Answered step by step

Verified Expert Solution

Question

1 Approved Answer

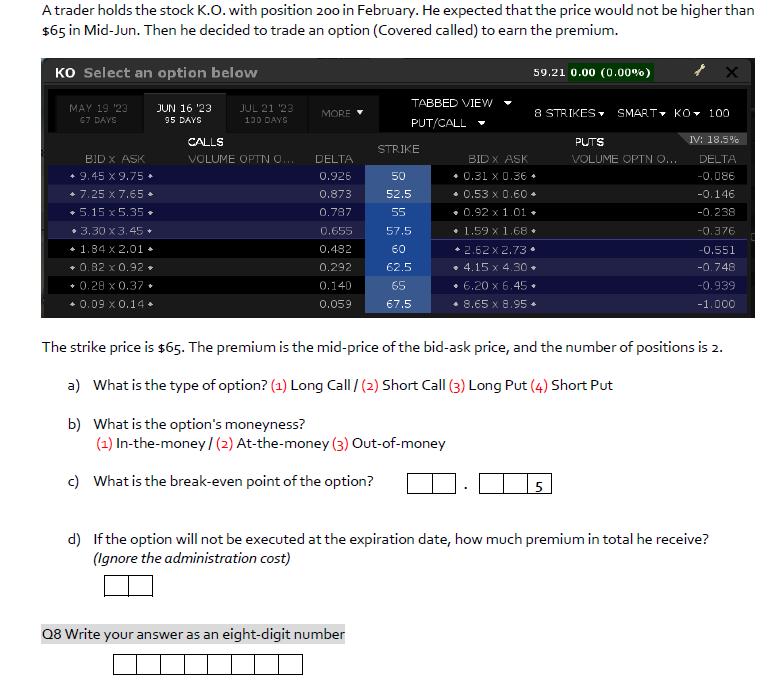

A trader holds the stock K.O. with position 200 in February. He expected that the price would not be higher than $65 in Mid-Jun.

A trader holds the stock K.O. with position 200 in February. He expected that the price would not be higher than $65 in Mid-Jun. Then he decided to trade an option (Covered called) to earn the premium. KO Select an option below MAY 19 23 67 DAYS JUN 16 '23 95 DAYS BID X ASK + 9.45 X 9.75 + 7.25 x 7.65. 5.15 x 5.35 + 1.30 x 3.45 + 1.84 x 2.01. 0.82 x 0.92. +0.28 x 0.37 0.09 x 0.14. JUL 21 23 130 DAYS CALLS VOLUME OPTN O..... MORE DELTA 0.925 0.873 0.787 0.655 0.482 0.292 0.140 0.059 TABBED VIEW PUT/CALL STRIKE 50 52.5 55 7.5 Q8 Write your answer as an eight-digit number 60 62.5 65 67.5 59.21 0.00 (0.00%) 8 STRIKES SMART KO 100 BIDX ASK 0.31 x 0.36 + 0.53 x 0.60 0.92 x 1.01. 1.59 x 1.68. 2.62 x 2.73. 4.15 x 4.30. 6.20 x 6.45 8.65 x 8.95. PUTS VOLUME OPTN O... 5 X IV: 18.5% The strike price is $65. The premium is the mid-price of the bid-ask price, and the number of positions is 2. a) What is the type of option? (1) Long Call / (2) Short Call (3) Long Put (4) Short Put b) What is the option's moneyness? (1) In-the-money/ (2) At-the-money (3) Out-of-money c) What is the break-even point of the option? DELTA -0.086 -0.146 -0.238 -0.376 -0.551 -0.748 -0.939 -1.000 d) If the option will not be executed at the expiration date, how much premium in total he receive? (Ignore the administration cost)

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a The trader is selling short a call option so the correct answer is 2 Short Call b The strike price ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started