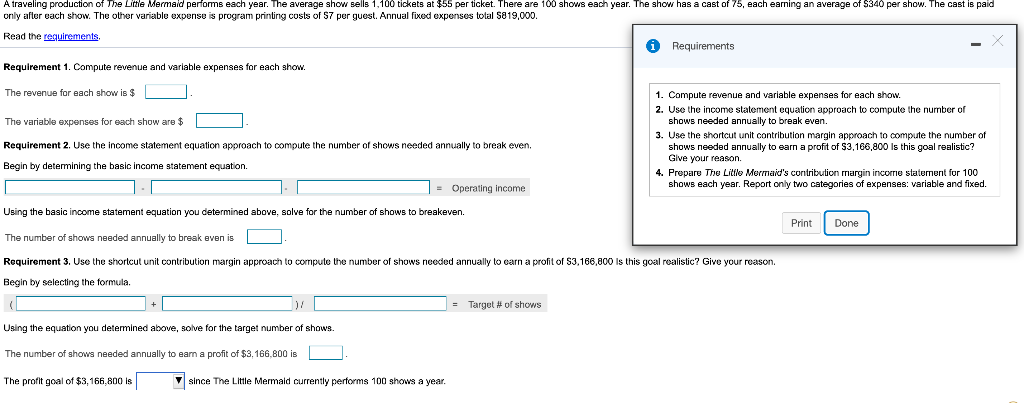

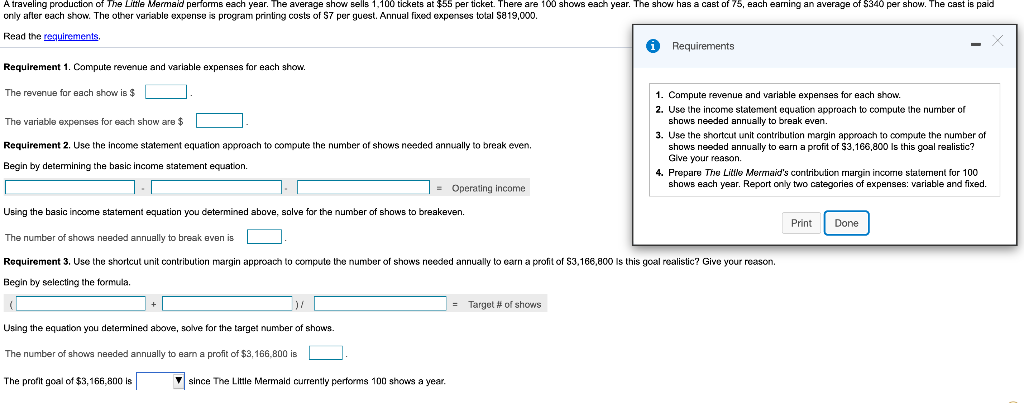

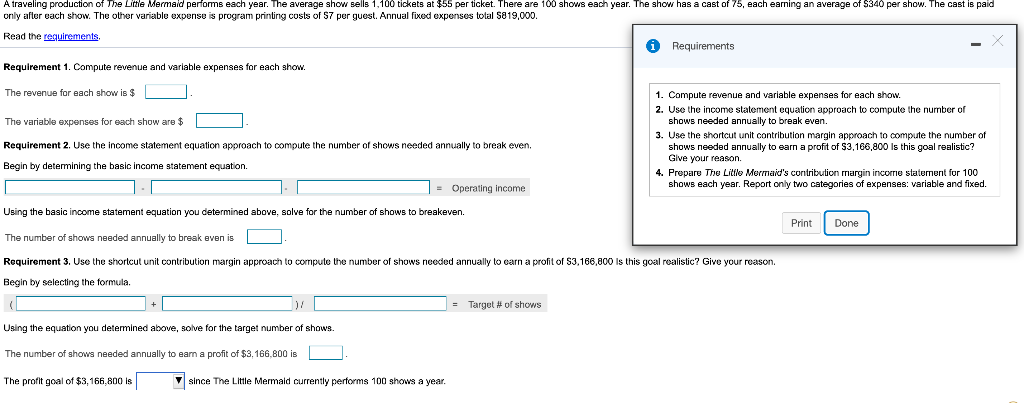

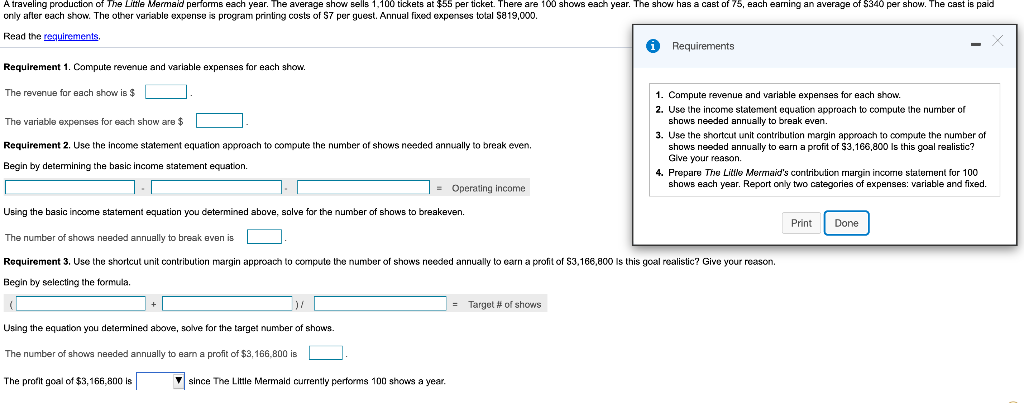

A traveling production of The Little Mermaid performs each year. The average show sells 1,100 tickets at $55 per ticket. There are 100 shows each year. The show has a cast of 75, each earning an average of $340 per show. The cast is paid only after each show. The other variable expense is program printing costs of 57 per guest. Annual fixed expenses total 5819,000. Read the requirements, i Requirements - Requirement 1. Compute revenue and variable expenses for each show. The revenue for each show is $L . The variable expenses for each show are $ 1. Compute revenue and variable expenses for each show. 2. Use the income statement equation approach to compute the number of shows needed annually to break even. 3. Use the shortcut unit contribution margin approach to compute the number of shows needed annually to earn a profit of $3,166,800 Is this goal realistic? Give your reason. 4. Prepare The Little Mermaid's contribution margin incorre statement for 100 shows each year, Report only two categories of expenses: variable and fixed. Requirement 2. Use the income statement equation approach to compute the number of shows needed annually to break even, Begin by determining the basic income statement equation. = Operating income Using the basic income statement equation you determined above, solve for the number of shows to breakeven. Print Done The number of shows needed annually to break even is L . Requirement 3. Use the shortcut unit contribution margin approach to compute the number of shows needed annually lo carn a profit of $3,166,800 Is this goal realistic? Give your reason Begin by selecting the formula. + ) = Target # of shows Using the equation you determined above, solve for the target number of shows. The number of shows needed annually to earn a profit of $3,166,800 is . The profit goal of $3,166,800 is since The Little Mermaid currently performs 100 shows a year. A traveling production of The Little Mermaid performs each year. The average show sells 1,100 tickets at $55 per ticket. There are 100 shows each year. The show has a cast of 75, each earning an average of $340 per show. The cast is paid only after each show. The other variable expense is program printing costs of 57 per guest. Annual fixed expenses total 5819,000. Read the requirements, i Requirements - Requirement 1. Compute revenue and variable expenses for each show. The revenue for each show is $L . The variable expenses for each show are $ 1. Compute revenue and variable expenses for each show. 2. Use the income statement equation approach to compute the number of shows needed annually to break even. 3. Use the shortcut unit contribution margin approach to compute the number of shows needed annually to earn a profit of $3,166,800 Is this goal realistic? Give your reason. 4. Prepare The Little Mermaid's contribution margin incorre statement for 100 shows each year, Report only two categories of expenses: variable and fixed. Requirement 2. Use the income statement equation approach to compute the number of shows needed annually to break even, Begin by determining the basic income statement equation. = Operating income Using the basic income statement equation you determined above, solve for the number of shows to breakeven. Print Done The number of shows needed annually to break even is L . Requirement 3. Use the shortcut unit contribution margin approach to compute the number of shows needed annually lo carn a profit of $3,166,800 Is this goal realistic? Give your reason Begin by selecting the formula. + ) = Target # of shows Using the equation you determined above, solve for the target number of shows. The number of shows needed annually to earn a profit of $3,166,800 is . The profit goal of $3,166,800 is since The Little Mermaid currently performs 100 shows a year