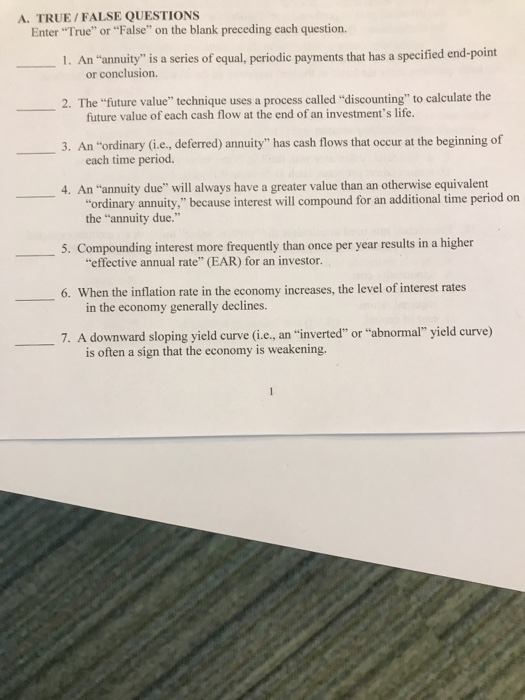

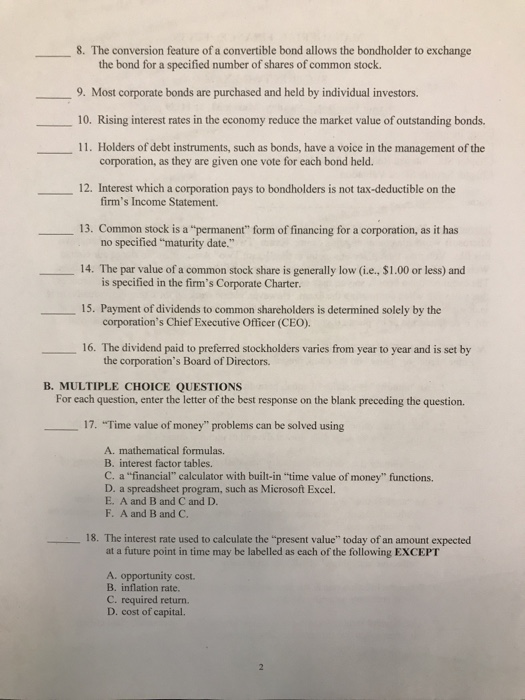

A. TRUE /FALSE QUESTIONS Enter "True" or "False" on the blank preceding each question. 1. An "annuity" is a series of equal, periodic payments that has a specified end-point or conclusion. 2. The "future value" technique uses a process called "discounting" to calculate the future value of each cash flow at the end of an investment's life. 3. An "ordinary (i.e., deferred) annuity" has cash flows that occur at the beginning of each time period. 4. An "annuity due" will always have a greater value than an otherwise equivalent ordinary annuity," because interest will compound for an additional time period on the "annuity due." 5. Compounding interest more frequently than once per year results in a higher 6. When the inflation rate in the economy increases, the level of interest rates 7. A downward sloping yield curve (i.e, an "inverted" or "abnormal" yield curve) "effective annual rate" (EAR) for an investor. in the economy generally declines. is often a sign that the economy is weakening. 8. The conversion feature of a convertible bond allows the bondholder to exchange the bond for a specified number of shares of common stock. 9. Most corporate bonds are purchased and held by individual investors. 10. Rising interest rates in the economy reduce the market value of outstanding bonds. 11. Holders of debt instruments, such as bonds, have a voice in the management of the corporation, as they are given one vote for each bond held. 12. Interest which a corporation pays to bondholders is not tax-deductible on the 13. Common stock is a "permanent" form of financing for a corporation, as it has 14. The par value of a common stock share is generally low (i.e., $1.00 or less) and 15. Payment of dividends to common shareholders is determined solely by the 16. The dividend paid to preferred stockholders varies from year to year and is set by firm's Income Statement. no specified "maturity date." is specified in the firm's Corporate Charter. corporation's Chief Executive Officer (CEO). the corporation's Board of Directors. B. MULTIPLE CHOICE QUESTIONS For each question, enter the letter of the best response on the blank preceding the question. 17. "Time value of money" problems can be solved using A. mathematical formulas. B. interest factor tables. C. a "financial" calculator with built-in "time value of money" functions. D. a spreadsheet program, such as Microsoft Excel. E. A and B and C and D. F. A and B and C. 18. The interest rate used to calculate the "present value" today of an amount expected at a future point in time may be labelled as each of the following EXCEPT A. opportunity cost. B. inflation rate. C. required return. D. cost of capital