Answered step by step

Verified Expert Solution

Question

1 Approved Answer

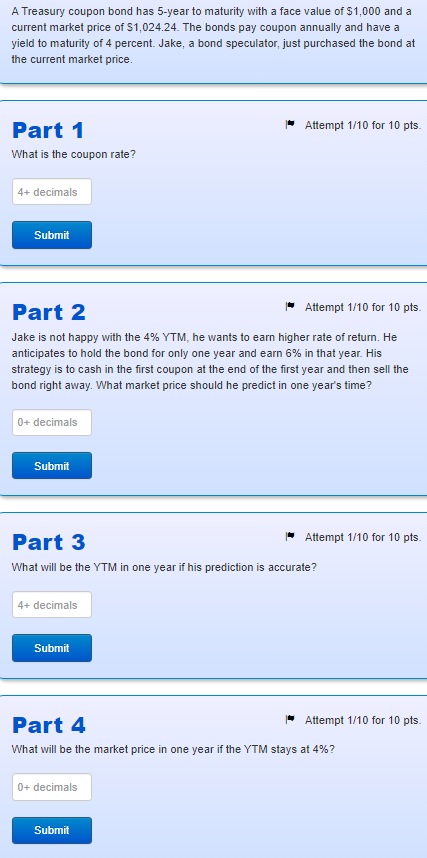

A Treasury coupon bond has 5 - year to maturity with a face value of $ 1 , 0 0 0 and a current market

A Treasury coupon bond has year to maturity with a face value of $ and a

current market price of $ The bonds pay coupon annually and have a

yield to maturity of percent. Jake, a bond speculator, just purchased the bond at

the current market price.

Part

What is the coupon rate?

Part

Jake is not happy with the YTM he wants to earn higher rate of return. He

anticipates to hold the bond for only one year and earn in that year. His

strategy is to cash in the first coupon at the end of the first year and then sell the

bond right away. What market price should he predict in one year's time?

Part

What will be the YTM in one year if his prediction is accurate?

Part

What will be the market price in one year if the YTM stays at

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started