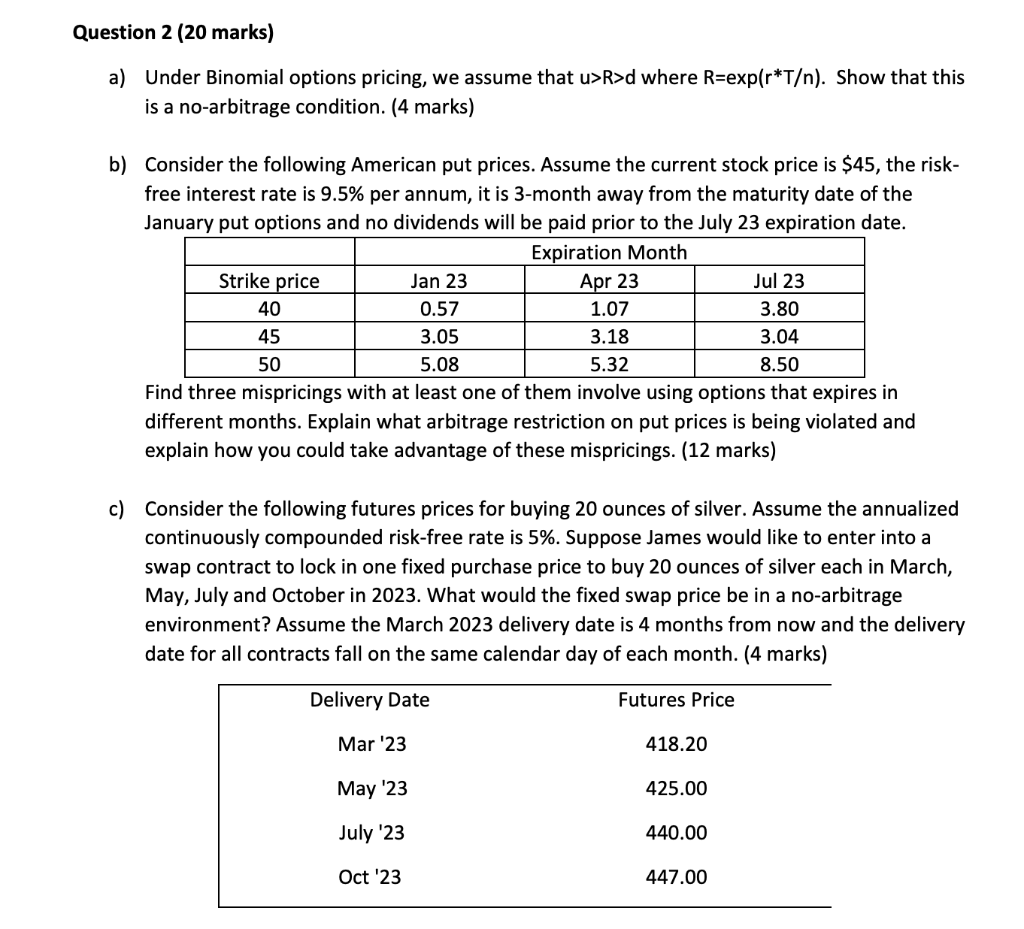

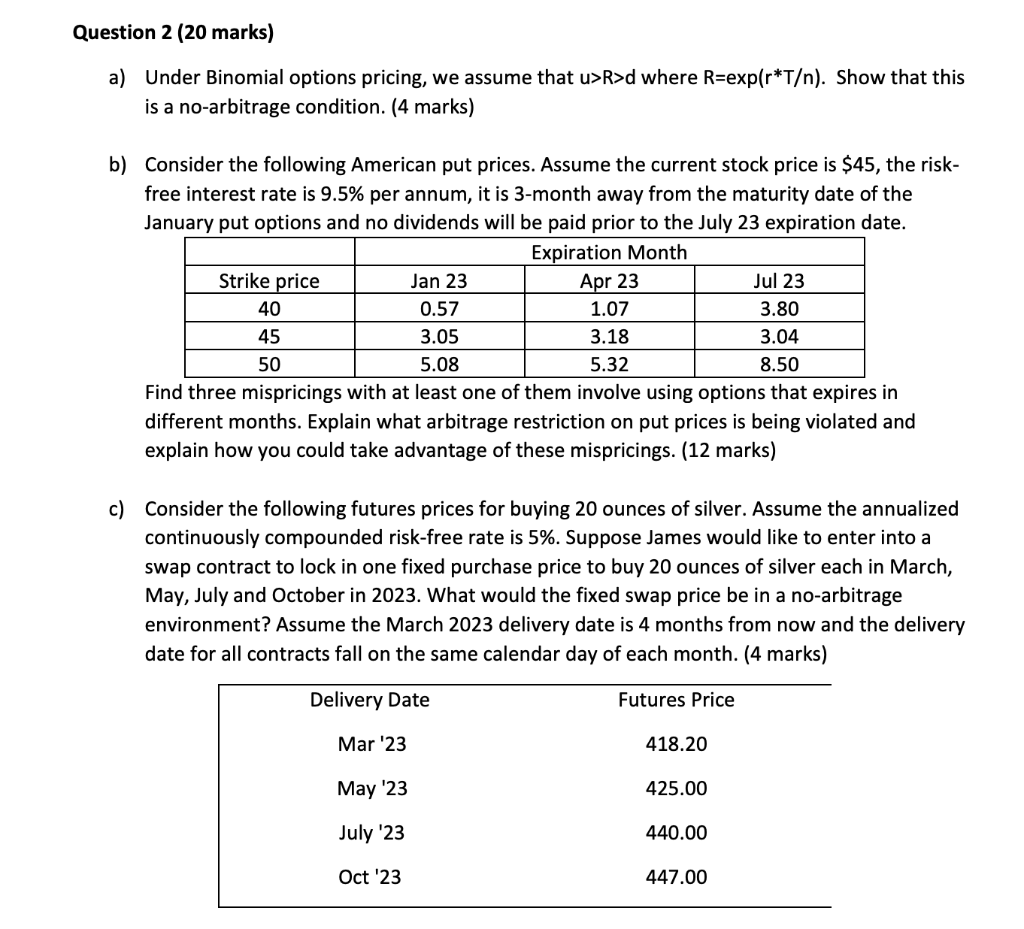

a) Under Binomial options pricing, we assume that u>R>d where R=exp(rT). Show that this is a no-arbitrage condition. (4 marks) b) Consider the following American put prices. Assume the current stock price is $45, the riskfree interest rate is 9.5% per annum, it is 3 -month away from the maturity date of the January put options and no dividends will be paid prior to the July 23 expiration date. Find three mispricings with at least one of them involve using options that expires in different months. Explain what arbitrage restriction on put prices is being violated and explain how you could take advantage of these mispricings. (12 marks) c) Consider the following futures prices for buying 20 ounces of silver. Assume the annualized continuously compounded risk-free rate is 5%. Suppose James would like to enter into a swap contract to lock in one fixed purchase price to buy 20 ounces of silver each in March, May, July and October in 2023 . What would the fixed swap price be in a no-arbitrage environment? Assume the March 2023 delivery date is 4 months from now and the delivery date for all contracts fall on the same calendar day of each month. (4 marks) a) Under Binomial options pricing, we assume that u>R>d where R=exp(rT). Show that this is a no-arbitrage condition. (4 marks) b) Consider the following American put prices. Assume the current stock price is $45, the riskfree interest rate is 9.5% per annum, it is 3 -month away from the maturity date of the January put options and no dividends will be paid prior to the July 23 expiration date. Find three mispricings with at least one of them involve using options that expires in different months. Explain what arbitrage restriction on put prices is being violated and explain how you could take advantage of these mispricings. (12 marks) c) Consider the following futures prices for buying 20 ounces of silver. Assume the annualized continuously compounded risk-free rate is 5%. Suppose James would like to enter into a swap contract to lock in one fixed purchase price to buy 20 ounces of silver each in March, May, July and October in 2023 . What would the fixed swap price be in a no-arbitrage environment? Assume the March 2023 delivery date is 4 months from now and the delivery date for all contracts fall on the same calendar day of each month. (4 marks)