Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A U.S. based MNC has just signed a contract with a British company that calls for the U.S. MNC to provide the British company with

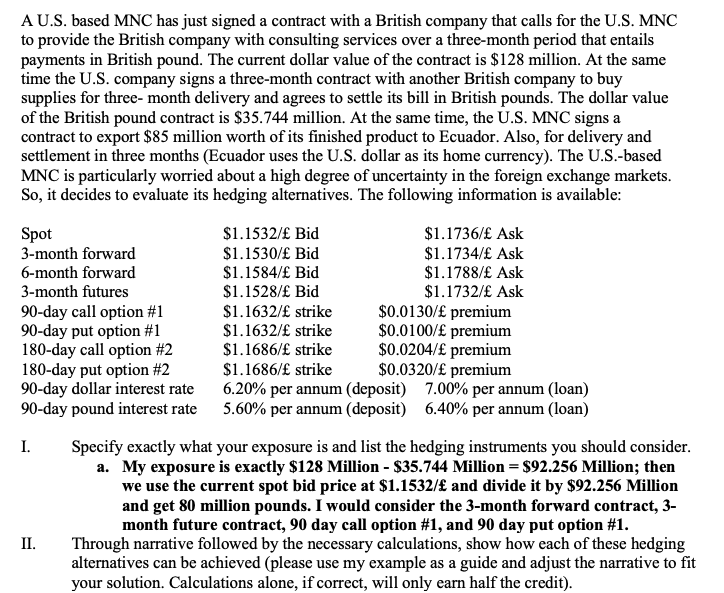

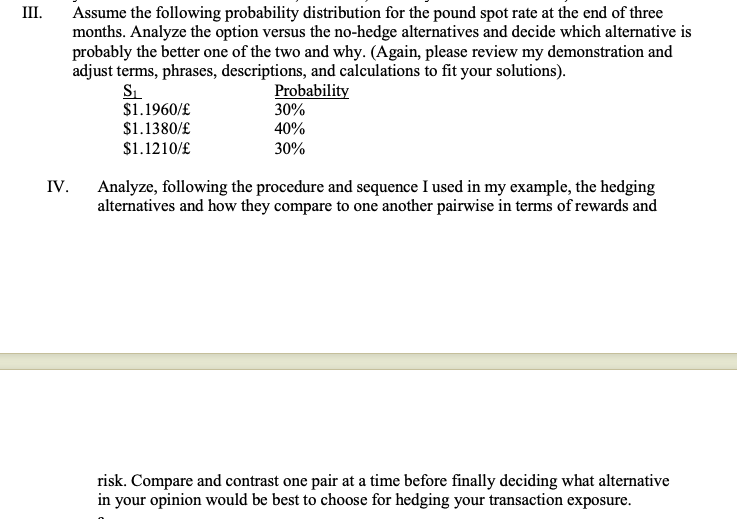

A U.S. based MNC has just signed a contract with a British company that calls for the U.S. MNC to provide the British company with consulting services over a three-month period that entails payments in British pound. The current dollar value of the contract is $128 million. At the same time the U.S. company signs a three-month contract with another British company to buy supplies for three- month delivery and agrees to settle its bill in British pounds. The dollar value of the British pound contract is $35.744 million. At the same time, the U.S. MNC signs a contract to export $85 million worth of its finished product to Ecuador. Also, for delivery and settlement in three months (Ecuador uses the U.S. dollar as its home currency). The U.S.-based MNC is particularly worried about a high degree of uncertainty in the foreign exchange markets. So, it decides to evaluate its hedging alternatives. The following information is available: n) n) I. Specify exactly what your exposure is and list the hedging instruments you should consider. a. My exposure is exactly $128 Million $35.744 Million =$$2.256 Million; then we use the current spot bid price at $1.1532/ and divide it by $92.256 Million and get 80 million pounds. I would consider the 3-month forward contract, 3month future contract, 90 day call option \#1, and 90 day put option \#1. II. Through narrative followed by the necessary calculations, show how each of these hedging alternatives can be achieved (please use my example as a guide and adjust the narrative to fit your solution. Calculations alone, if correct, will only earn half the credit). Assume the following probability distribution for the pound spot rate at the end of three months. Analyze the option versus the no-hedge alternatives and decide which alternative is probably the better one of the two and why. (Again, please review my demonstration and adjust terms, phrases, descriptions, and calculations to fit your solutions). IV. Analyze, following the procedure and sequence I used in my example, the hedging alternatives and how they compare to one another pairwise in terms of rewards and risk. Compare and contrast one pair at a time before finally deciding what alternative in your opinion would be best to choose for hedging your transaction exposure

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started