Question

A treasury bond has maturity T = 10Y and pays at the end of each year a coupon of $5.00 on a face value

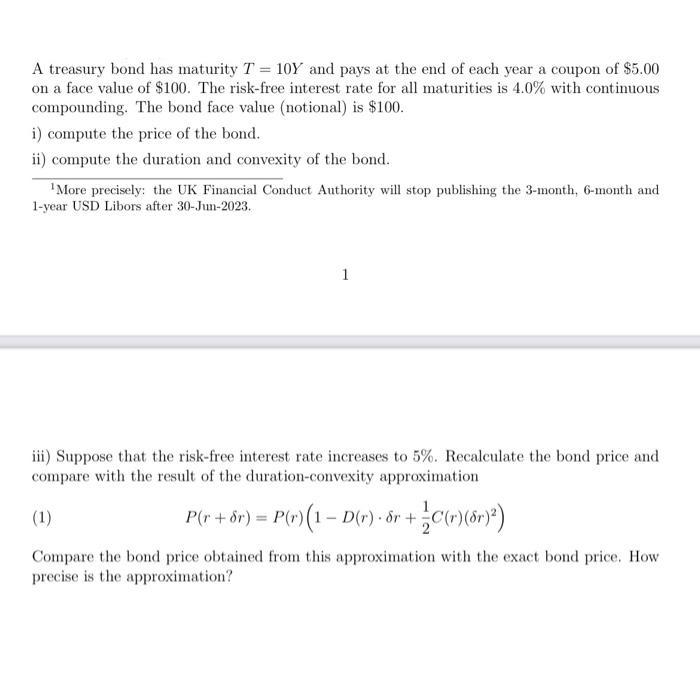

A treasury bond has maturity T = 10Y and pays at the end of each year a coupon of $5.00 on a face value of $100. The risk-free interest rate for all maturities is 4.0% with continuous compounding. The bond face value (notional) is $100. i) compute the price of the bond. ii) compute the duration and convexity of the bond. More precisely: the UK Financial Conduct Authority will stop publishing the 3-month, 6-month and 1-year USD Libors after 30-Jun-2023. 1 iii) Suppose that the risk-free interest rate increases to 5%. Recalculate the bond price and compare with the result of the duration-convexity approximation P(r + 8r) = P(r) (1 - D(r) - 8r + C(r)(sr)) Compare the bond price obtained from this approximation with the exact bond price. How precise is the approximation? (1)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Earl K. Stice, James D. Stice

18th edition

538479736, 978-1111534783, 1111534780, 978-0538479738

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App