Answered step by step

Verified Expert Solution

Question

1 Approved Answer

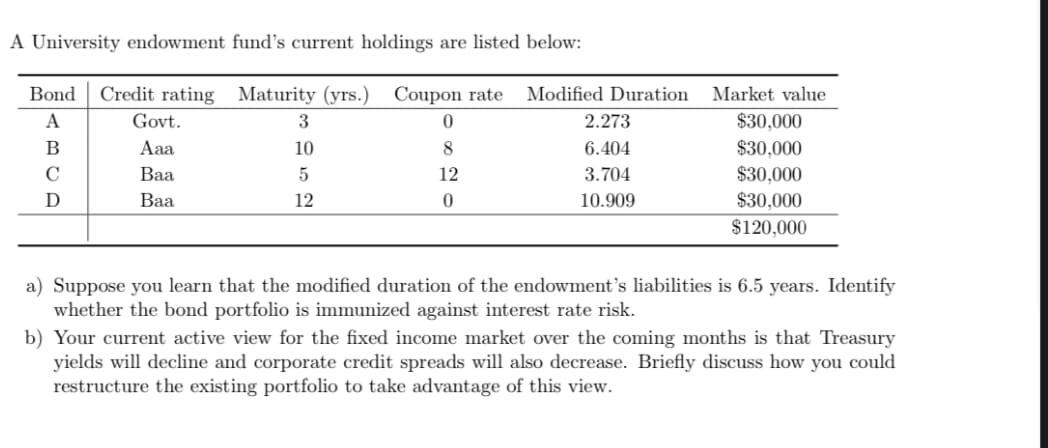

A University endowment fund's current holdings are listed below: Bond B Credit rating Maturity (yrs.) Coupon rate Govt. 3 0 Aaa 10 8 Baa 5

A University endowment fund's current holdings are listed below: Bond B Credit rating Maturity (yrs.) Coupon rate Govt. 3 0 Aaa 10 8 Baa 5 12 Baa 12 0 Modified Duration 2.273 6.404 3.704 10.909 Market value $30,000 $30,000 $30,000 $30,000 $120,000 D a) Suppose you learn that the modified duration of the endowment's liabilities is 6.5 years. Identify whether the bond portfolio is immunized against interest rate risk. b) Your current active view for the fixed income market over the coming months is that Treasury yields will decline and corporate credit spreads will also decrease. Briefly discuss how you could restructure the existing portfolio to take advantage of this view. A University endowment fund's current holdings are listed below: Bond B Credit rating Maturity (yrs.) Coupon rate Govt. 3 0 Aaa 10 8 Baa 5 12 Baa 12 0 Modified Duration 2.273 6.404 3.704 10.909 Market value $30,000 $30,000 $30,000 $30,000 $120,000 D a) Suppose you learn that the modified duration of the endowment's liabilities is 6.5 years. Identify whether the bond portfolio is immunized against interest rate risk. b) Your current active view for the fixed income market over the coming months is that Treasury yields will decline and corporate credit spreads will also decrease. Briefly discuss how you could restructure the existing portfolio to take advantage of this view

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started