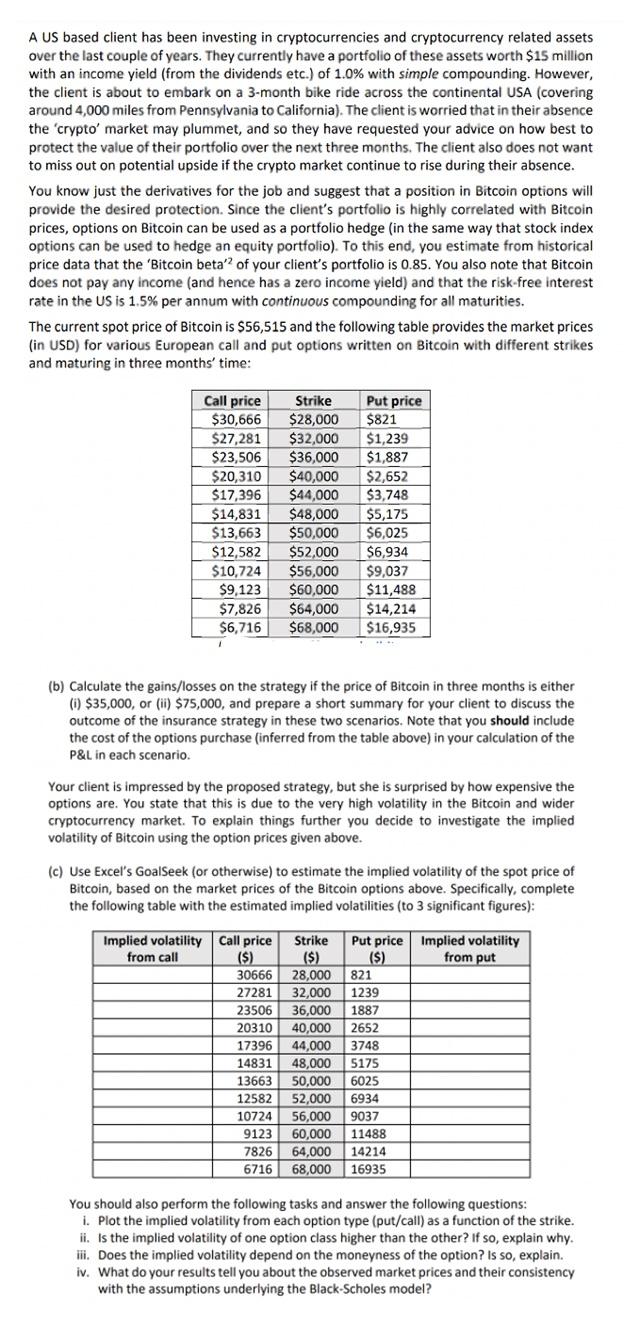

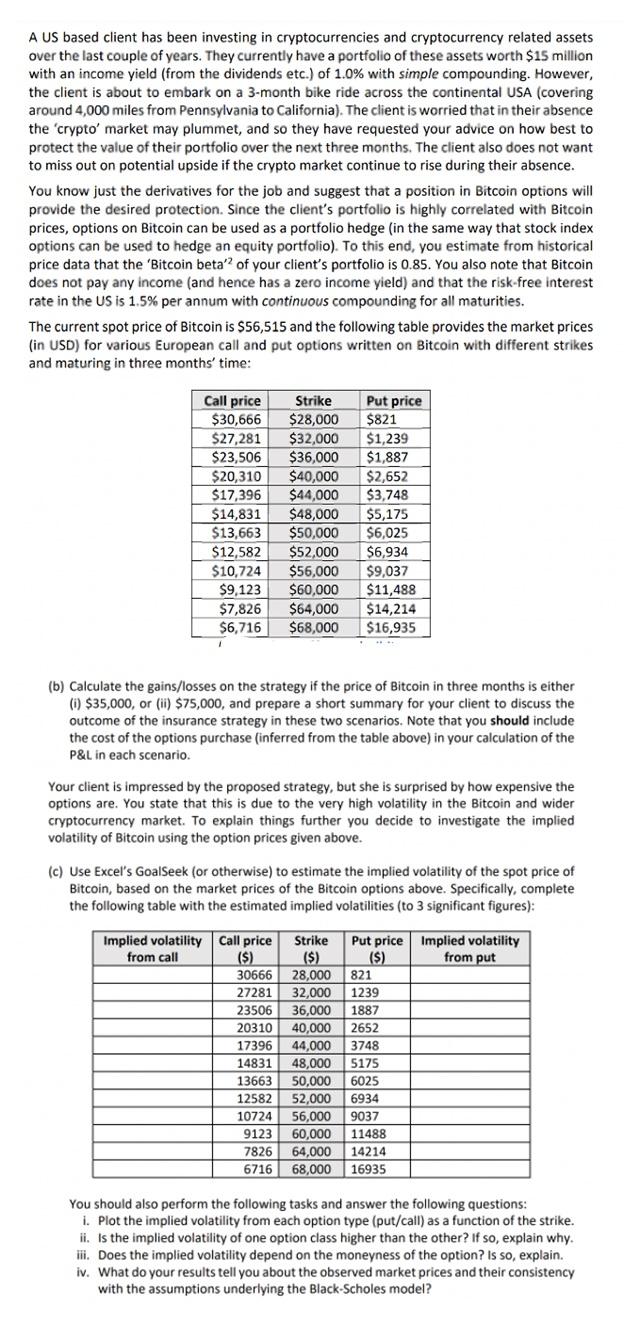

A US based client has been investing in cryptocurrencies and cryptocurrency related assets over the last couple of years. They currently have a portfolio of these assets worth $15 million with an income yield (from the dividends etc.) of 1.0% with simple compounding. However, the client is about to embark on a 3- month bike ride across the continental USA (covering around 4,000 miles from Pennsylvania to California). The client is worried that in their absence the 'crypto' market may plummet, and so they have requested your advice on how best to protect the value of their portfolio over the next three months. The client also does not want to miss out on potential upside if the crypto market continue to rise during their absence. You know just the derivatives for the job and suggest that a position in Bitcoin options will provide the desired protection. Since the client's portfolio is highly correlated with Bitcoin prices, options on Bitcoin can be used as a portfolio hedge (in the same way that stock index options can be used to hedge an equity portfolio). To this end, you estimate from historical price data that the 'Bitcoin beta'? of your client's portfolio is 0.85. You also note that Bitcoin does not pay any income (and hence has a zero income yield) and that the risk-free interest rate in the US is 1.5% per annum with continuous compounding for all maturities. The current spot price of Bitcoin is $56,515 and the following table provides the market prices (in USD) for various European call and put options written on Bitcoin with different strikes and maturing in three months' time: Put price Call price $30,666 $27,281 $23,506 $20,310 $17,396 $14,831 $13,663 $12,582 $10,724 $9,123 $7,826 $6,716 Strike $28,000 $32,000 $36,000 $40,000 $44,000 $48,000 $50,000 $52,000 $56,000 $60,000 $64,000 $68,000 $821 $1,239 $1,887 $2,652 $3,748 $5,175 $6,025 $6,934 $9,037 $11,488 $14,214 $16,935 (b) Calculate the gains/losses on the strategy if the price of Bitcoin in three months is either () $35,000, or (ii) $75,000, and prepare a short summary for your client to discuss the outcome of the insurance strategy in these two scenarios. Note that you should include the cost of the options purchase (inferred from the table above) in your calculation of the P&L in each scenario. Your client is impressed by the proposed strategy, but she is surprised by how expensive the options are. You state that this is due to the very high volatility in the Bitcoin and wider cryptocurrency market. To explain things further you decide to investigate the implied volatility of Bitcoin using the option prices given above. (c) Use Excel's GoalSeek (or otherwise) to estimate the implied volatility of the spot price of Bitcoin, based on the market prices of the Bitcoin options above. Specifically, complete the following table with the estimated implied volatilities (to 3 significant figures): Implied volatility from call Implied volatility from put Call price ($) 30666 27281 23506 20310 17396 14831 13663 12582 10724 9123 7826 6716 Strike ($) 28,000 32,000 36,000 40,000 44,000 48,000 50,000 52,000 56,000 60,000 64,000 68,000 Put price ($) 821 1239 1887 2652 3748 5175 6025 6934 9037 11488 14214 16935 You should also perform the following tasks and answer the following questions: i. Plot the implied volatility from each option type (put/call) as a function of the strike. ii. Is the implied volatility of one option class higher than the other? If so, explain why. iii. Does the implied volatility depend on the moneyness of the option? Is so, explain. iv. What do your results tell you about the observed market prices and their consistency with the assumptions underlying the Black-Scholes model? A US based client has been investing in cryptocurrencies and cryptocurrency related assets over the last couple of years. They currently have a portfolio of these assets worth $15 million with an income yield (from the dividends etc.) of 1.0% with simple compounding. However, the client is about to embark on a 3- month bike ride across the continental USA (covering around 4,000 miles from Pennsylvania to California). The client is worried that in their absence the 'crypto' market may plummet, and so they have requested your advice on how best to protect the value of their portfolio over the next three months. The client also does not want to miss out on potential upside if the crypto market continue to rise during their absence. You know just the derivatives for the job and suggest that a position in Bitcoin options will provide the desired protection. Since the client's portfolio is highly correlated with Bitcoin prices, options on Bitcoin can be used as a portfolio hedge (in the same way that stock index options can be used to hedge an equity portfolio). To this end, you estimate from historical price data that the 'Bitcoin beta'? of your client's portfolio is 0.85. You also note that Bitcoin does not pay any income (and hence has a zero income yield) and that the risk-free interest rate in the US is 1.5% per annum with continuous compounding for all maturities. The current spot price of Bitcoin is $56,515 and the following table provides the market prices (in USD) for various European call and put options written on Bitcoin with different strikes and maturing in three months' time: Put price Call price $30,666 $27,281 $23,506 $20,310 $17,396 $14,831 $13,663 $12,582 $10,724 $9,123 $7,826 $6,716 Strike $28,000 $32,000 $36,000 $40,000 $44,000 $48,000 $50,000 $52,000 $56,000 $60,000 $64,000 $68,000 $821 $1,239 $1,887 $2,652 $3,748 $5,175 $6,025 $6,934 $9,037 $11,488 $14,214 $16,935 (b) Calculate the gains/losses on the strategy if the price of Bitcoin in three months is either () $35,000, or (ii) $75,000, and prepare a short summary for your client to discuss the outcome of the insurance strategy in these two scenarios. Note that you should include the cost of the options purchase (inferred from the table above) in your calculation of the P&L in each scenario. Your client is impressed by the proposed strategy, but she is surprised by how expensive the options are. You state that this is due to the very high volatility in the Bitcoin and wider cryptocurrency market. To explain things further you decide to investigate the implied volatility of Bitcoin using the option prices given above. (c) Use Excel's GoalSeek (or otherwise) to estimate the implied volatility of the spot price of Bitcoin, based on the market prices of the Bitcoin options above. Specifically, complete the following table with the estimated implied volatilities (to 3 significant figures): Implied volatility from call Implied volatility from put Call price ($) 30666 27281 23506 20310 17396 14831 13663 12582 10724 9123 7826 6716 Strike ($) 28,000 32,000 36,000 40,000 44,000 48,000 50,000 52,000 56,000 60,000 64,000 68,000 Put price ($) 821 1239 1887 2652 3748 5175 6025 6934 9037 11488 14214 16935 You should also perform the following tasks and answer the following questions: i. Plot the implied volatility from each option type (put/call) as a function of the strike. ii. Is the implied volatility of one option class higher than the other? If so, explain why. iii. Does the implied volatility depend on the moneyness of the option? Is so, explain. iv. What do your results tell you about the observed market prices and their consistency with the assumptions underlying the Black-Scholes model