Question: A training organisation purchases aheavy volume copier for large workloadson 1/7/2022 for $36,000 [GST exclusive]. It has a useful life of 4 years and a

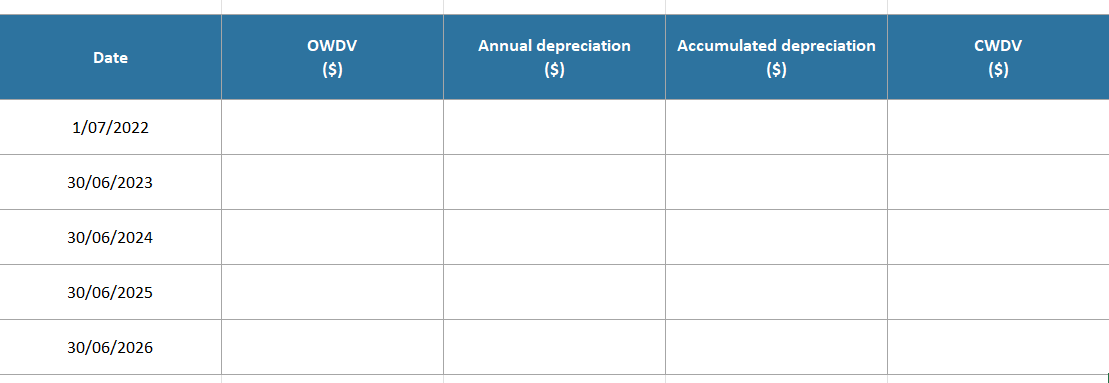

A training organisation purchases aheavy volume copier for large workloadson 1/7/2022 for $36,000 [GST exclusive]. It has a useful life of 4 years and a residual value of $4,000 [GST exclusive]. Produce a depreciation worksheet using straight line depreciation.

Fill in the missing numbers for financial years 2023 to 2026.

Date OWDV ($) Annual depreciation ($) Accumulated depreciation CWDV ($) ($) 1/07/2022 30/06/2023 30/06/2024 30/06/2025 30/06/2026

Step by Step Solution

There are 3 Steps involved in it

To calculate the straightline depreciation for the heavy volume copier we can use the following step... View full answer

Get step-by-step solutions from verified subject matter experts