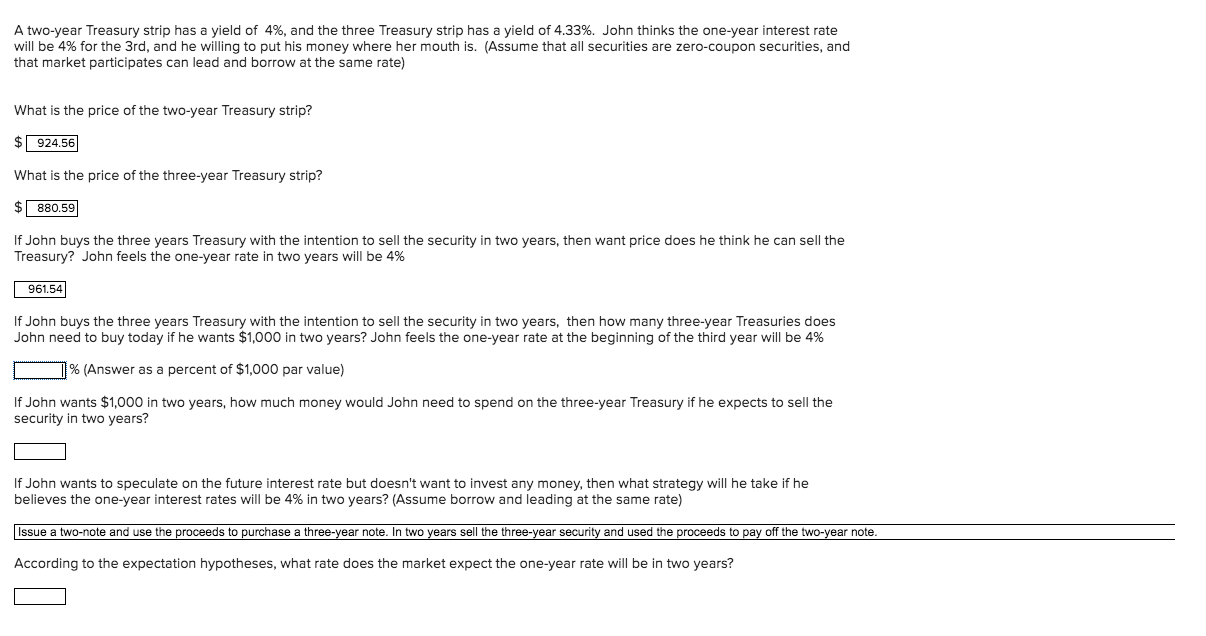

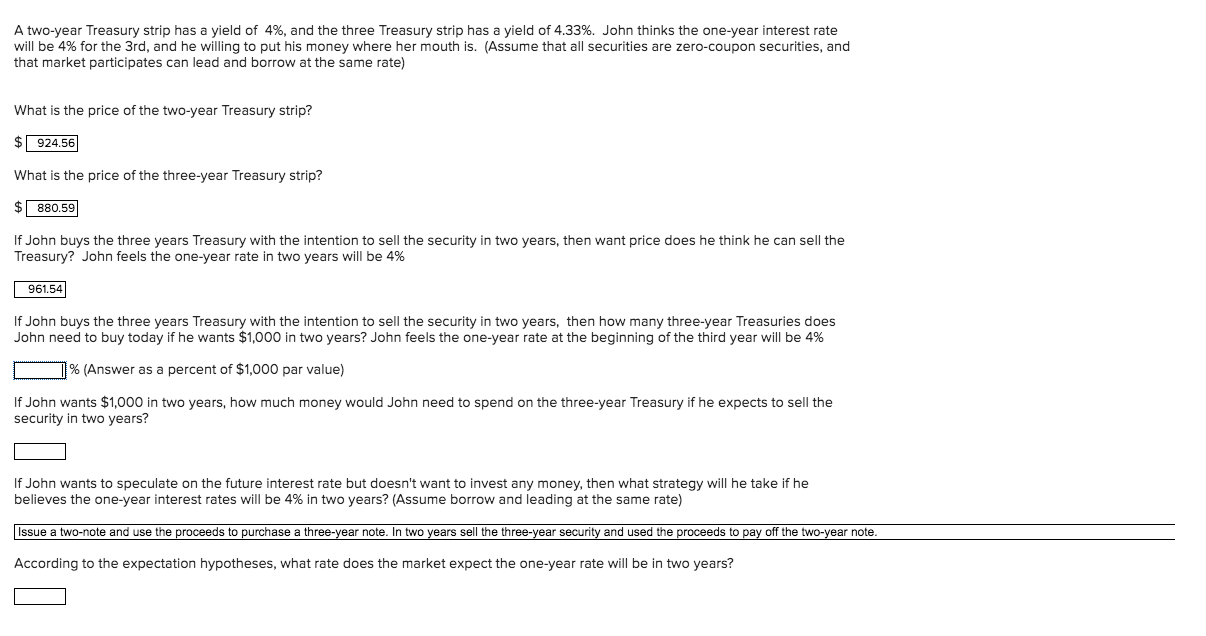

A two-year Treasury strip has a yield of 4%, and the three Treasury strip has a yield of 4.33%. John thinks the one-year interest rate will be 4% for the 3rd, and he willing to put his money where her mouth is. (Assume that all securities are zero-coupon securities, and that market participates can lead and borrow at the same rate) What is the price of the two-year Treasury strip? $924.56 What is the price of the three-year Treasury strip? $880.59 If John buys the three years Treasury with the intention to sell the security in two years, then want price does he think he can sell the Treasury? John feels the one-year rate in two years will be 4% 961.54 If John buys the three years Treasury with the intention to sell the security in two years, then how many three-year Treasuries does John need to buy today if he wants $1,000 in two years? John feels the one-year rate at the beginning of the third year will be 4% % (Answer as a percent of $1,000 par value) If John wants $1,000 in two years, how much money would John need to spend on the three-year Treasury if he expects to sell the security in two years? If John wants to speculate on the future interest rate but doesn't want to invest any money, then what strategy will he take if he believes the one-year interest rates will be 4% in two years? (Assume borrow and leading at the same rate) Issue a two-note and use the proceeds to purchase a three-year note. In two years sell the three-year security and used the proceeds to pay off the two-year note. According to the expectation hypotheses, what rate does the market expect the one-year rate will be in two years? A two-year Treasury strip has a yield of 4%, and the three Treasury strip has a yield of 4.33%. John thinks the one-year interest rate will be 4% for the 3rd, and he willing to put his money where her mouth is. (Assume that all securities are zero-coupon securities, and that market participates can lead and borrow at the same rate) What is the price of the two-year Treasury strip? $924.56 What is the price of the three-year Treasury strip? $880.59 If John buys the three years Treasury with the intention to sell the security in two years, then want price does he think he can sell the Treasury? John feels the one-year rate in two years will be 4% 961.54 If John buys the three years Treasury with the intention to sell the security in two years, then how many three-year Treasuries does John need to buy today if he wants $1,000 in two years? John feels the one-year rate at the beginning of the third year will be 4% % (Answer as a percent of $1,000 par value) If John wants $1,000 in two years, how much money would John need to spend on the three-year Treasury if he expects to sell the security in two years? If John wants to speculate on the future interest rate but doesn't want to invest any money, then what strategy will he take if he believes the one-year interest rates will be 4% in two years? (Assume borrow and leading at the same rate) Issue a two-note and use the proceeds to purchase a three-year note. In two years sell the three-year security and used the proceeds to pay off the two-year note. According to the expectation hypotheses, what rate does the market expect the one-year rate will be in two years