Question

A. Understand the cost of interest rates and fees associated with financial services including: determine the cost of various interest rates and fees to a

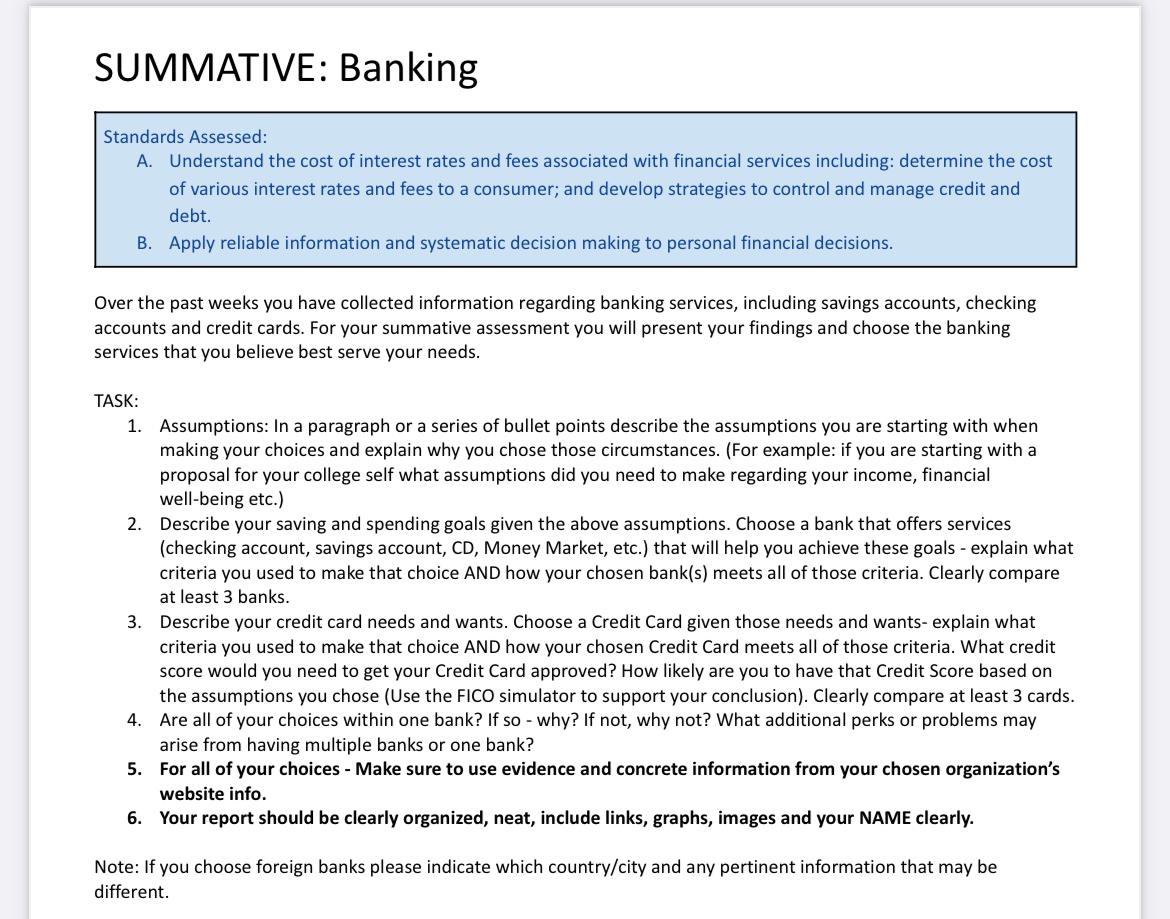

A. Understand the cost of interest rates and fees associated with financial services including: determine the cost of various interest rates and fees to a consumer; and develop strategies to control and manage credit and debt. B. Apply reliable information and systematic decision making to personal financial decisions. Over the past weeks you have collected information regarding banking services, including savings accounts, checking accounts and credit cards. For your summative assessment you will present your findings and choose the banking services that you believe best serve your needs. TASK: 1. Assumptions: In a paragraph or a series of bullet points describe the assumptions you are starting with when making your choices and explain why you chose those circumstances. (For example: if you are starting with a proposal for your college self what assumptions did you need to make regarding your income, financial well-being etc.) 2. Describe your saving and spending goals given the above assumptions. Choose a bank that offers services (checking account, savings account, CD, Money Market, etc.) that will help you achieve these goals - explain what criteria you used to make that choice AND how your chosen bank(s) meets all of those criteria. Clearly compare at least 3 banks. 3. Describe your credit card needs and wants. Choose a Credit Card given those needs and wants- explain what criteria you used to make that choice AND how your chosen Credit Card meets all of those criteria. What credit score would you need to get your Credit Card approved? How likely are you to have that Credit Score based on the assumptions you chose (Use the FICO simulator to support your conclusion). Clearly compare at least 3 cards. 4. Are all of your choices within one bank? If so - why? If not, why not? What additional perks or problems may arise from having multiple banks or one bank? 5. For all of your choices - Make sure to use evidence and concrete information from your chosen organizations website info. 6. Your report should be clearly organized, neat, include links, graphs, images and your NAME clearly. Note: If you choose foreign banks please indicate which country/city and any pertinent information that may be different.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started