more info needed? See Note 8.

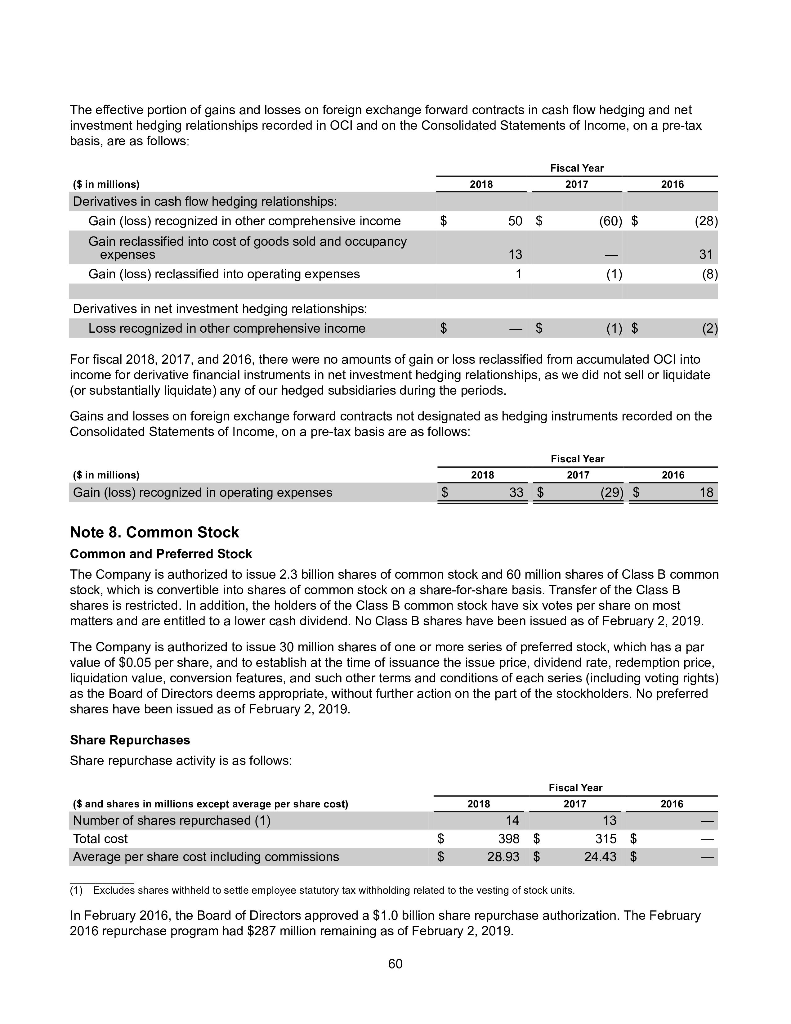

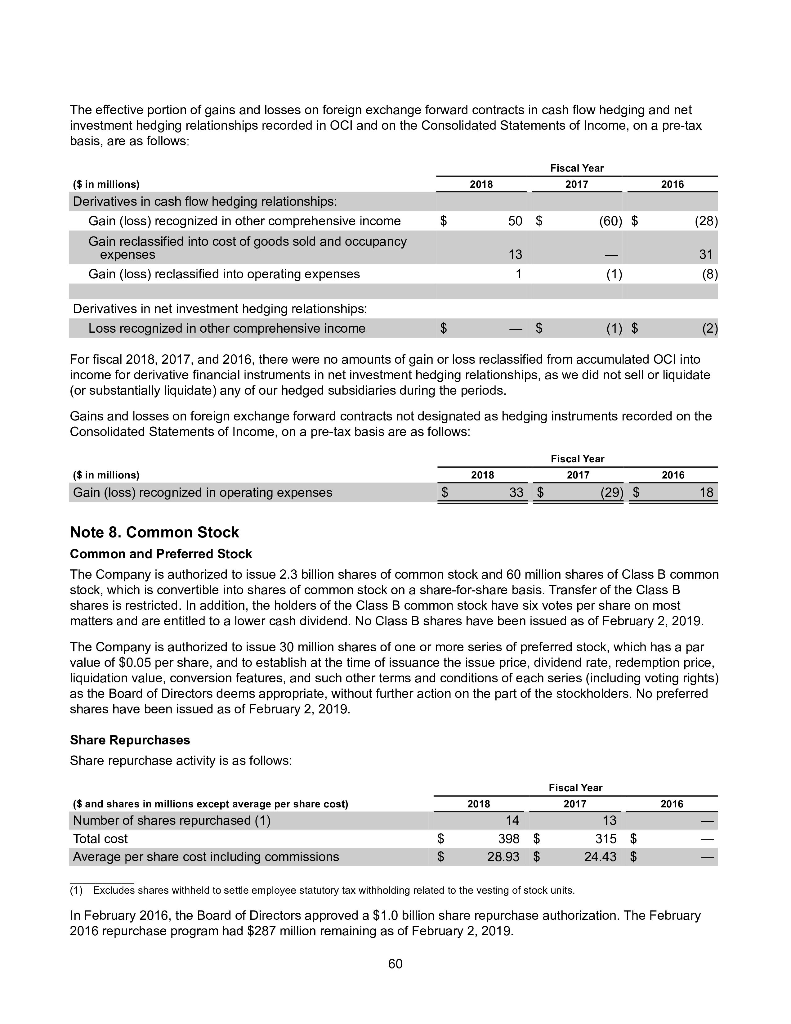

The effective portion of gains and losses on foreign exchange forward contracts in cash flow hedging and net investment hedging relationships recorded in OCI and on the Consolidated Statements of Income, on a pre-tax basis, are as follows: 2018 Fiscal Year 2017 - 2016 50 $ (60) $ ($ in millions) Derivatives in cash flow hedging relationships: Gain (loss) recognized in other comprehensive income Gain reclassified into cost of goods sold and occupancy expenses Gain (loss) reclassified into operating expenses (28) 13 - - (1) (8) Derivatives in net investment hedging relationships Loss recognized in other comprehensive income - s (1) $ - (2) For fiscal 2018, 2017, and 2016, there were no amounts of gain or loss reclassified from accumulated OCI into income for derivative financial instruments in net investment hedging relationships, as we did not sell or liquidate (or substantially liquidate) any of our hedged subsidiaries during the periods. Gains and losses on foreign exchange forward contracts not designated as hedging instruments recorded on the Consolidated Statements of Income, on a pre-tax basis are as follows: Fiscal Year 2018 2016 ($ in millions) Gain (loss) recognized in operating expenses $ 33 $ (29) $ 18 Note 8. Common Stock Common and Preferred Stock The Company is authorized to issue 2.3 billion shares of common stock and 60 million shares of Class B common stock, which is convertible into shares of common stock on a share-for-share basis. Transfer of the Class B shares is restricted. In addition, the holders of the Class B common stock have six votes per share on most matters and are entitled to a lower cash dividend. No Class B shares have been issued as of February 2, 2019. The Company is authorized to issue 30 million shares of one or more series of preferred stock, which has a par value of $0.05 per share, and to establish at the time of issuance the issue price, dividend rate, redemption price, liquidation value, conversion features, and such other terms and conditions of each series (including voting rights) as the Board of Directors deems appropriate, without further action on the part of the stockholders. No preferred shares have been issued as of February 2, 2019. Share Repurchases Share repurchase activity is as follows: 2016 ($ and shares in millions except average per share cost) Number of shares repurchased (1) Total cost Average per share cost including commissions 2018 14 398 28.93 $ $ Fiscal Year 2017 13 315 $ 24.43 $ $ $ - (1) Excludos shares withheld to settle employee statutory tax withholding related to the vesting of stock units. In February 2016, the Board of Directors approved a $ 1.0 billion share repurchase authorization. The February 2016 repurchase program had $287 million remaining as of February 2, 2019. 60